A leveraged buyout (LBO) is a financial transaction where a company is acquired using a significant amount of borrowed money, often secured by the assets of the acquired company. This strategy allows investors to increase their potential returns by minimizing their capital investment while taking advantage of the target's cash flow to service debt. Discover how leveraged buyouts work and the key factors that influence their success in the rest of this article.

Table of Comparison

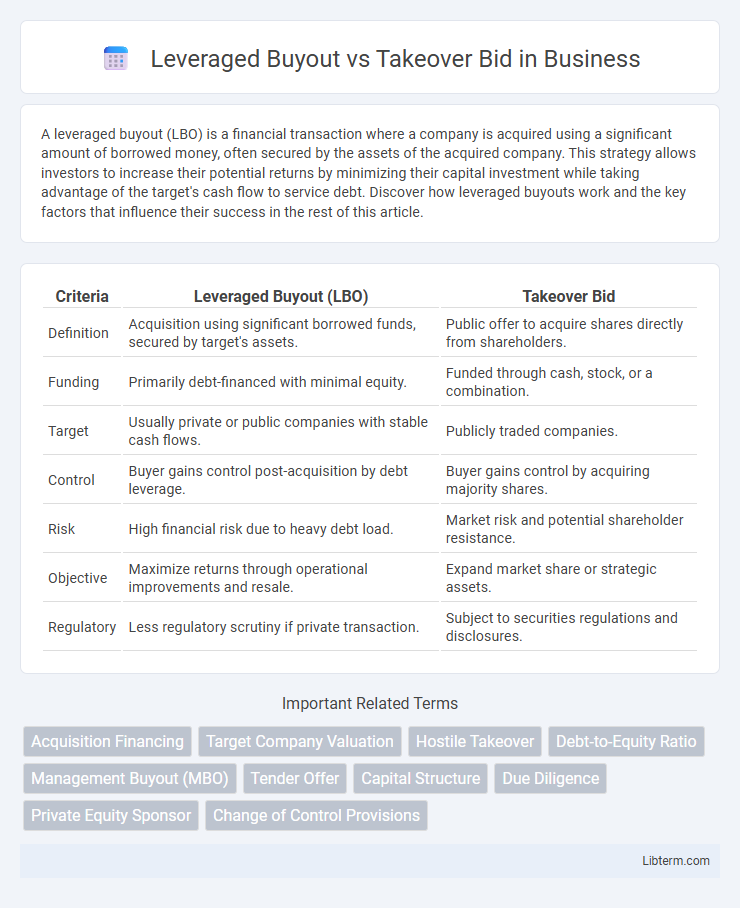

| Criteria | Leveraged Buyout (LBO) | Takeover Bid |

|---|---|---|

| Definition | Acquisition using significant borrowed funds, secured by target's assets. | Public offer to acquire shares directly from shareholders. |

| Funding | Primarily debt-financed with minimal equity. | Funded through cash, stock, or a combination. |

| Target | Usually private or public companies with stable cash flows. | Publicly traded companies. |

| Control | Buyer gains control post-acquisition by debt leverage. | Buyer gains control by acquiring majority shares. |

| Risk | High financial risk due to heavy debt load. | Market risk and potential shareholder resistance. |

| Objective | Maximize returns through operational improvements and resale. | Expand market share or strategic assets. |

| Regulatory | Less regulatory scrutiny if private transaction. | Subject to securities regulations and disclosures. |

Introduction to Leveraged Buyouts and Takeover Bids

Leveraged buyouts (LBOs) involve acquiring a company primarily through borrowed funds, using the target's assets as collateral, which allows investors to gain control with minimal equity. Takeover bids, or tender offers, occur when a bidder proposes to purchase shares directly from shareholders at a premium to gain control, typically without incurring significant debt. Both strategies aim for ownership control but differ in financing structures and shareholder engagement methods.

Defining Leveraged Buyout (LBO)

A Leveraged Buyout (LBO) is a financial acquisition method where a significant portion of the purchase price is financed through debt, utilizing the target company's assets as collateral. This strategy enables investors to acquire controlling interest while minimizing upfront equity investment, often aiming to improve operational efficiency and increase return on equity. In contrast, a Takeover Bid involves directly offering to purchase a company's shares, focusing on ownership transfer without the specific leverage structure characteristic of an LBO.

