Operating lease allows you to use an asset without ownership, typically for a short to medium term, while the lessor retains responsibility for maintenance and risks. This type of lease offers flexibility and off-balance-sheet financing advantages, making it ideal for managing cash flow and avoiding asset obsolescence. Explore the full article to understand how an operating lease can benefit your business and financial planning.

Table of Comparison

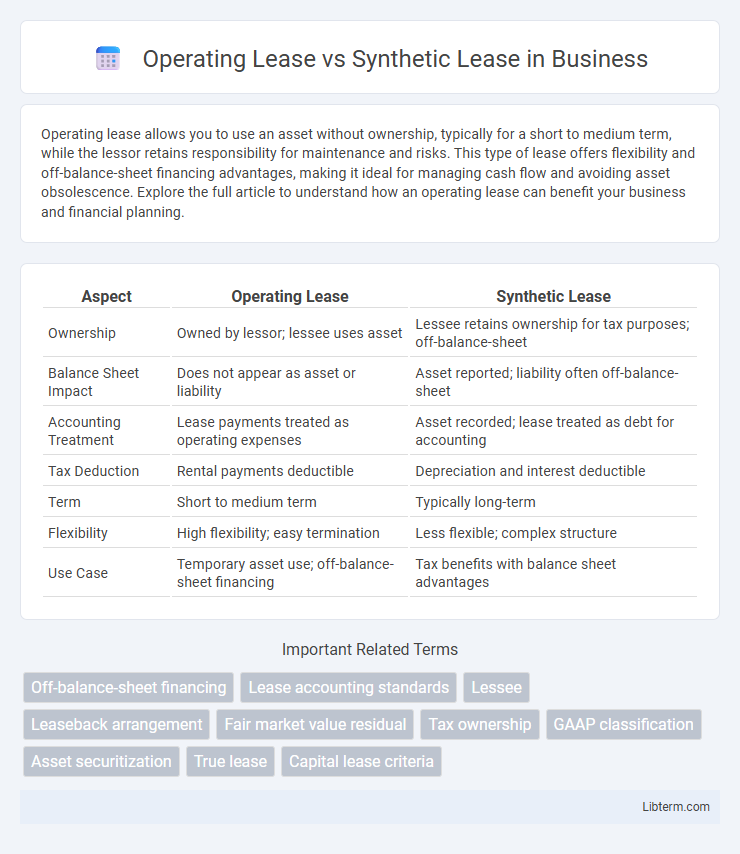

| Aspect | Operating Lease | Synthetic Lease |

|---|---|---|

| Ownership | Owned by lessor; lessee uses asset | Lessee retains ownership for tax purposes; off-balance-sheet |

| Balance Sheet Impact | Does not appear as asset or liability | Asset reported; liability often off-balance-sheet |

| Accounting Treatment | Lease payments treated as operating expenses | Asset recorded; lease treated as debt for accounting |

| Tax Deduction | Rental payments deductible | Depreciation and interest deductible |

| Term | Short to medium term | Typically long-term |

| Flexibility | High flexibility; easy termination | Less flexible; complex structure |

| Use Case | Temporary asset use; off-balance-sheet financing | Tax benefits with balance sheet advantages |

Introduction to Operating Lease and Synthetic Lease

An operating lease is a contract allowing the lessee to use an asset without ownership responsibilities, typically for short-term use and off-balance-sheet financing. A synthetic lease combines characteristics of both operating and capital leases, enabling companies to keep assets off their balance sheets while retaining control and tax benefits. This hybrid structure is commonly used in real estate and equipment financing to optimize financial and tax reporting.

Key Definitions: Operating Lease vs Synthetic Lease

An Operating Lease is a rental agreement where the lessee uses an asset without ownership rights, and the lessor retains the asset on their balance sheet, typically offering off-balance-sheet financing benefits. A Synthetic Lease combines features of both operating and capital leases, structured to appear as an operating lease for accounting purposes while allowing the lessee to maintain legal ownership and capitalize the asset for tax benefits. Understanding key differences in ownership, balance sheet impact, and tax treatment is crucial for businesses evaluating Operating Lease vs Synthetic Lease options.

