Acquisition processes are essential for businesses aiming to expand their market presence and increase competitive advantage. Understanding the strategic steps and legal considerations involved can significantly streamline your efforts and reduce risks. Discover key strategies and insights to enhance your acquisition success by exploring the full article.

Table of Comparison

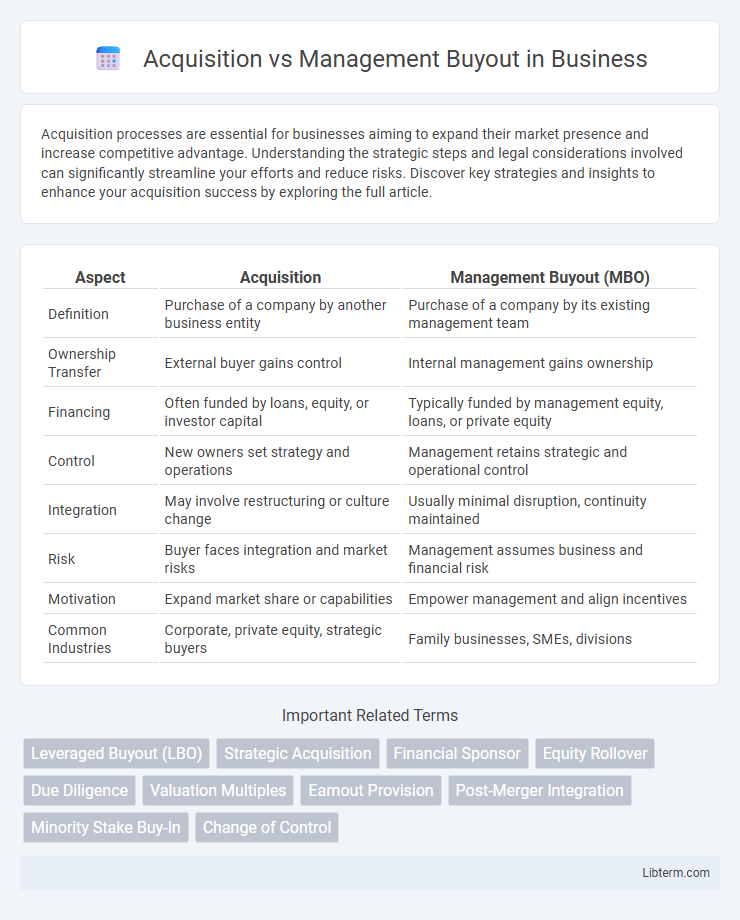

| Aspect | Acquisition | Management Buyout (MBO) |

|---|---|---|

| Definition | Purchase of a company by another business entity | Purchase of a company by its existing management team |

| Ownership Transfer | External buyer gains control | Internal management gains ownership |

| Financing | Often funded by loans, equity, or investor capital | Typically funded by management equity, loans, or private equity |

| Control | New owners set strategy and operations | Management retains strategic and operational control |

| Integration | May involve restructuring or culture change | Usually minimal disruption, continuity maintained |

| Risk | Buyer faces integration and market risks | Management assumes business and financial risk |

| Motivation | Expand market share or capabilities | Empower management and align incentives |

| Common Industries | Corporate, private equity, strategic buyers | Family businesses, SMEs, divisions |

Introduction to Acquisition and Management Buyout

Acquisition refers to the process where one company purchases most or all of another company's shares to gain control, often involving strategic expansion or market entry. A Management Buyout (MBO) occurs when a company's existing management team acquires a substantial portion or the entirety of the business, leveraging their intimate knowledge of operations to drive value. Both methods are key corporate restructuring strategies, but acquisitions typically involve external buyers, whereas MBOs focus on internal leadership transitions.

