Tail risk refers to the probability of rare but extreme events causing significant losses in financial markets, often lying beyond the standard deviation range of normal distributions. Understanding and managing tail risk is crucial for protecting your portfolio against unexpected market shocks and ensuring long-term investment stability. Explore the rest of this article to learn effective strategies for identifying and mitigating tail risk.

Table of Comparison

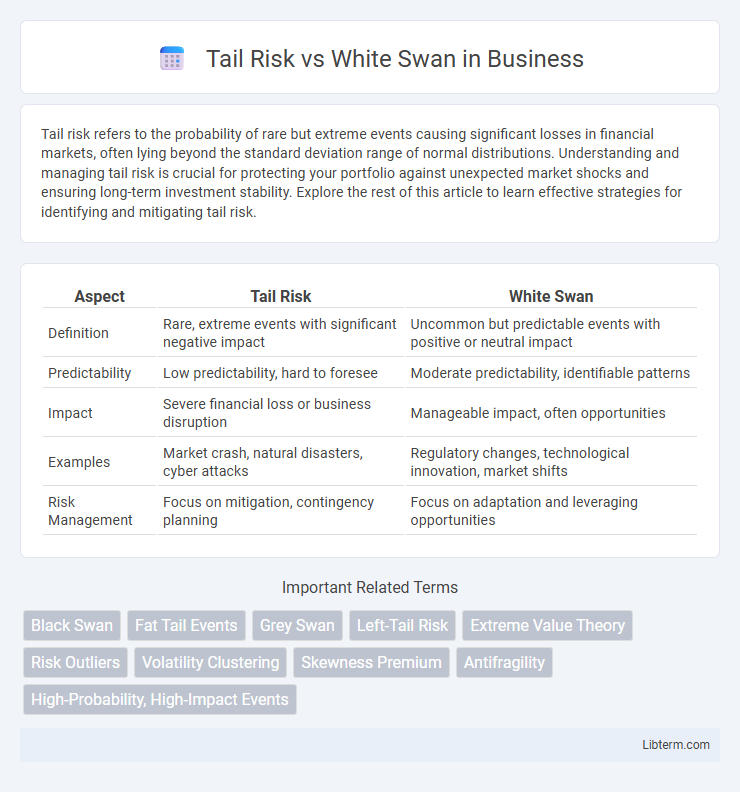

| Aspect | Tail Risk | White Swan |

|---|---|---|

| Definition | Rare, extreme events with significant negative impact | Uncommon but predictable events with positive or neutral impact |

| Predictability | Low predictability, hard to foresee | Moderate predictability, identifiable patterns |

| Impact | Severe financial loss or business disruption | Manageable impact, often opportunities |

| Examples | Market crash, natural disasters, cyber attacks | Regulatory changes, technological innovation, market shifts |

| Risk Management | Focus on mitigation, contingency planning | Focus on adaptation and leveraging opportunities |

Understanding Tail Risk: Definition and Examples

Tail risk refers to the possibility of rare but severe events occurring in the extreme ends of a probability distribution, often with significant financial or operational impact. Examples include catastrophic market crashes, natural disasters, or sudden geopolitical upheavals that fall outside regular risk models. Understanding tail risk helps organizations prepare for these unlikely yet highly consequential scenarios, differentiating it from more common, predictable events sometimes called "white swans.

What is a White Swan Event?

A White Swan event refers to a predictable, high-impact occurrence that is often underestimated or overlooked despite available data indicating its likelihood. Unlike Tail Risk, which involves rare and extreme situations in the probability distribution's tails, White Swan events possess a measurable probability and can be anticipated through thorough analysis. Understanding White Swan events allows investors and risk managers to prepare strategies for foreseeable disruptions that can significantly affect markets or operations.

Key Differences Between Tail Risk and White Swan

Tail risk refers to rare, extreme events in the far ends of a probability distribution that have a low likelihood but significant negative impact, often associated with financial markets. White swan events, in contrast, are highly probable, predictable occurrences that are often overlooked despite clear signals, resulting in substantial consequences. The key difference lies in predictability and recognition: tail risks are unforeseen, whereas white swan events are expected but ignored.

Statistical Foundations: Probability and Uncertainty

Tail risk represents extreme events with low probability but severe impact, often modeled using heavy-tailed distributions like Pareto or Cauchy to capture rare, high-consequence outcomes. White swan events, while unexpected, are considered within the realm of probability and uncertainty by acknowledging less extreme, yet impactful, deviations from normal distributions, often addressed through statistical measures such as kurtosis and skewness. Both concepts rely on advanced probabilistic frameworks to quantify uncertainty and guide risk management, with tail risk emphasizing extreme tail dependencies and white swans highlighting unforeseen but plausible events within expected statistical limits.

Historical Cases: Tail Risks in Financial Markets

Historical cases of tail risks in financial markets include the 1987 Black Monday crash, where the Dow Jones Industrial Average plummeted by 22.6% in a single day, exemplifying extreme market downturns beyond normal expectations. The 2008 Global Financial Crisis triggered massive losses due to the collapse of Lehman Brothers and widespread mortgage defaults, highlighting systemic tail risks from interconnected financial institutions. These events underscore the rarity but severe impact of tail risks compared to white swan events, which are more predictable and manageable market occurrences.

Notable White Swan Events and Their Impact

Notable white swan events, such as the fall of the Berlin Wall and the rise of the internet, have had profound and positive global economic and social impacts. These events defy typical risk models by presenting highly improbable but beneficial outcomes that reshape industries and societies. Understanding white swan events helps investors recognize opportunities beyond traditional tail risk frameworks shaped by negative black swan scenarios.

Risk Management Strategies for Tail Risks

Tail risk refers to the extreme, rare events in the far ends of a probability distribution that can cause significant financial losses, while white swan events are unexpected but less rare occurrences with notable impact. Effective risk management strategies for tail risks include stress testing, scenario analysis, and the use of options or other derivatives to hedge against severe market downturns. Diversification and maintaining adequate capital reserves further enhance the resilience of portfolios against tail risk exposure.

Preparing for Predictable White Swan Events

Preparing for predictable White Swan events involves identifying patterns and indicators that signal their approach, enabling proactive risk management. Organizations can implement scenario analysis and stress testing to assess potential impacts and allocate resources effectively. Building adaptive strategies and resilience plans reduces vulnerability when these foreseeable disruptions occur, ensuring stability and continuity.

Implications for Investors and Institutions

Tail risk refers to the probability of rare but extreme financial losses that lie beyond the normal distribution curve, often leading to significant portfolio damage. White swan events are highly improbable yet foreseeable occurrences that, while rare, can be anticipated and factored into risk management strategies. Investors and institutions must incorporate stress testing, scenario analysis, and robust capital buffers to mitigate tail risk impacts and prepare for white swan events, enhancing resilience against market shocks.

Future Outlook: Navigating Extreme Risk Events

Future outlook in navigating extreme risk events emphasizes robust risk management strategies incorporating Tail Risk and White Swan scenarios. Tail Risk refers to rare, high-impact financial events beyond normal expectations, while White Swan events are foreseeable but underappreciated risks with significant consequences. Investors and institutions must leverage advanced modeling, stress testing, and scenario analysis to anticipate and mitigate these risks for resilient portfolio performance and strategic decision-making.

Tail Risk Infographic

libterm.com

libterm.com