Explaining Takeover Bids

A takeover bid is a public offer made by an acquiring company to purchase shares of a target company, aiming to gain control by acquiring a majority stake. It typically involves offering a premium price above the current market value to persuade shareholders to sell their shares. Unlike leveraged buyouts, takeover bids do not necessarily rely on substantial borrowed capital and are often used for strategic acquisitions in publicly traded companies.

Key Differences Between LBO and Takeover Bid

A Leveraged Buyout (LBO) involves acquiring a company primarily through borrowed funds, using the target's assets as collateral, whereas a Takeover Bid is a direct offer to purchase shares from existing shareholders at a specified price. LBOs often aim for complete control with a focus on restructuring and improving profitability, while Takeover Bids can be friendly or hostile and do not necessarily involve significant financial restructuring. The financial risk is higher in LBOs due to heavy debt reliance, whereas Takeover Bids depend more on market acceptance and shareholder consent.

Financial Structures in LBOs vs Takeover Bids

Financial structures in Leveraged Buyouts (LBOs) primarily involve high levels of debt financing, where the acquisition is funded by borrowed capital secured against the target company's assets and cash flows, optimizing leverage to enhance returns. In contrast, Takeover Bids often rely on a mix of equity and cash payments, with less emphasis on debt, reflecting a more straightforward acquisition financed through the bidder's own resources or market issuance. The strategic use of leverage in LBOs creates complex capital structures with debt tranches such as senior loans, mezzanine financing, and high-yield bonds, while takeover bids exhibit simpler capital allocations focused on immediate payment and shareholder value transfer.

Strategic Objectives: LBOs vs Takeovers

Leveraged Buyouts (LBOs) primarily aim to acquire undervalued companies using high debt while enhancing operational efficiencies and cash flow to maximize shareholder returns. Takeover bids often focus on market expansion, gaining competitive advantage, or achieving synergies through acquisition of strategic assets. The strategic objective of LBOs centers on financial engineering, whereas takeovers emphasize long-term strategic growth and market positioning.

Legal and Regulatory Considerations

Leveraged Buyouts (LBOs) and Takeover Bids are subject to distinct legal and regulatory frameworks, with LBOs often scrutinized for debt structuring and compliance with securities regulations, while Takeover Bids must adhere to takeover codes, disclosure requirements, and shareholder protection laws. Regulatory authorities like the SEC in the US and the FCA in the UK monitor Takeover Bids to ensure fair treatment of shareholders and transparency, whereas LBOs face stringent antitrust reviews and fiduciary duty considerations to prevent conflicts of interest. Understanding the nuances of merger control laws, disclosure rules, and creditor protections is crucial for navigating the legal complexities inherent to both transaction types.

Risks and Benefits of Each Approach

Leveraged Buyouts (LBOs) involve acquiring a company primarily through debt, offering benefits such as higher potential returns and management control, but carry risks including increased financial leverage and potential bankruptcy. Takeover Bids typically use cash or stock offers to acquire control, providing the advantage of straightforward acquisition and liquidity for shareholders, while exposing acquirers to regulatory challenges and hostile resistance. Evaluating the trade-offs between LBOs' debt-driven growth and Takeover Bids' acquisition simplicity is critical for optimizing investment strategies.

Real-World Examples: LBOs and Takeover Bids

The 2007 leveraged buyout (LBO) of TXU Energy by Kohlberg Kravis Roberts exemplifies a high-profile LBO, where substantial debt was used to acquire a controlling interest, allowing the firm to restructure and optimize operations. In contrast, the hostile takeover bid launched by Kraft Foods for Cadbury in 2009 highlights an aggressive acquisition strategy relying on direct shareholder buyout offers aimed at immediate control transfer. These real-world cases illustrate the strategic and financial complexities distinctively inherent in LBOs and takeover bids within corporate acquisitions.

Conclusion: Choosing the Right Acquisition Strategy

Selecting the right acquisition strategy depends on the company's financial capacity and control objectives; leveraged buyouts (LBOs) are ideal for acquiring firms with stable cash flows using significant debt, allowing buyers to gain control with limited initial equity. In contrast, takeover bids suit investors seeking direct purchase of shares on the open market, often resulting in immediate ownership but requiring substantial capital outlay. Evaluating the target's financial health, market conditions, and desired level of involvement ensures alignment with strategic goals and maximizes acquisition success.

Leveraged Buyout Infographic

libterm.com

libterm.com