Restricted Stock Units (RSUs) are company shares granted to employees as part of their compensation, subject to a vesting schedule. These units align employee interests with company performance, creating potential long-term financial benefits once vested. Discover how RSUs can impact your financial growth and tax planning by reading the full article.

Table of Comparison

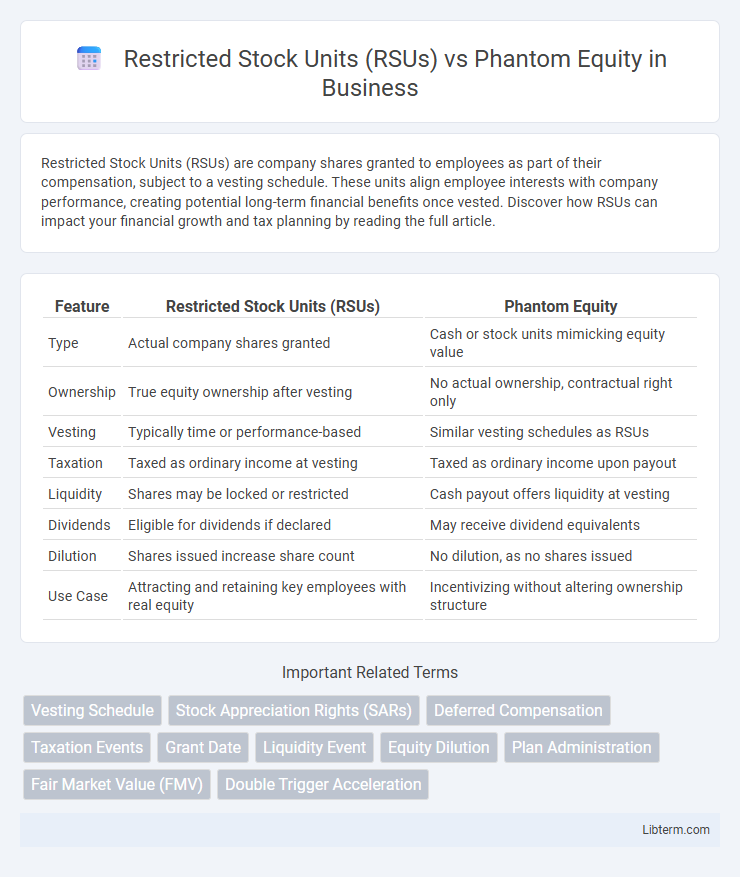

| Feature | Restricted Stock Units (RSUs) | Phantom Equity |

|---|---|---|

| Type | Actual company shares granted | Cash or stock units mimicking equity value |

| Ownership | True equity ownership after vesting | No actual ownership, contractual right only |

| Vesting | Typically time or performance-based | Similar vesting schedules as RSUs |

| Taxation | Taxed as ordinary income at vesting | Taxed as ordinary income upon payout |

| Liquidity | Shares may be locked or restricted | Cash payout offers liquidity at vesting |

| Dividends | Eligible for dividends if declared | May receive dividend equivalents |

| Dilution | Shares issued increase share count | No dilution, as no shares issued |

| Use Case | Attracting and retaining key employees with real equity | Incentivizing without altering ownership structure |

Introduction to Equity Compensation

Restricted Stock Units (RSUs) represent actual shares granted to employees upon vesting, providing tangible ownership and potential dividends, whereas Phantom Equity offers cash-based rewards mimicking stock value without transferring ownership. Both forms of equity compensation incentivize employee performance and retention by aligning their interests with company growth but differ in tax implications and liquidity. Understanding the distinct mechanics of RSUs and Phantom Equity helps companies tailor compensation packages to meet strategic goals while managing shareholder dilution and employee motivation.

What Are Restricted Stock Units (RSUs)?

Restricted Stock Units (RSUs) are company shares granted to employees as part of their compensation, subject to a vesting schedule based on time or performance milestones. Unlike stock options, RSUs represent actual ownership once vested, providing employees with tangible equity without requiring upfront payment. They are commonly used to align employees' interests with shareholders by offering potential value tied to the company's stock price appreciation.

