A business accelerator provides startups with mentorship, resources, and funding to rapidly grow and scale their operations. These programs offer intense, time-limited support designed to refine your business model, connect you with industry experts, and attract potential investors. Discover how joining a business accelerator can fast-track your company's success in the rest of this article.

Table of Comparison

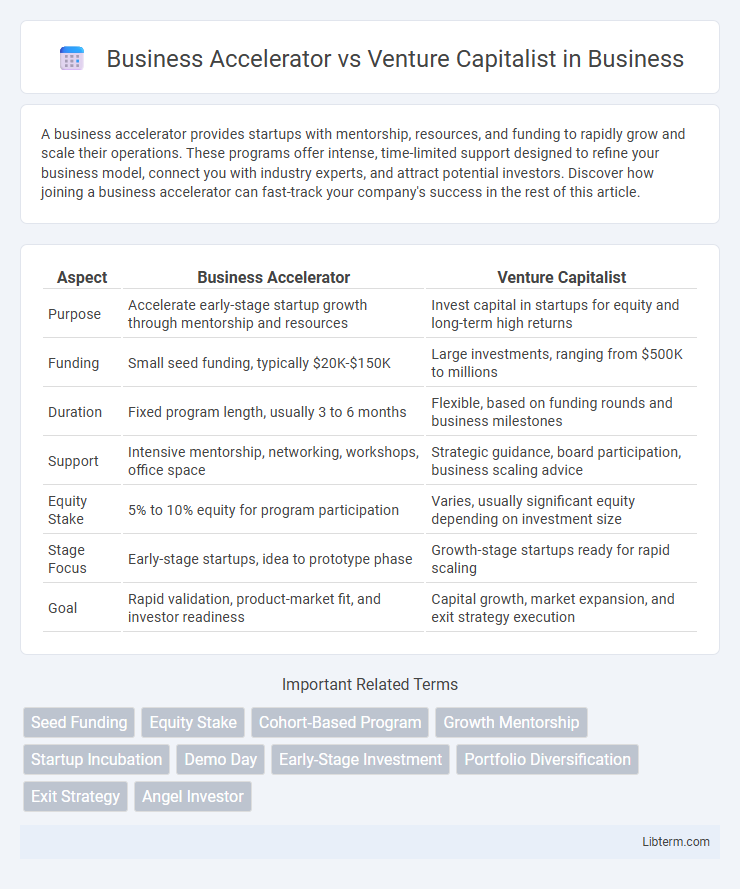

| Aspect | Business Accelerator | Venture Capitalist |

|---|---|---|

| Purpose | Accelerate early-stage startup growth through mentorship and resources | Invest capital in startups for equity and long-term high returns |

| Funding | Small seed funding, typically $20K-$150K | Large investments, ranging from $500K to millions |

| Duration | Fixed program length, usually 3 to 6 months | Flexible, based on funding rounds and business milestones |

| Support | Intensive mentorship, networking, workshops, office space | Strategic guidance, board participation, business scaling advice |

| Equity Stake | 5% to 10% equity for program participation | Varies, usually significant equity depending on investment size |

| Stage Focus | Early-stage startups, idea to prototype phase | Growth-stage startups ready for rapid scaling |

| Goal | Rapid validation, product-market fit, and investor readiness | Capital growth, market expansion, and exit strategy execution |

Introduction to Business Accelerators and Venture Capitalists

Business accelerators are programs designed to support early-stage startups through mentorship, resources, and funding, typically over a fixed period to rapidly scale business operations. Venture capitalists (VCs) provide significant capital investment in exchange for equity, focusing on high-growth potential startups with scalable products or services. While accelerators emphasize structured growth and development support, venture capitalists primarily offer financial backing and strategic guidance for expansion.

Definition and Core Functions

Business accelerators provide fixed-term, cohort-based programs offering mentorship, resources, and seed funding to early-stage startups to rapidly scale their business models. Venture capitalists (VCs) invest substantial equity capital into startups and high-growth companies in exchange for ownership stakes, focusing on long-term financial returns and strategic support. Accelerators emphasize intensive education and network access, while VCs prioritize capital infusion and board-level involvement to drive company growth.

Key Differences Between Accelerators and Venture Capitalists

Business accelerators provide startups with structured programs, mentorship, and resources over a fixed duration, typically in exchange for equity, aiming to rapidly scale early-stage companies. Venture capitalists invest significant capital directly into startups or growth-stage companies, focusing primarily on financial returns and often taking a seat on the board to influence strategic decisions. Accelerators emphasize intensive development and networking within a community setting, while venture capitalists prioritize funding rounds, long-term growth, and exit opportunities.

Funding Models and Investment Structures

Business accelerators provide early-stage startups with seed funding, mentorship, and resources in exchange for equity, typically offering smaller investment amounts within a structured program lasting a few months. Venture capitalists invest larger sums of capital in exchange for significant equity stakes, focusing on high-growth potential companies with less hands-on support but a longer-term investment horizon. The funding model of accelerators is often tied to program completion and milestones, while venture capital investments involve multiple funding rounds and structured equity agreements such as preferred shares or convertible notes.

Application and Selection Processes

Business accelerators typically have structured application processes with fixed deadlines, requiring startups to submit detailed business plans, prototypes, and growth strategies for evaluation. Venture capitalists often engage in ongoing deal sourcing, relying on referrals, market trends, and direct outreach to identify high-potential startups, with less formalized application steps. Selection by accelerators emphasizes scalability and team dynamics during a cohort-based program, whereas venture capitalists prioritize market traction, financial metrics, and long-term return potential.

Mentorship and Added Value

Business accelerators provide intensive mentorship, access to resources, and structured programs designed to rapidly grow startups through expert guidance and networking opportunities. Venture capitalists primarily offer financial investment, though some also provide strategic advice and industry connections to support business scaling. The key distinction lies in accelerators' hands-on mentorship and comprehensive support versus venture capitalists' focus on funding with selective advisory involvement.

Equity Stakes and Financial Implications

Business accelerators typically take smaller equity stakes, ranging from 5% to 10%, in exchange for seed funding and mentorship, fostering early-stage growth with manageable financial dilution. Venture capitalists often demand larger equity shares, commonly between 15% and 30%, reflecting higher capital investments and risk exposure with significant influence on company decisions. The financial implications include accelerators providing structured program benefits that enhance scalability, while venture capitalists contribute substantial funds aimed at rapid expansion and substantial returns.

Ideal Business Stages for Each Path

Business accelerators primarily target early-stage startups in the ideation or prototype phase, offering mentorship, resources, and seed funding to refine their business models quickly. Venture capitalists generally invest in growth-stage companies with proven market traction, seeking scalable businesses ready for larger capital infusions to expand operations. Choosing between an accelerator and venture capital depends on the startup's development stage, funding needs, and growth objectives.

Success Stories and Case Studies

Business accelerators nurture early-stage startups through intensive mentorship and resources, often leading to successful outcomes like Airbnb, which thrived after participating in Y Combinator's program. Venture capitalists provide substantial funding to scale companies, exemplified by companies like Uber, which secured large VC investments to expand globally. Both models demonstrate significant success through strategic support and capital infusion, driving startup growth and market disruption.

Choosing the Right Option for Your Startup

Selecting between a business accelerator and a venture capitalist depends on your startup's needs, stage, and growth goals. Business accelerators provide structured mentorship, resources, and early-stage funding to rapidly scale, ideal for startups seeking guidance and network access. Venture capitalists offer larger investment sums in exchange for equity, suited for companies ready for significant expansion and long-term financial backing.

Business Accelerator Infographic

libterm.com

libterm.com