Secondary buyouts occur when a private equity firm sells a portfolio company to another private equity buyer instead of exiting via a strategic sale or public offering. These transactions often provide liquidity for the initial investor while offering the acquiring firm opportunities for further operational improvements or growth. Discover how secondary buyouts can impact your investment strategy and the broader market by exploring the rest of this article.

Table of Comparison

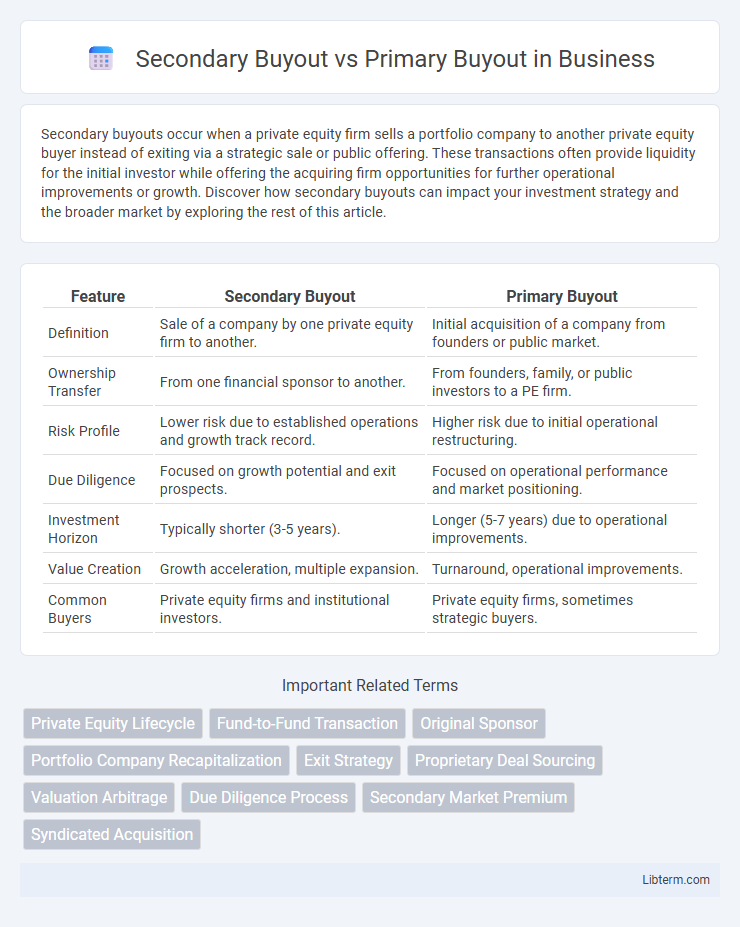

| Feature | Secondary Buyout | Primary Buyout |

|---|---|---|

| Definition | Sale of a company by one private equity firm to another. | Initial acquisition of a company from founders or public market. |

| Ownership Transfer | From one financial sponsor to another. | From founders, family, or public investors to a PE firm. |

| Risk Profile | Lower risk due to established operations and growth track record. | Higher risk due to initial operational restructuring. |

| Due Diligence | Focused on growth potential and exit prospects. | Focused on operational performance and market positioning. |

| Investment Horizon | Typically shorter (3-5 years). | Longer (5-7 years) due to operational improvements. |

| Value Creation | Growth acceleration, multiple expansion. | Turnaround, operational improvements. |

| Common Buyers | Private equity firms and institutional investors. | Private equity firms, sometimes strategic buyers. |

Introduction to Buyouts

Primary buyouts occur when private equity firms acquire a company directly from its original owners, often involving founders or family businesses. Secondary buyouts involve the purchase of a company by one private equity firm from another, typically after the initial buyout has created value and growth. Both types of buyouts play a crucial role in private equity by enabling ownership transitions and unlocking operational improvements.

