Actuaries analyze statistical data to assess financial risks and uncertainties, particularly in insurance, pensions, and investment sectors. Their expertise helps businesses and individuals make informed decisions about risk management and financial planning. Discover how becoming an actuary can secure your future by reading the rest of the article.

Table of Comparison

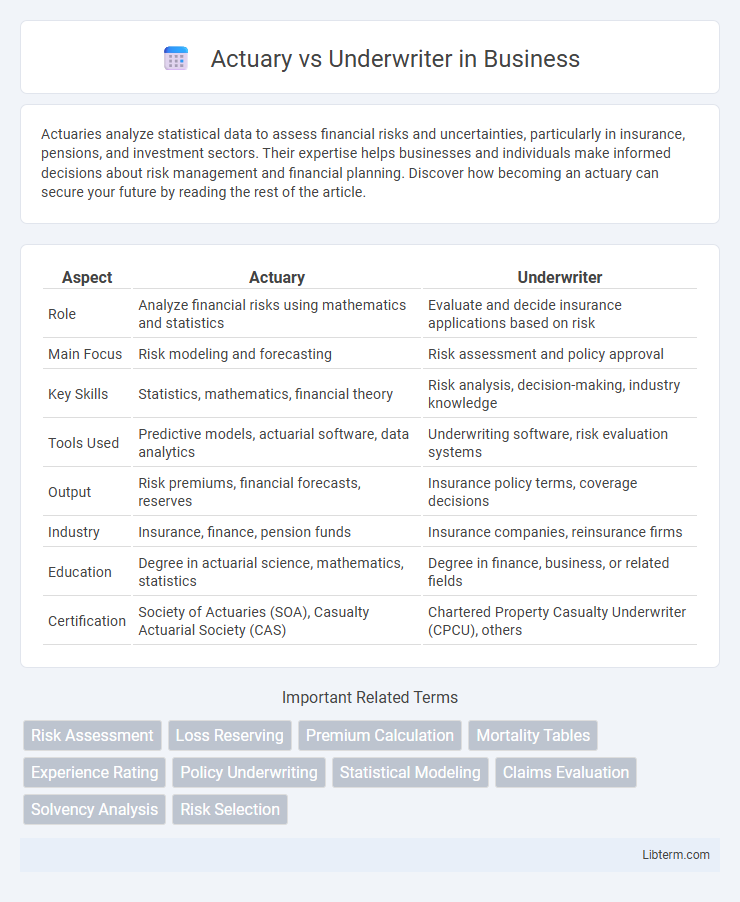

| Aspect | Actuary | Underwriter |

|---|---|---|

| Role | Analyze financial risks using mathematics and statistics | Evaluate and decide insurance applications based on risk |

| Main Focus | Risk modeling and forecasting | Risk assessment and policy approval |

| Key Skills | Statistics, mathematics, financial theory | Risk analysis, decision-making, industry knowledge |

| Tools Used | Predictive models, actuarial software, data analytics | Underwriting software, risk evaluation systems |

| Output | Risk premiums, financial forecasts, reserves | Insurance policy terms, coverage decisions |

| Industry | Insurance, finance, pension funds | Insurance companies, reinsurance firms |

| Education | Degree in actuarial science, mathematics, statistics | Degree in finance, business, or related fields |

| Certification | Society of Actuaries (SOA), Casualty Actuarial Society (CAS) | Chartered Property Casualty Underwriter (CPCU), others |

Introduction to Actuaries and Underwriters

Actuaries specialize in analyzing statistical data to evaluate financial risks and uncertainties, primarily using mathematics, statistics, and financial theory to predict future events such as mortality, accidents, or natural disasters. Underwriters assess individual applications for insurance coverage by evaluating the risk profiles and determining the terms and premiums based on the data and guidelines provided by actuaries. Both professionals play crucial roles in the insurance industry, with actuaries focusing on risk modeling and forecasting, while underwriters focus on risk selection and policy issuance.

