Audit and assurance services provide an independent evaluation of financial statements to ensure accuracy and compliance with regulatory standards. These services enhance the credibility of your financial information, helping stakeholders make informed decisions. Explore the article to understand how audit and assurance can benefit your organization.

Table of Comparison

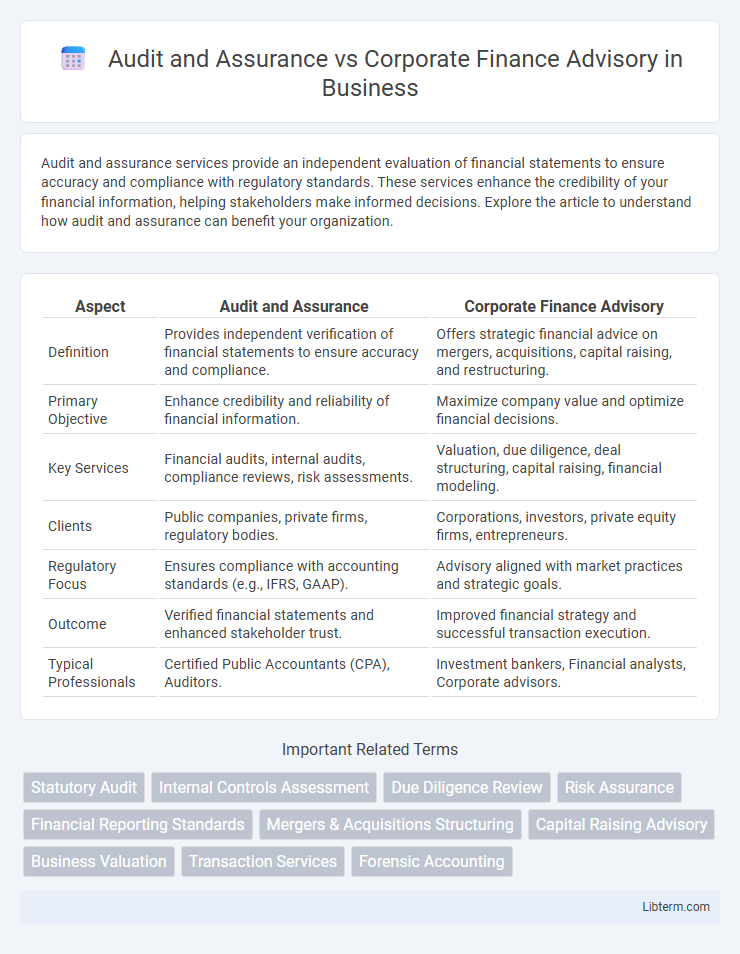

| Aspect | Audit and Assurance | Corporate Finance Advisory |

|---|---|---|

| Definition | Provides independent verification of financial statements to ensure accuracy and compliance. | Offers strategic financial advice on mergers, acquisitions, capital raising, and restructuring. |

| Primary Objective | Enhance credibility and reliability of financial information. | Maximize company value and optimize financial decisions. |

| Key Services | Financial audits, internal audits, compliance reviews, risk assessments. | Valuation, due diligence, deal structuring, capital raising, financial modeling. |

| Clients | Public companies, private firms, regulatory bodies. | Corporations, investors, private equity firms, entrepreneurs. |

| Regulatory Focus | Ensures compliance with accounting standards (e.g., IFRS, GAAP). | Advisory aligned with market practices and strategic goals. |

| Outcome | Verified financial statements and enhanced stakeholder trust. | Improved financial strategy and successful transaction execution. |

| Typical Professionals | Certified Public Accountants (CPA), Auditors. | Investment bankers, Financial analysts, Corporate advisors. |

Introduction to Audit and Assurance vs Corporate Finance Advisory

Audit and Assurance involves evaluating financial statements and internal controls to ensure accuracy, compliance, and transparency for stakeholders. Corporate Finance Advisory focuses on strategic financial planning, including mergers and acquisitions, capital raising, and valuation to enhance business growth and shareholder value. Both services support organizational financial health but differ in scope, with Audit emphasizing risk mitigation and assurance, while Corporate Finance targets transactional and strategic financial decisions.

