Revenue represents the total income generated by a business from its core operations, including sales of goods and services. It serves as a crucial indicator of financial health and business performance. Explore the rest of this article to understand how maximizing your revenue can drive growth and profitability.

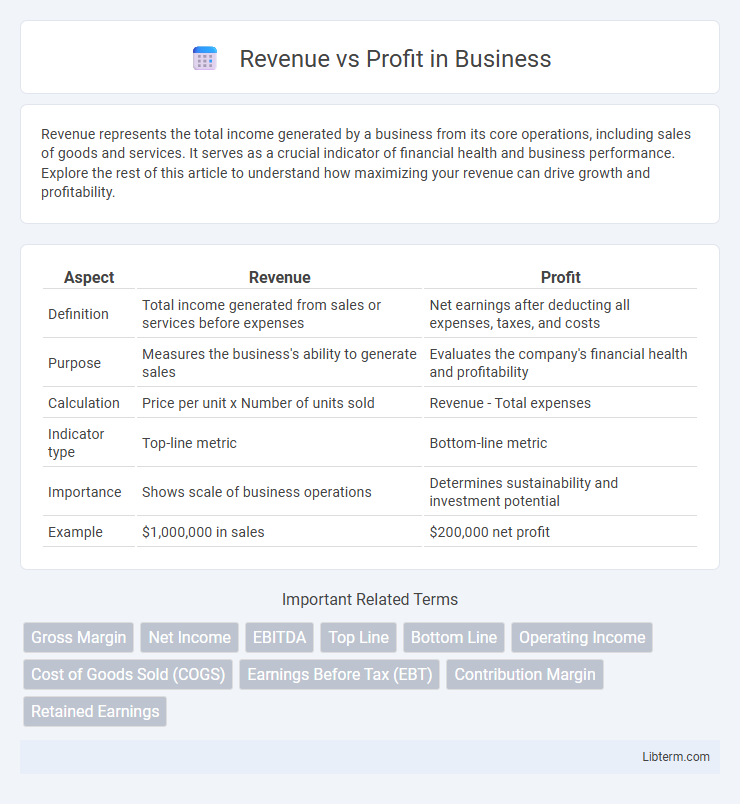

Table of Comparison

| Aspect | Revenue | Profit |

|---|---|---|

| Definition | Total income generated from sales or services before expenses | Net earnings after deducting all expenses, taxes, and costs |

| Purpose | Measures the business's ability to generate sales | Evaluates the company's financial health and profitability |

| Calculation | Price per unit x Number of units sold | Revenue - Total expenses |

| Indicator type | Top-line metric | Bottom-line metric |

| Importance | Shows scale of business operations | Determines sustainability and investment potential |

| Example | $1,000,000 in sales | $200,000 net profit |

Introduction to Revenue and Profit

Revenue represents the total income generated from sales or services before any expenses are deducted, serving as a key indicator of a company's market demand and operational scale. Profit, calculated by subtracting all costs and expenses from revenue, reflects the actual financial gain and business efficiency. Understanding the distinction between revenue and profit is essential for evaluating a company's financial health and making informed strategic decisions.

Defining Revenue: The Top Line

Revenue, often referred to as the top line, represents the total income generated by a company from its core business activities before any expenses are deducted. It includes sales of goods, services, and any other primary operational income streams. Monitoring revenue is crucial for assessing business growth potential and market demand, distinguishing it clearly from profit, which accounts for all costs and expenses.

Defining Profit: The Bottom Line

Profit represents the financial gain remaining after subtracting all expenses, taxes, and costs from total revenue, often referred to as the bottom line. It serves as a key indicator of a company's profitability and operational efficiency. Unlike revenue, which measures total income generated from sales, profit reflects the true earnings that contribute to business growth and shareholder value.

Key Differences Between Revenue and Profit

Revenue represents the total income generated from sales or services before any expenses are deducted, highlighting the company's ability to generate business. Profit, on the other hand, is the net income remaining after all costs, taxes, and expenses are subtracted from revenue, indicating overall financial health and efficiency. The key difference lies in revenue measuring gross earnings while profit reflects true profitability and operational success.

Types of Revenue in Business

Revenue in business primarily includes operating revenue, generated from core activities such as sales of goods or services, and non-operating revenue, which encompasses earnings from secondary sources like interest, dividends, or asset sales. Different businesses may record multiple revenue streams including recurring revenue from subscriptions, transactional revenue from one-time sales, and project-based revenue from completing specific contracts. Understanding these types is crucial for accurate financial analysis and optimizing profit margins by aligning revenue strategies with business models.

Types of Profit: Gross, Operating, and Net

Revenue represents the total income generated from sales, while profit measures the financial gain after various expenses. Gross profit is calculated by subtracting the cost of goods sold (COGS) from revenue, indicating the efficiency of production. Operating profit accounts for operating expenses like wages and rent, reflecting core business performance, and net profit is the final bottom line after all expenses, taxes, and interest, showcasing overall profitability.

Importance of Revenue in Business Growth

Revenue represents the total income generated from sales before any expenses are deducted, serving as a crucial indicator of market demand and business viability. High revenue levels enable companies to invest in product development, marketing, and expansion strategies that drive sustainable growth. Consistent revenue growth signals strong customer acquisition and retention, laying the foundation for long-term profitability and competitive advantage.

Why Profit Matters for Sustainability

Profit reflects the true financial health of a business, enabling reinvestment in innovation, operational improvements, and market expansion. Companies generating consistent profits can build reserves to withstand economic downturns and fund sustainable practices such as reducing environmental impact or enhancing social responsibility. Revenue alone does not account for costs or efficiency, making profit the critical metric for long-term business viability and sustainability.

Common Misconceptions About Revenue vs Profit

Revenue represents the total income generated from sales before any expenses are deducted, often mistaken for actual earnings. Profit, however, is the net income remaining after all costs, taxes, and expenses have been subtracted, revealing the true financial health of a business. Confusing revenue with profit can lead to overestimating business viability and making poor financial decisions based on inflated figures.

How to Improve Both Revenue and Profit

Improving both revenue and profit requires strategic pricing, expanding product lines, and enhancing sales channels to increase overall income. Reducing operational costs, optimizing supply chains, and improving efficiency directly boost profit margins without sacrificing revenue. Leveraging data analytics for customer insights enables targeted marketing and personalized offerings, driving higher sales and profitability simultaneously.

Revenue Infographic

libterm.com

libterm.com