Key Roles and Responsibilities

Actuaries analyze statistical data to assess risk and determine insurance policy pricing using mathematical models and financial theory. Underwriters evaluate insurance applications, verify information accuracy, and decide policy approvals based on risk assessments and company guidelines. Both roles collaborate to ensure profitable risk management and compliance with regulatory standards in the insurance industry.

Educational Requirements and Certifications

Actuaries typically require a strong background in mathematics, statistics, and economics, often holding a bachelor's degree in actuarial science, mathematics, or a related field, followed by passing a series of rigorous professional exams administered by organizations like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS). Underwriters usually possess a bachelor's degree in finance, business, or economics and may obtain certifications such as the Chartered Property Casualty Underwriter (CPCU) designation to demonstrate expertise in risk assessment and insurance principles. Both professions emphasize continuous education, but actuaries face more extensive exam requirements to achieve full certification compared to underwriters.

Core Skills and Competencies

Actuaries excel in advanced statistical analysis, risk modeling, and financial theory to predict future events and assess insurance liabilities. Underwriters specialize in evaluating risk exposure, applying underwriting guidelines, and making informed decisions on policy acceptance and pricing. Both roles require strong analytical skills, attention to detail, and proficiency in data interpretation, but actuaries emphasize quantitative modeling, while underwriters focus on risk assessment and decision-making.

Day-to-Day Work Environment

Actuaries analyze statistical data and develop models to assess financial risks, primarily working with complex algorithms and software in office settings. Underwriters evaluate insurance applications and determine coverage eligibility by reviewing client information and risk factors, often collaborating directly with sales agents and brokers. Both roles require detailed documentation and compliance checks but differ in tasks: actuaries focus on predictive analytics, while underwriters concentrate on decision-making and risk approval.

Analytical Tools and Techniques Used

Actuaries primarily utilize statistical analysis, predictive modeling, and stochastic simulations to assess risk and determine insurance premiums. Underwriters rely on risk assessment tools such as credit scoring systems, financial statement analysis, and automated underwriting software to evaluate individual applications. Both professionals employ data analytics but actuaries focus on long-term risk projections while underwriters emphasize real-time decision-making.

Impact on Insurance Industry

Actuaries analyze statistical data to assess risk and determine insurance premiums, directly influencing the financial stability and pricing strategies within the insurance industry. Underwriters evaluate individual applications and decide on policy approvals, ensuring risk is appropriately managed on a case-by-case basis. Together, actuaries and underwriters optimize risk management, contributing to profitability and sustainable growth in insurance companies.

Salary and Career Progression

Actuaries typically command higher average salaries, with entry-level positions starting around $65,000 and experienced professionals earning upwards of $150,000 annually, reflecting their specialized expertise in risk modeling and statistical analysis. Underwriters often begin with salaries near $50,000, progressing to mid-level roles that can reach $90,000, with top-tier underwriters or managers earning over $120,000 depending on industry and complexity of risk assessment. Career progression for actuaries generally involves advancing through credentialed exams to senior, consulting, or executive roles, while underwriters often move from junior to senior underwriting positions, with opportunities in management or specialized underwriting sectors.

Challenges Faced in Each Profession

Actuaries face challenges in accurately modeling risk using complex statistical methods while adapting to evolving data sources and regulatory environments. Underwriters confront difficulties in assessing individual risk profiles quickly and making precise decisions amidst incomplete information and fluctuating market conditions. Both professions require balancing quantitative analysis with judgment to manage uncertainty effectively.

Choosing Between Actuary and Underwriter

Choosing between an actuary and an underwriter depends on whether you prefer analyzing risk through statistical models or making real-time decisions on insurance applications. Actuaries use mathematics, statistics, and financial theory to estimate future risks and design policies, making them essential for long-term risk assessment and pricing strategies. Underwriters evaluate individual insurance applications by assessing risk factors to approve or deny coverage, focusing on immediate risk management and customer interaction.

Actuary Infographic

libterm.com

libterm.com