A cooling-off period provides a specific timeframe during which you can cancel a contract or transaction without penalty, ensuring consumer protection and reducing buyer's remorse. This period is especially important in industries like real estate, finance, and insurance, where significant commitments are made. Explore the rest of this article to understand how cooling-off periods work and when you can use them to your advantage.

Table of Comparison

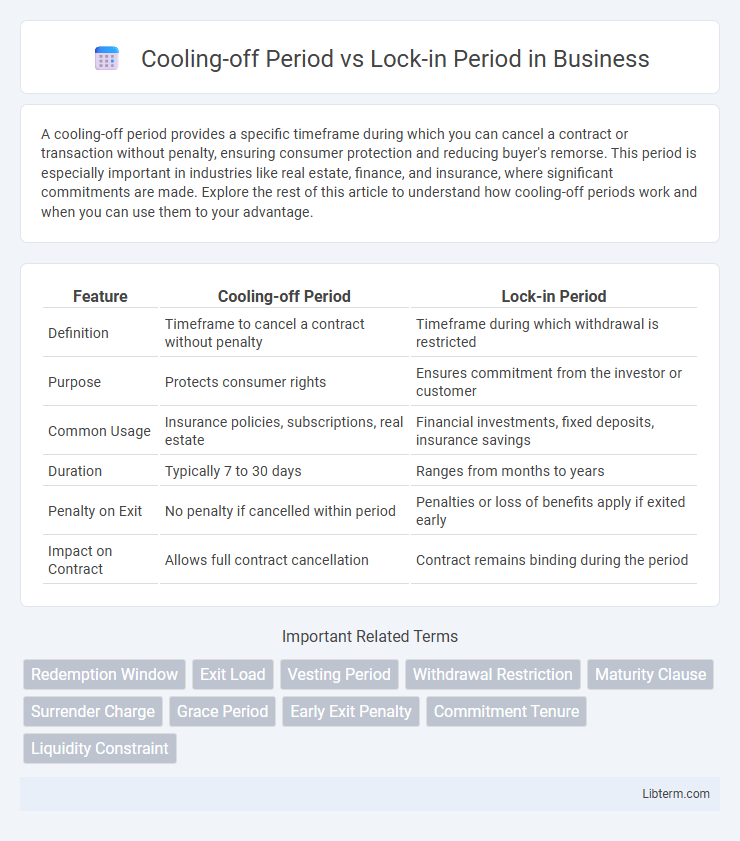

| Feature | Cooling-off Period | Lock-in Period |

|---|---|---|

| Definition | Timeframe to cancel a contract without penalty | Timeframe during which withdrawal is restricted |

| Purpose | Protects consumer rights | Ensures commitment from the investor or customer |

| Common Usage | Insurance policies, subscriptions, real estate | Financial investments, fixed deposits, insurance savings |

| Duration | Typically 7 to 30 days | Ranges from months to years |

| Penalty on Exit | No penalty if cancelled within period | Penalties or loss of benefits apply if exited early |

| Impact on Contract | Allows full contract cancellation | Contract remains binding during the period |

Introduction to Cooling-off and Lock-in Periods

Cooling-off periods allow investors to withdraw from a financial product within a specified timeframe without incurring penalties, providing a risk-free exit option after purchase. Lock-in periods restrict the redemption or withdrawal of investments for a predetermined duration, ensuring committed funds and often qualifying investors for specific benefits or incentives. Understanding the differences between cooling-off and lock-in periods is essential for managing investment liquidity and aligning financial goals.

Definition of Cooling-off Period

The cooling-off period refers to a specific time frame after a financial transaction or contract during which the investor or consumer can reconsider and cancel the agreement without incurring penalties or charges. This period is typically mandated by regulatory authorities to protect consumers from impulsive decisions, allowing them to withdraw or modify their commitment. Unlike the lock-in period, which restricts withdrawal of funds for a set duration, the cooling-off period offers flexibility and a risk-free option to opt-out early.

Definition of Lock-in Period

The lock-in period refers to a specified timeframe during which investors are restricted from redeeming or selling their investments, commonly seen in fixed deposits, mutual funds, or insurance policies. This period is designed to ensure stability in investment and encourage long-term commitment by preventing premature withdrawal. The lock-in period differs from the cooling-off period, which allows investors to reconsider and cancel an investment within a short timeframe without penalty.

Key Differences Between Cooling-off and Lock-in Periods

Cooling-off period allows investors to withdraw investment without penalty within a specified time frame, typically ranging from 5 to 15 days, offering flexibility and risk mitigation. Lock-in period mandates investors to hold their investment for a predetermined duration, often several months to years, restricting withdrawals to ensure long-term commitment and stability. The key difference lies in liquidity and investor control: cooling-off prioritizes investor exit options, while lock-in enforces holding for strategic investment horizons.

Importance of Cooling-off Period in Contracts

The cooling-off period in contracts serves as a critical consumer protection mechanism, allowing parties a designated timeframe to reconsider and withdraw from agreements without penalties, thereby reducing impulsive decisions and potential disputes. This period enhances trust and transparency between involved stakeholders, ensuring informed consent and mitigating risks of buyer's remorse. Compared to the lock-in period, which restricts withdrawals to secure contractual commitments, the cooling-off period prioritizes flexibility and risk management for consumers.

Importance of Lock-in Period in Agreements

The lock-in period in agreements ensures commitment by restricting premature withdrawal, which is critical in investment and real estate contracts to stabilize returns and secure assets. This period protects both parties by preventing early termination that could disrupt financial planning or project timelines. Unlike the cooling-off period that allows contract cancellation without penalty, the lock-in period enforces a binding obligation to uphold the terms for a specified duration, fostering trust and reducing transactional risk.

Legal Implications of Cooling-off Periods

The cooling-off period legally grants consumers the right to rescind a contract within a specified timeframe, typically ranging from 7 to 15 days depending on jurisdiction, without facing penalties, ensuring protection against impulsive decisions. This statutory right is crucial in sectors like insurance, real estate, and financial services where significant commitments are made. Conversely, the lock-in period restricts withdrawal or cancellation, often used in investment contracts, mandating binding engagement without exit options for a predetermined duration.

Legal Implications of Lock-in Periods

Lock-in periods legally restrict investors from redeeming or selling their investment for a specified timeframe, ensuring fund stability and compliance with regulatory mandates. Breach of lock-in terms can lead to penalties, forfeiture of returns, or legal disputes as outlined in the investment contract. Unlike cooling-off periods, which allow cancellation and refunds without penalties shortly after purchase, lock-in periods impose binding financial commitments with significant legal consequences for early exit.

Industries Commonly Using Cooling-off and Lock-in Periods

Industries such as insurance, mutual funds, and real estate frequently implement cooling-off periods to allow consumers to reconsider and cancel contracts without penalty. In contrast, sectors like investment banking, private equity, and software subscriptions often enforce lock-in periods to ensure client commitment and reduce early withdrawals. These periods safeguard both consumers and companies by balancing flexibility and financial stability.

Tips for Consumers and Businesses Regarding Both Periods

Consumers should carefully review contract details to understand the duration and conditions of both cooling-off and lock-in periods, enabling informed decisions and timely cancellations if needed. Businesses need to clearly communicate these periods in plain language, ensuring customers recognize their rights during the cooling-off period and the obligations within the lock-in period. Transparent policies, proactive reminders, and accessible support channels help prevent disputes and enhance trust throughout these contractual timelines.

Cooling-off Period Infographic

libterm.com

libterm.com