Defining Acquisition: Key Concepts

Acquisition refers to the process where one company purchases most or all of another company's shares to gain control, often involving strategic expansion or market entry. Key concepts include due diligence, valuation, negotiation of purchase price, and integration planning. This differs from a management buyout, where the existing management team acquires the business, primarily focusing on control retention and operational continuity.

Understanding Management Buyout (MBO)

A Management Buyout (MBO) occurs when a company's existing management team acquires a significant portion or all of the business, leveraging their internal knowledge and operational expertise to drive growth. This type of buyout often involves financing through private equity, bank loans, or seller financing, aligning management's interests closely with business performance. MBOs provide continuity of leadership and minimize disruption, making them an attractive option for owners seeking to exit while ensuring experienced management remains in control.

Main Differences Between Acquisition and MBO

Acquisition involves a company purchasing another firm, often leading to external ownership and integration, whereas a Management Buyout (MBO) occurs when a company's existing managers acquire the business, maintaining internal control. Key differences include funding sources, with acquisitions typically financed by the buyer's capital or debt, while MBOs often rely on the management team's equity and private equity financing. Ownership transition in acquisitions usually shifts to new external stakeholders, whereas MBOs preserve managerial leadership and continuity.

Strategic Goals: Acquisition vs Management Buyout

Acquisitions typically target rapid market expansion, increased competitive advantage, and diversification of product lines or services to enhance shareholder value. Management buyouts focus on enabling existing leadership to align operational control with strategic vision, driving long-term growth and profitability through insider expertise and commitment. Both approaches serve distinct strategic goals, with acquisitions aiming for external growth and buyouts prioritizing internal optimization.

Financing Methods in Acquisition and MBO

Financing methods in acquisitions typically include leveraged buyouts, asset-based loans, and equity financing from private equity firms or strategic investors, leveraging the target company's assets or future cash flows to secure funds. Management Buyouts (MBOs) rely heavily on a mix of debt financing, such as mezzanine debt and senior loans, combined with management's equity contribution and often support from private equity firms specializing in buyouts. The choice between financing techniques in acquisitions and MBOs hinges on factors like risk tolerance, control retention, and the financial health of the target company.

Legal and Regulatory Considerations

Acquisition involves the purchase of one company by another, triggering extensive due diligence, regulatory approvals, and compliance with antitrust laws to prevent market monopolization. Management Buyouts (MBOs) require careful structuring to address conflicts of interest, valuation fairness, and securing financing while adhering to corporate governance and fiduciary duty standards. Both transactions demand rigorous legal documentation, including shareholder agreements and regulatory filings, to ensure transparency and mitigate risks of litigation or regulatory penalties.

Risks and Benefits: Acquisition vs MBO

Acquisitions offer rapid market expansion and access to established resources but carry risks such as cultural clashes and integration challenges that can disrupt operations. Management Buyouts (MBOs) provide continuity and strong leadership commitment, minimizing disruption; however, they often involve significant financial leverage, increasing organizational risk. Assessing risks and benefits requires evaluating factors like funding structure, management expertise, and long-term strategic alignment to determine the optimal growth strategy.

Real-World Examples of Acquisition and MBO

Warren Buffett's acquisition of Burlington Northern Santa Fe (BNSF) in 2010 exemplifies a large-scale acquisition where Berkshire Hathaway gained full control to expand its logistics footprint. In contrast, the 2012 management buyout of Dell led by Michael Dell and Silver Lake Partners shifted the company from public to private ownership, enabling strategic restructuring without shareholder pressure. Both cases highlight distinct pathways for business control, with acquisitions often driven by external investors and MBOs initiated by internal management teams.

Choosing the Right Approach for Business Growth

Choosing the right approach for business growth depends on your strategic goals, financial capacity, and long-term vision. An acquisition enables rapid expansion and market penetration by purchasing an existing company, offering immediate access to new products or customer bases. A management buyout fosters internal stability and continuity, empowering existing leaders to drive growth while preserving company culture and operational control.

Acquisition Infographic

libterm.com

libterm.com