The question mark is a vital punctuation symbol used to indicate direct questions and express uncertainty or inquiry in written English. Proper use of the question mark enhances clarity and helps your reader understand the intended tone and meaning of your sentences. Explore the rest of this article to master the rules and best practices for using question marks effectively.

Table of Comparison

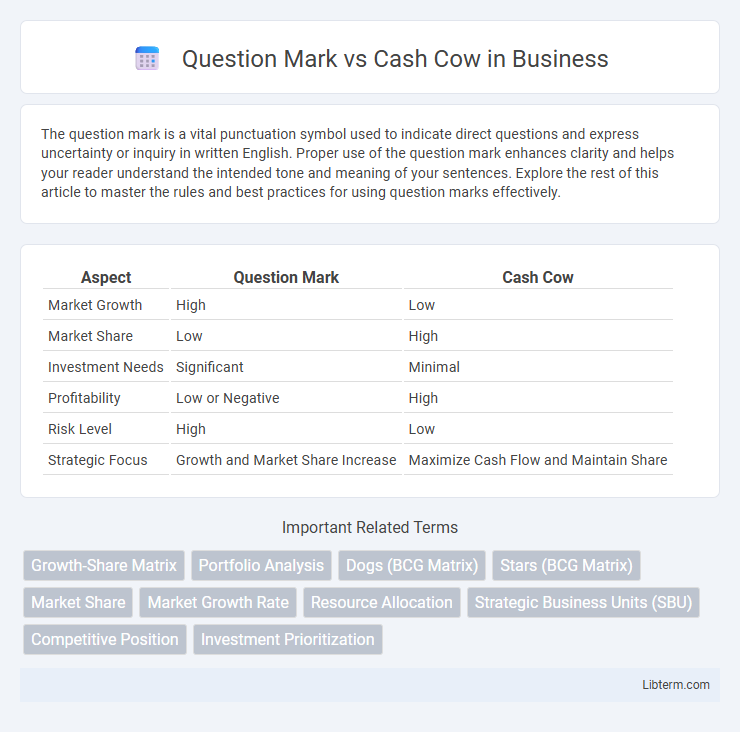

| Aspect | Question Mark | Cash Cow |

|---|---|---|

| Market Growth | High | Low |

| Market Share | Low | High |

| Investment Needs | Significant | Minimal |

| Profitability | Low or Negative | High |

| Risk Level | High | Low |

| Strategic Focus | Growth and Market Share Increase | Maximize Cash Flow and Maintain Share |

Introduction to Question Mark and Cash Cow

Question Mark and Cash Cow are key concepts in the BCG Growth-Share Matrix, used to analyze business units or products based on market growth and market share. A Question Mark operates in a high-growth market but holds a low market share, often requiring substantial investment to increase its position. In contrast, a Cash Cow dominates a low-growth market with a high market share, generating consistent, strong cash flow with minimal investment.

Understanding the BCG Matrix

The BCG Matrix categorizes business units into four groups based on market growth and market share, with Question Marks representing products in high-growth markets but with low market share, while Cash Cows have high market share in low-growth markets. Question Marks require significant investment to increase market share and have the potential to become Cash Cows, which generate steady cash flow with minimal investment. Strategic management involves allocating resources efficiently between these two categories to balance growth opportunities and revenue stability.

Defining Question Mark: Characteristics and Examples

Question Marks are business units or products with low market share but operate in high-growth markets, often requiring significant investment to increase market presence. They are characterized by uncertain potential, high cash consumption, and the possibility of turning into Stars or being divested if growth prospects fail. Examples include emerging tech startups or innovative product lines in rapidly expanding industries like electric vehicles or renewable energy solutions.

Defining Cash Cow: Characteristics and Examples

Cash cows are business units or products with a high market share in a mature, low-growth industry that consistently generate stable and substantial cash flow. Characteristics include strong brand loyalty, established customer base, and low investment requirements, allowing companies to fund other segments. Well-known examples of cash cows include Apple's iPhone in the smartphone market and Coca-Cola's flagship beverage in the soft drink industry.

Key Differences Between Question Mark and Cash Cow

Question Mark products operate in high-growth markets but have low market share, requiring significant investment to increase their position, whereas Cash Cow products have high market share in low-growth markets and generate steady, reliable cash flow. Question Marks are uncertain and riskier, necessitating strategic decisions on whether to invest or divest, while Cash Cows are usually well-established and fund other business units without the need for heavy investment. The primary distinction lies in market growth rate and market share, influencing their roles in portfolio management and resource allocation within the BCG matrix.

Strategic Importance in Business Portfolio

Question Marks represent high-growth market segments with low market share, requiring significant investment to increase competitive position and potentially become Cash Cows. Cash Cows hold dominant market share in mature, low-growth industries, generating steady revenue streams that fund investments in Question Marks and other business units. Efficiently balancing and prioritizing investment between Question Marks and Cash Cows drives long-term strategic growth and financial stability in a diversified business portfolio.

Managing Question Marks: Challenges and Solutions

Managing Question Marks presents challenges such as high uncertainty in market growth and significant investment requirements without guaranteed returns. Effective solutions include rigorous market analysis to identify potential for growth, strategic allocation of resources to promising products, and timely divestment from underperforming units to optimize the product portfolio. Implementing adaptive strategies and continuous performance monitoring can transform Question Marks into Cash Cows, enhancing long-term profitability.

Maximizing Cash Cow Potential in Business

Maximizing Cash Cow potential in business involves focusing resources on high market share products in mature markets that generate consistent, substantial cash flow. Investing in operational efficiency and market penetration can sustain profitability and fund innovation in other segments. Strategic management of Cash Cows ensures stability and funds growth initiatives, balancing the business portfolio.

Real-world Case Studies: Successes and Failures

Apple's iPhone began as a Question Mark with uncertain market share but evolved into a Cash Cow generating massive profits and dominating the smartphone industry. On the other hand, Amazon's Fire Phone failed to transition from a Question Mark, resulting in a costly market exit that highlighted risks tied to product misalignment and poor consumer adoption. These cases illustrate how strategic investments and market responsiveness determine whether Question Marks mature into Cash Cows or become costly failures.

Conclusion: Choosing the Right Strategy

Selecting the appropriate strategy between Question Mark and Cash Cow depends on a company's market position and resource allocation goals. Investing in Question Marks can stimulate growth by turning uncertain products into future Cash Cows, while maintaining Cash Cows ensures steady revenue and profitability. A balanced approach optimizes market share and long-term financial stability by prioritizing innovation and cash flow management.

Question Mark Infographic

libterm.com

libterm.com