Equity financing involves raising capital by selling shares of your company, providing investors with ownership stakes. This method can enhance your business's financial strength without incurring debt, but it may also dilute control. Explore the article to understand how equity financing can impact your growth strategy and investor relationships.

Table of Comparison

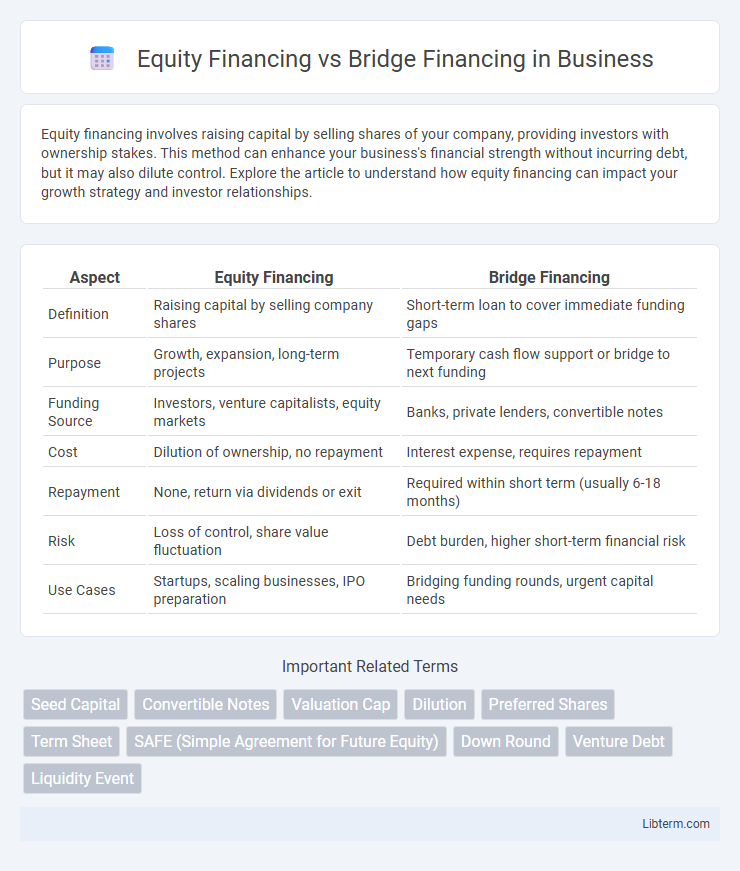

| Aspect | Equity Financing | Bridge Financing |

|---|---|---|

| Definition | Raising capital by selling company shares | Short-term loan to cover immediate funding gaps |

| Purpose | Growth, expansion, long-term projects | Temporary cash flow support or bridge to next funding |

| Funding Source | Investors, venture capitalists, equity markets | Banks, private lenders, convertible notes |

| Cost | Dilution of ownership, no repayment | Interest expense, requires repayment |

| Repayment | None, return via dividends or exit | Required within short term (usually 6-18 months) |

| Risk | Loss of control, share value fluctuation | Debt burden, higher short-term financial risk |

| Use Cases | Startups, scaling businesses, IPO preparation | Bridging funding rounds, urgent capital needs |

Introduction to Equity Financing and Bridge Financing

Equity financing involves raising capital by selling shares of ownership in a company, allowing investors to gain partial control and potential dividends in exchange for their investment. Bridge financing is a short-term loan designed to provide immediate cash flow between more substantial funding rounds or until long-term financing is secured. Both financing methods address capital needs but differ in terms of ownership dilution, risk, and repayment structure.

Key Differences Between Equity and Bridge Financing

Equity financing involves raising capital by selling shares of ownership in a company, providing investors with partial control and potential dividends, whereas bridge financing is short-term debt used to cover immediate expenses before securing long-term funding. Equity financing dilutes ownership but does not require repayment, while bridge financing must be repaid quickly, often with higher interest rates. The primary difference lies in ownership impact and repayment obligations, with equity focusing on long-term capital growth and bridge financing offering temporary liquidity solutions.

Advantages of Equity Financing

Equity financing offers the advantage of not requiring repayment, allowing businesses to preserve cash flow and invest in growth without incurring debt. It brings strategic partners and investors who can provide valuable expertise, networking opportunities, and credibility. Unlike bridge financing, equity financing reduces financial risk by avoiding interest payments and fixed repayment schedules, making it more sustainable for long-term expansion.

Disadvantages of Equity Financing

Equity financing dilutes ownership control, reducing the original shareholders' influence over business decisions. It often requires giving up a significant portion of future profits to investors, impacting long-term earnings. Additionally, raising equity can be time-consuming and costly due to regulatory compliance and investor relations.

Advantages of Bridge Financing

Bridge financing offers rapid access to capital, enabling businesses to cover immediate expenses while waiting for long-term funding or liquidity events. It typically involves fewer regulatory requirements and less dilution of ownership compared to equity financing. This short-term debt solution provides flexibility and quick closure, making it ideal for bridging financial gaps without relinquishing equity stakes.

Disadvantages of Bridge Financing

Bridge financing often carries higher interest rates compared to traditional loans, increasing the overall cost of capital for businesses. The short-term nature of this financing creates pressure to secure permanent funding quickly, which can lead to rushed decision-making. Lack of long-term security and potential dilution of ownership if converted to equity are additional drawbacks for companies relying on bridge loans.

When to Choose Equity Financing

Choose equity financing when a company needs substantial capital for long-term growth without immediate repayment pressures, particularly during early-stage development or scaling phases. This method is ideal for startups and high-risk ventures that can attract investors willing to exchange ownership stakes for funding. Equity financing supports sustained expansion by aligning investor interests with company success, avoiding debt burdens that bridge financing typically entails.

When to Opt for Bridge Financing

Bridge financing is ideal when companies require immediate capital to cover short-term operational gaps or to quickly capitalize on emerging opportunities before a larger equity round is secured. It provides a temporary funding solution with faster approval and disbursement compared to equity financing, often used during transitions such as pre-IPO phases or between funding rounds. This option bridges the cash flow gap without diluting ownership, making it suitable for businesses expecting imminent, substantial investments.

Impact on Ownership and Control

Equity financing involves raising capital by selling shares of ownership, which dilutes existing shareholders' control and influence over business decisions. Bridge financing provides short-term loans or credit options without altering ownership structure, thus maintaining current control levels but increasing debt obligations. Choosing between these options depends on balancing immediate funding needs against long-term ownership and governance impact.

Which Financing Option is Right for Your Business?

Choosing between equity financing and bridge financing depends on your business's growth stage, capital needs, and willingness to share ownership. Equity financing provides long-term capital by offering shares to investors, ideal for startups seeking substantial funding without immediate repayment obligations. Bridge financing serves as short-term cash flow support to cover expenses or bridge gaps to subsequent funding rounds, best suited for businesses needing quick liquidity without diluting equity.

Equity Financing Infographic

libterm.com

libterm.com