Project-based revenue offers a flexible income model where businesses generate earnings through specific, defined projects rather than ongoing contracts. This approach allows companies to tailor services and pricing to the unique requirements of each project, maximizing profitability and client satisfaction. Explore the rest of the article to learn how project-based revenue can transform your business strategy.

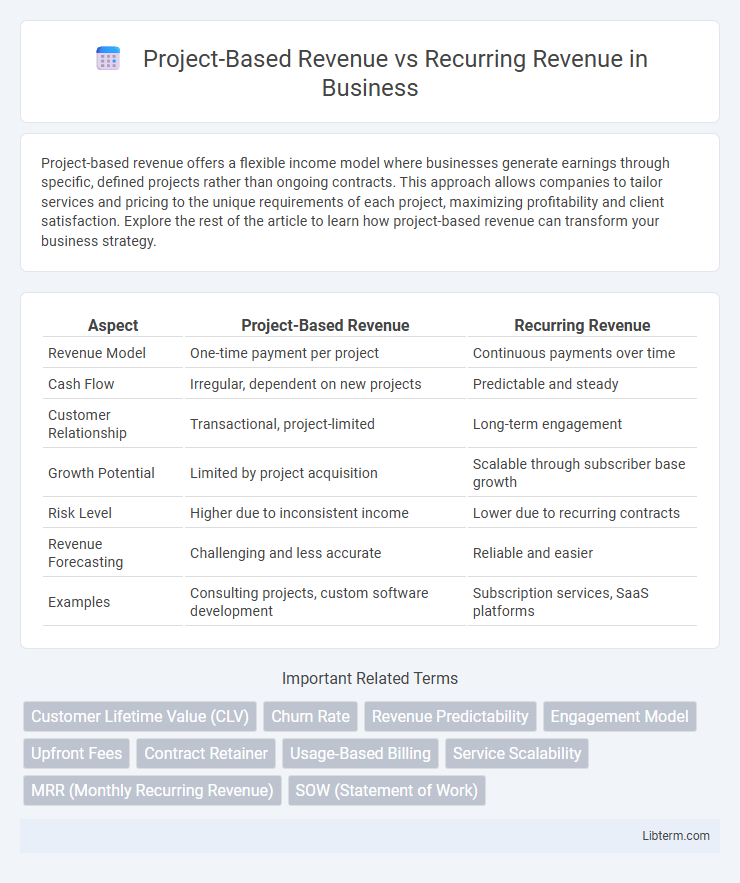

Table of Comparison

| Aspect | Project-Based Revenue | Recurring Revenue |

|---|---|---|

| Revenue Model | One-time payment per project | Continuous payments over time |

| Cash Flow | Irregular, dependent on new projects | Predictable and steady |

| Customer Relationship | Transactional, project-limited | Long-term engagement |

| Growth Potential | Limited by project acquisition | Scalable through subscriber base growth |

| Risk Level | Higher due to inconsistent income | Lower due to recurring contracts |

| Revenue Forecasting | Challenging and less accurate | Reliable and easier |

| Examples | Consulting projects, custom software development | Subscription services, SaaS platforms |

Understanding Project-Based Revenue

Project-based revenue arises from delivering specific, one-time services or products to clients, often tied to defined scopes and deadlines, allowing companies to recognize income upon project completion or milestones. This revenue model benefits businesses with clear deliverables and variable workloads but can result in fluctuating cash flow due to its non-recurring nature. Understanding project-based revenue is essential for managing financial planning, resource allocation, and forecasting in industries like consulting, construction, and custom software development.

Defining Recurring Revenue

Recurring revenue represents a stable and predictable income stream generated from ongoing customer subscriptions or service agreements, such as SaaS products, memberships, or maintenance contracts. This revenue model enhances financial forecasting accuracy and supports long-term business sustainability by ensuring consistent cash flow. Businesses leveraging recurring revenue benefit from higher customer lifetime value and reduced sales volatility compared to project-based revenue, which depends on one-time transactions or deliverables.

Key Differences Between Project-Based and Recurring Revenue

Project-based revenue generates income from one-time contracts or deliverables, leading to unpredictable cash flow and variable income streams. Recurring revenue relies on ongoing subscriptions or services, providing predictable, stable, and scalable income over time. Key differences include cash flow consistency, customer retention focus, and revenue forecasting accuracy.

Pros and Cons of Project-Based Revenue

Project-based revenue offers clear financial visibility for each completed project, allowing businesses to budget precisely and assess profitability per engagement. This revenue model provides flexibility and can accommodate customized client demands, but it often results in inconsistent cash flow and potential revenue gaps between projects. Managing project-based revenue requires meticulous resource allocation and can lead to increased administrative overhead compared to recurring revenue streams.

Advantages and Disadvantages of Recurring Revenue

Recurring revenue offers stable, predictable cash flow, enhancing financial planning and long-term business growth. The advantage lies in customer retention and lower acquisition costs compared to project-based revenue, but it may limit flexibility and revenue spikes tied to one-time projects. A key disadvantage includes dependency on continuous customer satisfaction, with risks of churn impacting consistent income streams.

Revenue Predictability and Business Stability

Project-based revenue offers higher immediate cash flow but lacks revenue predictability due to its one-time nature, causing fluctuations in business stability. Recurring revenue streams provide consistent and predictable income by securing long-term customer subscriptions or contracts, enhancing financial forecasting and business resilience. Companies prioritizing recurring revenue typically achieve greater stability and scalability, reducing dependency on constant new project acquisition.

Cash Flow Management in Different Revenue Models

Project-based revenue generates cash inflows tied to specific deliverables, often resulting in irregular and unpredictable cash flow patterns that require careful timing of expenses and reserves. Recurring revenue models, such as subscriptions or retainers, create steady and predictable cash flow streams that facilitate smoother financial planning and operational scalability. Effective cash flow management varies significantly between these models, with project-based approaches necessitating contingency funds for gaps, while recurring revenue supports more stable budgeting and investment strategies.

Choosing the Right Revenue Model for Your Business

Selecting the right revenue model between project-based revenue and recurring revenue depends on your business goals, cash flow stability, and customer relationships. Project-based revenue suits businesses with distinct, one-time deliverables, providing immediate income but less predictability. Recurring revenue models, such as subscriptions or retainers, ensure consistent cash flow, higher customer lifetime value, and scalability, essential for long-term growth and financial planning.

Impact on Customer Relationships and Retention

Project-based revenue often results in transactional customer relationships with limited ongoing engagement, making retention efforts more challenging due to irregular interaction. Recurring revenue models foster continuous customer engagement through predictable, long-term commitments, enhancing loyalty and enabling personalized support. Consistent revenue streams from subscriptions or service contracts improve customer lifetime value and provide opportunities for upselling and proactive relationship management.

Scaling Strategies for Project-Based and Recurring Revenue Models

Project-based revenue relies on one-time contracts and requires scalable marketing and sales efforts to continuously secure new clients, often leveraging portfolio expansion and client referrals for growth. Recurring revenue models, such as subscriptions or service retainers, scale by enhancing customer retention, automating billing processes, and upselling additional features or services to existing customers. Combining a project-based approach with recurring revenue streams can optimize cash flow stability and long-term business scalability.

Project-Based Revenue Infographic

libterm.com

libterm.com