Fixed capital refers to long-term assets like buildings, machinery, and equipment used in production to generate wealth over time. These assets are not consumed in the production process but play a crucial role in enhancing your business's operational efficiency and capacity. Explore the rest of the article to understand how managing fixed capital impacts your company's growth and financial stability.

Table of Comparison

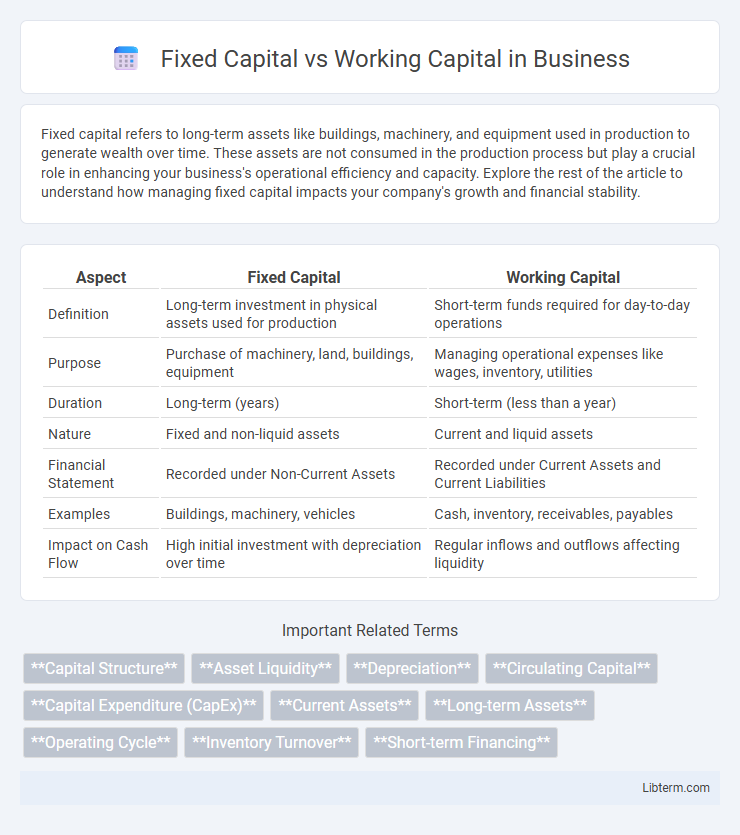

| Aspect | Fixed Capital | Working Capital |

|---|---|---|

| Definition | Long-term investment in physical assets used for production | Short-term funds required for day-to-day operations |

| Purpose | Purchase of machinery, land, buildings, equipment | Managing operational expenses like wages, inventory, utilities |

| Duration | Long-term (years) | Short-term (less than a year) |

| Nature | Fixed and non-liquid assets | Current and liquid assets |

| Financial Statement | Recorded under Non-Current Assets | Recorded under Current Assets and Current Liabilities |

| Examples | Buildings, machinery, vehicles | Cash, inventory, receivables, payables |

| Impact on Cash Flow | High initial investment with depreciation over time | Regular inflows and outflows affecting liquidity |

Introduction to Fixed Capital and Working Capital

Fixed capital refers to the long-term assets used in production such as machinery, buildings, and equipment that remain in the business for an extended period. Working capital represents the short-term assets and liabilities needed to manage day-to-day operations, including cash, inventory, and accounts receivable. Understanding the distinction ensures efficient allocation of resources for both ongoing operational expenses and long-term investments.

Definition of Fixed Capital

Fixed Capital refers to the long-term investment assets used by a company to produce goods and services, such as machinery, buildings, and equipment. These assets are not consumed in the production process and provide ongoing value over multiple accounting periods. Unlike Working Capital, which covers daily operational expenses, Fixed Capital represents assets essential for sustaining business operations and supporting growth.

Definition of Working Capital

Working capital represents the difference between a company's current assets and current liabilities, reflecting the liquidity available for day-to-day operations. It includes cash, accounts receivable, and inventory, crucial for meeting short-term financial obligations and operational expenses. Effective management of working capital ensures smooth business continuity and avoids insolvency risks.

Key Differences Between Fixed and Working Capital

Fixed capital refers to long-term assets such as machinery, buildings, and equipment used for production over multiple years, whereas working capital represents short-term assets and liabilities involved in day-to-day operations, including inventory, receivables, and payables. Fixed capital is invested for business expansion and capacity enhancement, typically involving significant funds and long-term commitments, while working capital manages the liquidity and operational efficiency to meet immediate expenses and operational needs. The key difference lies in the time horizon and function: fixed capital supports long-term business sustainability, while working capital ensures smooth daily functioning and solvency.

Importance of Fixed Capital in Business Operations

Fixed capital represents long-term investments in physical assets such as machinery, buildings, and equipment that are essential for sustained business operations. It ensures the production capacity and operational efficiency needed to generate revenue over time, directly impacting a company's ability to compete and grow. Adequate fixed capital enables businesses to maintain stability and support large-scale projects, distinguishing it as a critical component for long-term success.

Importance of Working Capital in Day-to-Day Activities

Working capital is crucial for managing the daily operational expenses such as payroll, rent, and inventory purchases, ensuring smooth business functioning without interruption. Unlike fixed capital, which is invested in long-term assets, working capital maintains liquidity to meet short-term obligations and operational needs efficiently. Effective working capital management helps prevent cash flow problems, supports supplier relationships, and sustains ongoing production and sales processes.

Sources of Fixed Capital Financing

Fixed capital financing primarily involves long-term funding sources such as equity capital, debentures, long-term loans from banks, and retained earnings, which are utilized for acquiring or upgrading physical assets like machinery, buildings, and land. Equity capital includes funds raised through issuing shares, offering investors ownership stakes and voting rights. Debentures and term loans provide companies with debt financing options, often secured against fixed assets, enabling sustained investment in infrastructure without immediate repayment pressures.

Sources of Working Capital Financing

Working capital financing primarily comes from short-term sources such as trade credit, bank overdrafts, and commercial paper, enabling businesses to manage daily operational expenses effectively. Companies also utilize secured loans and factoring of receivables to enhance liquidity without increasing long-term liabilities. Efficient management of these financing sources ensures continuous cash flow and supports inventory and accounts payable cycles.

Impact of Fixed and Working Capital on Business Growth

Fixed capital investment in machinery, buildings, and equipment provides the essential infrastructure for long-term business expansion and operational efficiency. Working capital, comprising cash, inventory, and receivables, ensures smooth day-to-day operations, enabling companies to meet short-term liabilities and seize immediate market opportunities. A balanced allocation between fixed and working capital optimizes growth by supporting both strategic asset acquisition and operational liquidity.

Conclusion: Choosing the Right Capital Balance

Selecting the appropriate balance between fixed capital and working capital is crucial for maintaining financial stability and operational efficiency. Fixed capital investments ensure long-term growth through asset acquisition, while working capital manages day-to-day liquidity and short-term obligations. A strategic approach aligning capital structure with business goals enhances profitability and sustains competitive advantage.

Fixed Capital Infographic

libterm.com

libterm.com