Defining Primary Buyouts

Primary buyouts involve private equity firms acquiring controlling stakes directly from the original owners or founders of a company, typically to implement strategic changes or fuel growth. These buyouts enable the initial shareholders to realize liquidity while transferring operational control to the acquiring firm. The distinction from secondary buyouts lies in the source of ownership, as secondary buyouts involve transactions between private equity firms rather than direct founder or family sales.

Defining Secondary Buyouts

Secondary buyouts refer to the acquisition of a company by one private equity firm from another private equity firm, distinguishing it from primary buyouts where an investor acquires a company directly from the founders or public markets. These transactions enable portfolio liquidity and allow the selling firm to realize gains, while the purchasing firm seeks further value creation through operational improvements or strategic repositioning. Secondary buyouts have gained prominence due to increased private equity activity and provide a mechanism for continuous market-driven ownership transfers.

Key Differences Between Primary and Secondary Buyouts

Primary buyouts involve private equity firms acquiring companies directly from founders or original owners, often to facilitate growth or restructuring. Secondary buyouts occur when one private equity firm sells its portfolio company to another private equity firm, focusing on value realization or portfolio rebalancing. Key differences include the transaction origin, with primaries targeting founder exits and secondaries emphasizing ownership transfers within private equity investors, impacting deal structures and time horizons.

Motivations Behind Primary Buyouts

Primary buyouts involve the acquisition of a company directly from its original owners or founders, often motivated by the pursuit of establishing operational control and implementing strategic growth initiatives. Investors in primary buyouts seek to capitalize on untapped value through hands-on management and long-term value creation, typically aiming to drive significant enhancements in the target's performance. This approach contrasts with secondary buyouts, where the focus centers on acquiring portfolio companies from existing private equity owners, usually driven by portfolio reshuffling and exit strategy optimization.

Motivations Behind Secondary Buyouts

Secondary buyouts occur when private equity firms sell portfolio companies to other private equity investors, driven by motivations such as portfolio rebalancing, fund lifecycle pressures, and unlocking value through operational improvements. Primary buyouts typically involve acquiring companies directly from founders or strategic owners with growth potential and market repositioning as key incentives. Institutional investors favor secondary buyouts for their potential to deliver quicker returns and reduced market risk compared to primary acquisitions.

Advantages of Primary Buyouts

Primary buyouts offer investors direct access to high-growth potential companies at earlier stages, enabling significant value creation opportunities. These transactions often involve management teams with strong growth visions, fostering operational improvements and strategic development. Investing in primary buyouts allows for better alignment of interests between new investors and company leadership, enhancing long-term returns.

Advantages of Secondary Buyouts

Secondary buyouts provide private equity firms with enhanced liquidity options by allowing them to exit investments through sales to other financial sponsors rather than strategic buyers. These transactions often enable smoother deal closures due to the buyer's familiarity with private equity processes and appetite for growth-oriented assets. Secondary buyouts also facilitate portfolio optimization by reallocating capital towards new investment opportunities while maintaining asset value in competitive markets.

Risks and Challenges in Each Buyout Type

Secondary buyouts carry risks such as valuation inflation, reduced operational improvements, and potential over-leveraging due to repeated buyout cycles. Primary buyouts face challenges including identifying promising initial investment targets, managing integration risks, and ensuring sufficient growth to justify the acquisition cost. Both types confront liquidity risks and market fluctuations, but secondary buyouts often grapple more with asset quality deterioration from previous owners.

Choosing Between Primary and Secondary Buyouts

Choosing between primary and secondary buyouts depends on the investment stage and risk profile; primary buyouts involve acquiring companies directly from founders or early investors, offering growth opportunities in relatively less mature firms. Secondary buyouts occur when private equity firms sell portfolio companies to other private equity investors, often providing more stable, lower-risk investments with clearer financial histories. Investors prioritize primary buyouts for higher returns through operational improvements, while secondary buyouts appeal to those seeking portfolio diversification and predictable cash flows.

Secondary Buyout Infographic

libterm.com

libterm.com