EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures a company's operating performance by focusing on profitability from core business activities. Understanding EBITDA helps investors and analysts evaluate the true cash flow potential of a company without the influence of financial and accounting decisions. Discover how mastering EBITDA can enhance your financial analysis by exploring the detailed insights in the rest of this article.

Table of Comparison

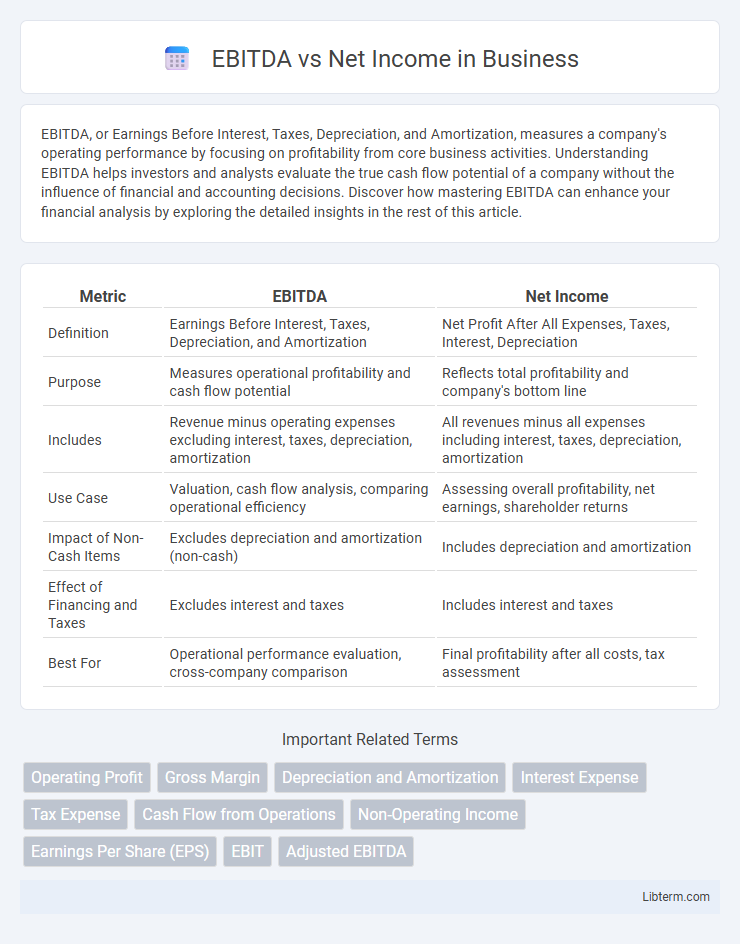

| Metric | EBITDA | Net Income |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Net Profit After All Expenses, Taxes, Interest, Depreciation |

| Purpose | Measures operational profitability and cash flow potential | Reflects total profitability and company's bottom line |

| Includes | Revenue minus operating expenses excluding interest, taxes, depreciation, amortization | All revenues minus all expenses including interest, taxes, depreciation, amortization |

| Use Case | Valuation, cash flow analysis, comparing operational efficiency | Assessing overall profitability, net earnings, shareholder returns |

| Impact of Non-Cash Items | Excludes depreciation and amortization (non-cash) | Includes depreciation and amortization |

| Effect of Financing and Taxes | Excludes interest and taxes | Includes interest and taxes |

| Best For | Operational performance evaluation, cross-company comparison | Final profitability after all costs, tax assessment |

Introduction to EBITDA and Net Income

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by excluding non-operational expenses and non-cash charges, providing a clear view of core profitability. Net Income represents the company's total profit after accounting for all expenses, including interest, taxes, depreciation, and amortization, reflecting the actual bottom-line profitability. Investors use EBITDA to assess operational efficiency, while Net Income offers insight into overall financial health and profitability.

Defining EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures a company's operating performance by excluding non-operational expenses. This metric helps investors assess profitability from core business activities without the impact of capital structure and tax environments. Unlike net income, which accounts for all expenses including interest and taxes, EBITDA provides a clearer view of cash generation potential.

Understanding Net Income

Net Income represents a company's total profit after all expenses, taxes, and costs have been deducted from total revenue, providing a comprehensive measure of financial performance. It reflects the actual profitability available to shareholders and is a key indicator for assessing the company's bottom line. Unlike EBITDA, Net Income accounts for interest, taxes, depreciation, and amortization, offering a more complete view of the firm's financial health.

Key Differences Between EBITDA and Net Income

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures operating performance by excluding non-operating expenses, while Net Income reflects the company's total profitability after all expenses. EBITDA emphasizes cash flow from core operations, making it useful for comparing companies across industries with different capital structures and tax environments. Net Income accounts for interest, taxes, depreciation, and amortization, providing a comprehensive view of financial health and earnings available to shareholders.

Calculation Methods for EBITDA and Net Income

EBITDA is calculated by adding back interest, taxes, depreciation, and amortization to net income, providing a measure of operational profitability before non-operating expenses and non-cash charges. Net income is derived by subtracting all operating expenses, interest, taxes, depreciation, and amortization from total revenue, reflecting the company's bottom-line profit after all costs. The key difference lies in EBITDA excluding interest, taxes, and non-cash expenses, while net income incorporates these elements, offering a comprehensive view of profitability.

Use Cases: When to Use EBITDA vs Net Income

EBITDA is ideal for evaluating operational performance and cash flow potential, especially in industries with high depreciation and amortization, as it excludes non-cash expenses and financing effects. Net Income provides a comprehensive view of profitability, incorporating all expenses, taxes, and interest, making it essential for assessing overall financial health and shareholder returns. Investors and analysts use EBITDA for comparing companies within capital-intensive sectors, while Net Income is critical for understanding net profitability and guiding dividend decisions.

Limitations of EBITDA

EBITDA excludes crucial expenses like interest, taxes, depreciation, and amortization, which can distort a company's true profitability and cash flow situation. This omission limits its usefulness in assessing long-term financial health and capital-intensive industries where depreciation and amortization significantly impact earnings. Investors and analysts must consider EBITDA alongside net income to gain a comprehensive view of operational performance and financial stability.

Limitations of Net Income

Net Income reflects a company's profitability after all expenses, taxes, and interest but can be significantly affected by non-cash items like depreciation and amortization, leading to potential distortions in operational performance analysis. It includes one-time charges and accounting adjustments that may not relate to core business activities, thus limiting its usefulness for assessing ongoing profitability. Investors often prefer EBITDA for evaluating operational efficiency because it excludes these factors, providing a clearer picture of cash flow generation potential.

Impact on Business Valuation and Analysis

EBITDA provides a clearer picture of operational profitability by excluding non-cash expenses, interest, and taxes, making it crucial for comparing business performance across industries and assessing ongoing cash flow generation. Net Income reflects the company's overall profitability after accounting for all expenses, taxes, and interest, offering a comprehensive view of financial health. Investors and analysts often use EBITDA to gauge a company's operating efficiency and valuation multiples, while Net Income helps determine earnings quality and the impact on shareholder value.

Which Metric is Better for Investors?

EBITDA provides investors with a clear view of a company's operational performance by excluding non-cash expenses like depreciation and amortization, making it useful for comparing profitability across firms and industries. Net income reflects the company's bottom line after all expenses, taxes, and interest, offering a comprehensive measure of financial health and profitability. Investors often prefer EBITDA for evaluating operational efficiency, but net income is better for assessing overall profitability and cash flow sustainability.

EBITDA Infographic

libterm.com

libterm.com