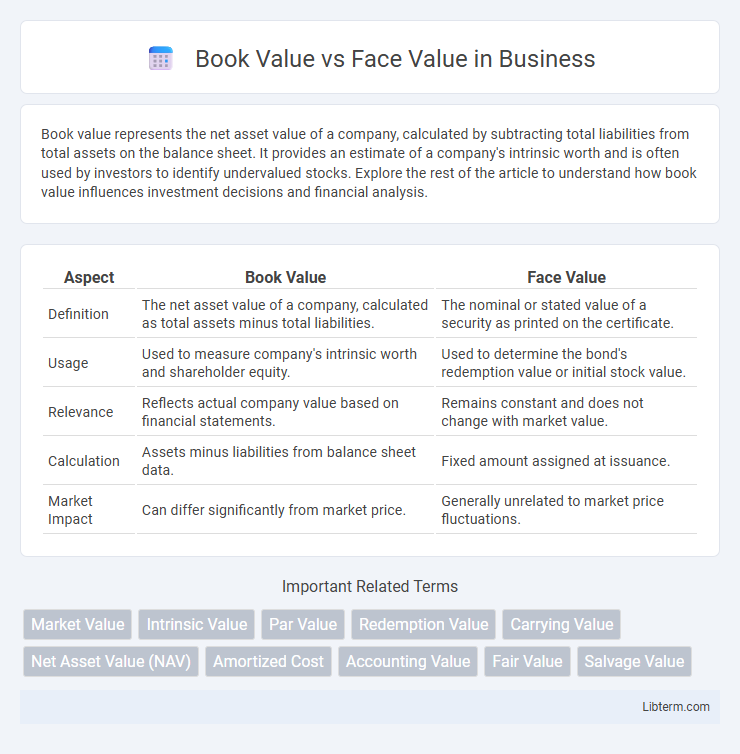

Book value represents the net asset value of a company, calculated by subtracting total liabilities from total assets on the balance sheet. It provides an estimate of a company's intrinsic worth and is often used by investors to identify undervalued stocks. Explore the rest of the article to understand how book value influences investment decisions and financial analysis.

Table of Comparison

| Aspect | Book Value | Face Value |

|---|---|---|

| Definition | The net asset value of a company, calculated as total assets minus total liabilities. | The nominal or stated value of a security as printed on the certificate. |

| Usage | Used to measure company's intrinsic worth and shareholder equity. | Used to determine the bond's redemption value or initial stock value. |

| Relevance | Reflects actual company value based on financial statements. | Remains constant and does not change with market value. |

| Calculation | Assets minus liabilities from balance sheet data. | Fixed amount assigned at issuance. |

| Market Impact | Can differ significantly from market price. | Generally unrelated to market price fluctuations. |

Understanding Book Value: Definition and Significance

Book value represents the net asset value of a company, calculated as total assets minus liabilities, reflecting the intrinsic worth from an accounting perspective. It is crucial for investors to understand book value as it provides insight into a company's financial health and indicates the value shareholders would theoretically receive if the company were liquidated. Unlike face value, which is the nominal value stated on securities, book value offers a realistic measure of financial stability and potential investment value.

What is Face Value? Key Concepts Explained

Face value is the nominal or stated value of a financial instrument, such as a bond or stock, printed on the certificate and used to calculate interest payments or dividends. It represents the amount the issuer agrees to pay the holder at maturity for bonds, serving as the basis for coupon payments. In stocks, face value is usually a fixed, low amount that has little impact on market price but is important for legal and accounting purposes.

Book Value vs Face Value: Core Differences

Book value represents the net asset value of a company or security, calculated by subtracting liabilities from total assets, reflecting the actual worth on the balance sheet. Face value, also called par value, is the nominal value printed on a bond or stock certificate and serves as the basis for interest calculation or legal capital. The core difference lies in book value depicting true financial health and market value alignment, while face value remains fixed and primarily used for accounting and legal purposes.

Calculation Methods: Book Value and Face Value

Book value is calculated by subtracting accumulated depreciation and liabilities from the asset's original cost, representing the net worth of the asset on the balance sheet. Face value, also known as par value, is the nominal value stated on the security or bond certificate, reflecting the amount payable to the holder at maturity. Understanding the distinction between book value and face value is essential for accurate asset valuation and investment analysis.

Importance of Book Value in Investment Analysis

Book value represents a company's net asset value calculated as total assets minus liabilities, serving as a critical metric in investment analysis to determine intrinsic worth beyond market price. It helps investors assess whether a stock is undervalued or overvalued by comparing the book value per share to the market price per share. Analyzing book value provides insights into a company's financial stability and long-term growth potential, making it essential for value investing and risk assessment.

How Face Value Impacts Financial Instruments

Face value directly influences the issuance price of financial instruments such as bonds and stocks, determining the initial capital raised by the issuer. It serves as the baseline for interest and dividend calculations, affecting investor returns and market pricing. Understanding face value is essential for assessing the redemption amount and potential gains or losses upon maturity or sale.

Book Value vs Face Value in Stock Evaluation

Book value represents a company's net asset value per share, calculated by dividing total equity minus liabilities by the number of outstanding shares, reflecting the intrinsic value of the stock. Face value, also known as par value, is the nominal value assigned to a stock at issuance and does not fluctuate with market conditions or company performance. Investors prioritize book value over face value in stock evaluation as it provides a more accurate measure of a company's financial health and tangible worth.

Real-Life Examples: Book Value and Face Value

Book value represents the net asset value of a company as shown on its balance sheet and is crucial for investors assessing a firm's intrinsic worth, such as Apple Inc., whose book value per share reflects its total assets minus liabilities divided by shares outstanding. Face value refers to the nominal value of a financial instrument, like bonds or stocks, exemplified by a government bond issued with a face value of $1,000 payable at maturity. Real-life applications show that while a bond's trading price may fluctuate with market conditions, its face value remains constant, and book value offers a grounded estimate of company valuation beyond market price volatility.

Book Value and Face Value in Company Valuation

Book value represents a company's net asset value calculated by subtracting total liabilities from total assets, reflecting its intrinsic worth on the balance sheet. Face value, or par value, is the nominal value assigned to a security, such as a stock or bond, at issuance and is used primarily for accounting and legal purposes rather than market valuation. In company valuation, book value provides a more accurate measure of ownership equity, while face value is a static figure that does not reflect current market conditions or company performance.

Key Takeaways: Book Value vs Face Value

Book value represents the net asset value of a company calculated by total assets minus liabilities, reflecting the intrinsic worth of a share. Face value, also known as par value, is the nominal value assigned to a security at issuance, used primarily for accounting and legal purposes. Investors rely on book value to assess a company's financial health, while face value determines the initial price and dividend calculations of stocks and bonds.

Book Value Infographic

libterm.com

libterm.com