Understanding Phantom Equity

Phantom equity represents a form of employee compensation that mirrors the value of company stock without granting actual ownership or voting rights, providing employees with cash bonuses equivalent to stock appreciation upon exit events. Unlike Restricted Stock Units (RSUs), which involve the issuance of actual shares subject to vesting, phantom equity plans avoid dilution of ownership and are often used by private companies aiming to incentivize employees. Understanding phantom equity is crucial for evaluating tax implications, vesting schedules, and payout conditions tied to company liquidity events or valuation milestones.

Key Differences Between RSUs and Phantom Equity

Restricted Stock Units (RSUs) represent actual shares granted to employees, vesting over time with ownership rights such as voting and dividends, while Phantom Equity provides cash or stock equivalents tied to company valuation without issuing real shares. RSUs impact shareholder dilution as they convert into company stock, whereas Phantom Equity avoids dilution by offering cash payouts or stock appreciation rights based on performance metrics. Tax treatment also differs: RSUs are taxed at vesting as ordinary income, whereas Phantom Equity is typically taxed upon payout, aligning with the value of the phantom shares or cash received.

Tax Implications: RSUs vs. Phantom Equity

Restricted Stock Units (RSUs) are taxed as ordinary income upon vesting, with the value of shares included in W-2 wages, subject to federal, state, and payroll taxes. Phantom equity, structured as a cash bonus tied to company valuation, is typically taxed as ordinary income at payout without requiring upfront taxation at vesting. Unlike RSUs, phantom equity does not grant actual stock ownership, which can lead to simplified tax reporting but may lack capital gains advantages.

Vesting Schedules: RSUs Compared to Phantom Equity

Restricted Stock Units (RSUs) typically feature predefined vesting schedules based on time or performance milestones, granting actual shares to employees upon vesting. Phantom equity, however, often incorporates more flexible or customizable vesting arrangements tied to company valuation events or specific targets, without issuing real shares. Understanding these differences in vesting schedules is crucial for aligning employee incentives with company goals and liquidity preferences.

Pros and Cons of RSUs

Restricted Stock Units (RSUs) provide employees with actual shares of company stock upon vesting, offering clear ownership and potential dividends, which can enhance long-term wealth accumulation. However, RSUs are subject to income tax at vesting and may create tax liabilities even if the shares are not sold, posing a cash flow challenge for recipients. Unlike Phantom Equity, RSUs expose employees to stock price volatility but align their interests closely with shareholder value and company performance.

Pros and Cons of Phantom Equity

Phantom Equity offers the advantage of providing employees with stock value appreciation without diluting company ownership or requiring actual equity issuance, making it ideal for closely held businesses. It simplifies tax implications by deferring taxable events until cash payouts occur, reducing employees' upfront tax burden compared to Restricted Stock Units (RSUs). However, Phantom Equity lacks voting rights and long-term equity incentives, potentially reducing employee engagement and alignment with company growth compared to RSUs.

Choosing the Right Equity Compensation for Your Company

Choosing between Restricted Stock Units (RSUs) and Phantom Equity hinges on your company's goals for employee incentives and cash flow management. RSUs offer actual shares, aligning employee interests with company ownership but may dilute equity and trigger tax events upon vesting. Phantom Equity provides cash or stock value without issuing shares, preserving equity structure and offering flexible payout timing suitable for private companies seeking to reward employees without immediate liquidity impact.

Conclusion: RSUs or Phantom Equity?

Restricted Stock Units (RSUs) provide employees with actual company shares that vest over time, offering both ownership and potential dividends, making them attractive in companies with strong stock growth. Phantom Equity simulates ownership value without granting real shares, reducing dilution and administrative complexity while aligning incentives through cash or stock payouts tied to company performance. Choosing between RSUs and Phantom Equity depends on a company's goals for employee retention, tax considerations, and preference for equity dilution versus cash-based rewards.

Restricted Stock Units (RSUs) Infographic

libterm.com

libterm.com