Defining Audit and Assurance Services

Audit and Assurance services involve the independent examination of financial statements to ensure accuracy, compliance, and transparency for stakeholders. These services provide credibility to financial reporting by identifying risks, validating internal controls, and enhancing investor confidence. Corporate Finance Advisory, by contrast, focuses on strategic financial planning, mergers and acquisitions, and capital raising, rather than verifying financial integrity.

Overview of Corporate Finance Advisory

Corporate Finance Advisory encompasses strategic guidance on mergers and acquisitions, capital raising, and financial restructuring to maximize enterprise value and manage investment risks. It involves financial modeling, valuation analysis, and negotiation support tailored to the client's goals and market conditions. This advisory service contrasts with Audit and Assurance, which focuses primarily on verifying financial statements and ensuring regulatory compliance.

Key Objectives of Audit and Assurance

Audit and Assurance primarily aim to provide stakeholders with independent verification of financial statements, ensuring accuracy, compliance, and transparency in financial reporting. This process enhances credibility, reduces risks of fraud, and supports regulatory adherence. Corporate Finance Advisory, by contrast, focuses on providing strategic financial advice to optimize capital structure and investment decisions, rather than verifying past financial performance.

Core Functions of Corporate Finance Advisory

Corporate Finance Advisory primarily focuses on activities such as mergers and acquisitions, capital raising, financial restructuring, and valuation services to optimize a company's financial strategy and growth potential. Unlike Audit and Assurance, which centers on verifying financial accuracy and regulatory compliance, Corporate Finance Advisory provides strategic guidance to enhance shareholder value and facilitate critical investment decisions. Core functions include due diligence, transaction support, debt advisory, and financial modeling to support long-term corporate objectives.

Regulatory Framework and Compliance

Audit and Assurance services primarily focus on evaluating an organization's financial statements to ensure compliance with accounting standards and regulatory frameworks such as IFRS, GAAP, and Sarbanes-Oxley Act, thereby enhancing the reliability and transparency of financial reporting. Corporate Finance Advisory involves providing strategic guidance on transactions like mergers, acquisitions, and capital raising, with emphasis on compliance with securities regulations, tax laws, and industry-specific guidelines to mitigate legal and financial risks. Both fields require thorough understanding and adherence to evolving regulatory environments to maintain corporate governance and stakeholder confidence.

Required Skills and Professional Qualifications

Audit and Assurance professionals require strong analytical skills, attention to detail, and proficiency in accounting principles, with certifications such as CPA, ACCA, or CA often mandatory. Corporate Finance Advisory demands expertise in financial modeling, valuation techniques, and strategic decision-making, complemented by qualifications like CFA or an MBA. Both fields benefit from excellent communication skills and a deep understanding of regulatory environments and financial markets.

Career Opportunities and Progression

Audit and Assurance careers offer structured progression from junior auditor roles to senior auditor, audit manager, and ultimately partner positions, emphasizing skills in financial compliance, risk assessment, and regulatory reporting. Corporate Finance Advisory provides diverse career opportunities across deal advisory, mergers and acquisitions, and capital raising, with progression paths from analyst to associate, vice president, and director, focusing on strategic financial planning and transaction execution. Both fields demand strong analytical abilities but differ in specialization, with Audit emphasizing accuracy and control, while Corporate Finance centers on value creation and business growth strategies.

Major Differences Between Audit and Assurance and Corporate Finance Advisory

Audit and Assurance services primarily focus on evaluating financial statements for accuracy and compliance with regulatory standards, ensuring stakeholders receive reliable information. Corporate Finance Advisory involves strategic financial planning, mergers and acquisitions, capital raising, and valuation to enhance business growth and investment decisions. The major difference lies in Audit's regulatory and compliance emphasis versus Corporate Finance Advisory's strategic and transactional focus.

Choosing the Right Path: Factors to Consider

Audit and assurance services focus on verifying financial accuracy and compliance, essential for maintaining stakeholder trust and regulatory adherence. Corporate finance advisory involves strategic planning for mergers, acquisitions, capital raising, and financial restructuring, driving business growth and value creation. When choosing the right path, professionals should consider their analytical skills, interest in regulatory frameworks versus strategic deals, and long-term career goals within finance sectors.

Audit and Assurance Infographic

libterm.com

libterm.com