Structure and Mechanics of Operating Leases

Operating leases involve a contract where the lessee uses an asset without ownership transfer, with lease payments considered operating expenses on the income statement. The lessor retains asset ownership and depreciation benefits, while the lessee records no asset or liability on the balance sheet under operating lease accounting standards. Payments typically cover usage and maintenance, allowing lessees off-balance-sheet financing and flexibility without long-term commitment.

Structure and Mechanics of Synthetic Leases

A synthetic lease is a financing arrangement that combines the benefits of operating leases and ownership, where the lessee retains operational control and tax advantages while the asset is off-balance-sheet for financial reporting purposes. This structure involves a special purpose entity (SPE) that legally owns the asset, with the lessee maintaining operational control through a lease agreement, allowing for off-balance-sheet treatment under GAAP while keeping tax benefits from asset ownership. The mechanics include structured lease payments that mimic debt repayment schedules, enabling lessees to optimize balance sheet presentation and enhance financial ratios without sacrificing tax depreciation benefits.

Accounting Treatment and Financial Reporting

Operating leases are recorded off-balance-sheet, allowing companies to avoid recognizing asset and liability, with lease payments expensed on the income statement, enhancing reported EBITDA. Synthetic leases, structured to appear as operating leases for financial reporting while treated as financing leases for tax purposes, require capitalization of the leased asset and corresponding liability under new lease accounting standards like ASC 842 or IFRS 16. This dual treatment impacts lease classification, necessitating disclosure of both operating lease expenses and synthetic lease obligations to provide transparent financial reporting and compliance with accounting regulations.

Tax Implications and Benefits

Operating leases do not appear on the lessee's balance sheet, allowing businesses to conserve debt capacity and receive tax-deductible lease payments as operating expenses, reducing taxable income. Synthetic leases combine elements of ownership and leasing, enabling the asset to remain off-balance-sheet for financial reporting while the lessee retains ownership for tax purposes, allowing depreciation deductions that provide significant tax benefits. Tax implications vary as operating leases offer expense deductions without depreciation, whereas synthetic leases allow for depreciation and interest expense deductions, optimizing tax advantages based on the company's financial strategy.

Risk Allocation and Legal Considerations

Operating leases allocate most risks to the lessor, including asset obsolescence and residual value risk, while the lessee benefits from off-balance-sheet treatment and lower financial exposure. Synthetic leases are structured to maintain off-balance-sheet classification but shift more risks and obligations to the lessee, such as maintenance responsibilities and potential regulatory scrutiny. Legal considerations for synthetic leases involve complex agreements ensuring lessee control and compliance with accounting standards, whereas operating leases follow more straightforward regulatory frameworks with clearer risk separation.

Impact on Balance Sheet and Off-Balance-Sheet Financing

Operating leases typically remain off-balance-sheet, allowing companies to use assets without recognizing liabilities, thus enhancing financial ratios such as return on assets and debt-to-equity. Synthetic leases, structured to combine tax benefits of ownership with off-balance-sheet treatment, enable firms to control assets while minimizing reported debt, but recent accounting standards have reduced their off-balance-sheet advantages. Both lease types influence financial statement presentation and risk assessment, affecting lending decisions and compliance with regulatory capital requirements.

Suitability for Businesses and Industry Applications

Operating leases suit businesses aiming to preserve capital and maintain flexible asset management, commonly used in industries like retail and technology where equipment needs change rapidly. Synthetic leases appeal to larger corporations seeking off-balance-sheet financing while retaining ownership benefits, often applied in real estate and heavy manufacturing sectors. The choice depends on factors such as asset type, financial strategy, and regulatory environment impacting lease accounting and tax implications.

Comparative Summary: Choosing Between Operating and Synthetic Leases

Operating leases offer off-balance-sheet treatment, preserving company debt capacity and providing flexibility for short-term asset use, while synthetic leases combine tax benefits of ownership with off-balance-sheet financing, often requiring complex structuring to meet accounting and tax criteria. Companies prioritizing financial statement impact and simpler administration may prefer operating leases, whereas those seeking tax advantages and asset control might opt for synthetic leases. The decision hinges on balancing off-balance-sheet financing, tax implications, and compliance with GAAP and IRS regulations.

Operating Lease Infographic

libterm.com

libterm.com