A term loan is a specific type of financing where a borrower receives a lump sum amount upfront and repays it over a fixed period with regular installments. This loan structure typically comes with a predetermined interest rate and repayment schedule, making it easier for you to plan your financial commitments. Explore the rest of the article to learn how term loans can support your business or personal financial goals.

Table of Comparison

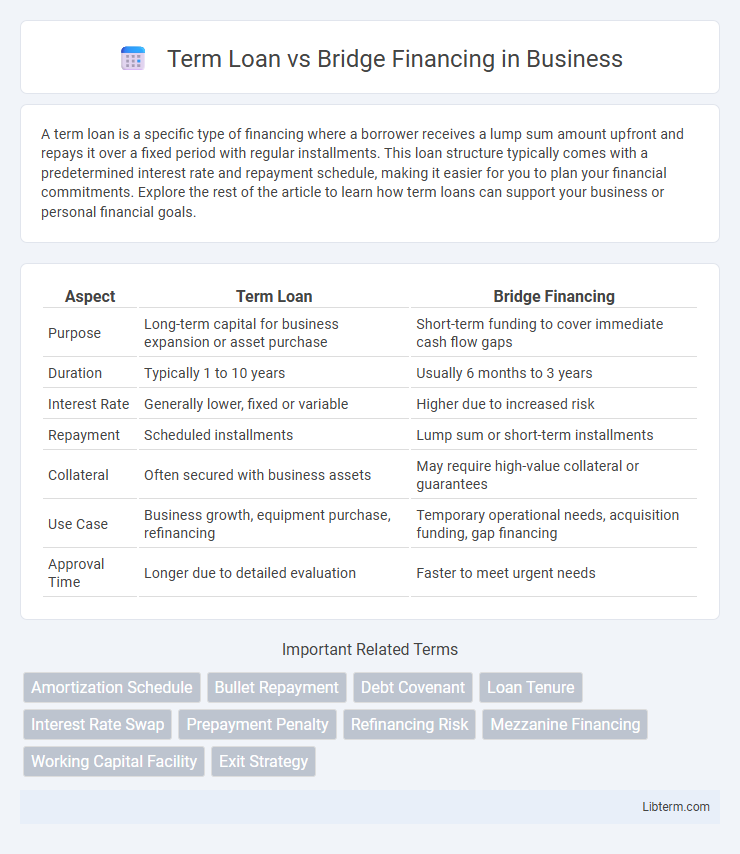

| Aspect | Term Loan | Bridge Financing |

|---|---|---|

| Purpose | Long-term capital for business expansion or asset purchase | Short-term funding to cover immediate cash flow gaps |

| Duration | Typically 1 to 10 years | Usually 6 months to 3 years |

| Interest Rate | Generally lower, fixed or variable | Higher due to increased risk |

| Repayment | Scheduled installments | Lump sum or short-term installments |

| Collateral | Often secured with business assets | May require high-value collateral or guarantees |

| Use Case | Business growth, equipment purchase, refinancing | Temporary operational needs, acquisition funding, gap financing |

| Approval Time | Longer due to detailed evaluation | Faster to meet urgent needs |

Understanding Term Loans

Term loans provide businesses with fixed amounts of capital repaid over a predetermined period with regular interest payments, making them ideal for long-term investments and solid financial planning. These loans typically feature stable interest rates and structured repayment schedules that help companies manage cash flow predictably. Understanding the commitment and benefits of term loans allows businesses to leverage them for expansion, equipment purchases, or debt refinancing effectively.

Defining Bridge Financing

Bridge financing is a short-term loan used to cover immediate cash flow needs and bridge the gap between two larger financing rounds or transactions. It provides quick access to capital, often secured by collateral or pending long-term financing, to facilitate urgent business needs or acquisitions. Unlike term loans, which have fixed repayment schedules and longer durations, bridge loans are designed to be repaid quickly once permanent financing is secured.

Key Differences Between Term Loans and Bridge Financing

Term loans provide long-term financing with fixed interest rates and regular repayment schedules, primarily used for established projects or business expansions. Bridge financing offers short-term, high-interest loans designed to cover temporary cash flow gaps or facilitate immediate acquisitions until permanent funding is secured. Key differences include loan duration, interest rates, and usage purpose: term loans focus on long-term growth, while bridge financing addresses urgent, short-term financial needs.

Pros and Cons of Term Loans

Term loans provide predictable repayment schedules with fixed or variable interest rates, making them suitable for long-term investments and business expansion. They often come with lower interest rates and longer maturity periods, but require collateral and strict credit evaluations, which may limit accessibility for some borrowers. Limited flexibility in prepayment and potential penalties can be disadvantages compared to short-term bridge financing.

Advantages and Disadvantages of Bridge Financing

Bridge financing offers quick access to short-term capital, enabling businesses to cover immediate expenses or seize time-sensitive opportunities before securing long-term funding. Its advantages include speed, flexibility, and less stringent qualification criteria compared to traditional term loans. However, high-interest rates and fees, along with the risk of repayment pressure, are major disadvantages that can impact cash flow and overall financial stability.

Eligibility Criteria for Term Loans vs Bridge Financing

Eligibility criteria for term loans typically require a strong credit history, stable cash flow, and collateral to secure the loan, making them suitable for established businesses with predictable revenue streams. Bridge financing demands less stringent credit qualifications but often necessitates a clear exit strategy, such as a confirmed long-term financing arrangement or asset sale, to repay the loan within a short duration. Lenders assess term loans based on debt service coverage ratio (DSCR) and business financial stability, whereas bridge financing approval hinges on the borrower's ability to demonstrate rapid liquidity conversion and specific repayment plans.

Typical Use Cases for Term Loans

Term loans are commonly used for long-term investments such as acquiring fixed assets, funding business expansion, or refinancing existing debt due to their structured repayment schedules and fixed interest rates. Companies often opt for term loans to finance capital-intensive projects that require stable, predictable funding over several years. Typical industries leveraging term loans include manufacturing, real estate, and technology sectors aiming for sustained growth and operational stability.

When to Opt for Bridge Financing

Bridge financing is ideal for businesses needing immediate capital to cover short-term gaps before securing long-term funding, such as during property acquisitions or transitional periods. It provides quick access to funds with relatively flexible terms compared to term loans, which are better suited for stable, long-term financing needs with structured repayment schedules. Companies facing urgent cash flow issues or awaiting expected financing milestones often rely on bridge loans to maintain operations without delays.

Cost Comparison: Interest Rates and Fees

Term loans typically feature lower interest rates ranging from 5% to 12%, reflecting their longer repayment periods and lower risk profile, while bridge financing often carries higher rates between 8% and 15% due to short-term, high-risk nature. Fees for term loans generally include origination fees of 1% to 3%, whereas bridge loans impose higher fees that can reach 2% to 4%, including prepayment penalties and exit fees. Understanding these cost differences is crucial for businesses to optimize financing expenses based on their cash flow needs and project timelines.

Choosing the Right Financing Option for Your Needs

Term loans provide long-term financing with fixed repayment schedules, ideal for businesses seeking predictable cash flow management and capital for expansion or equipment purchases. Bridge financing offers short-term funding to cover immediate cash needs or gaps between financing rounds, making it suitable for urgent transactions or interim solutions. Assess your project timeline, repayment capacity, and financial goals to determine whether the stability of a term loan or the flexibility of bridge financing aligns best with your business requirements.

Term Loan Infographic

libterm.com

libterm.com