A straight bond is a fixed-income security that pays periodic interest at a predetermined rate and returns the principal at maturity without any embedded options or special features. It offers predictable income and is less complex compared to callable or convertible bonds, making it suitable for conservative investors seeking steady returns. Explore the rest of the article to understand how straight bonds fit into your investment portfolio.

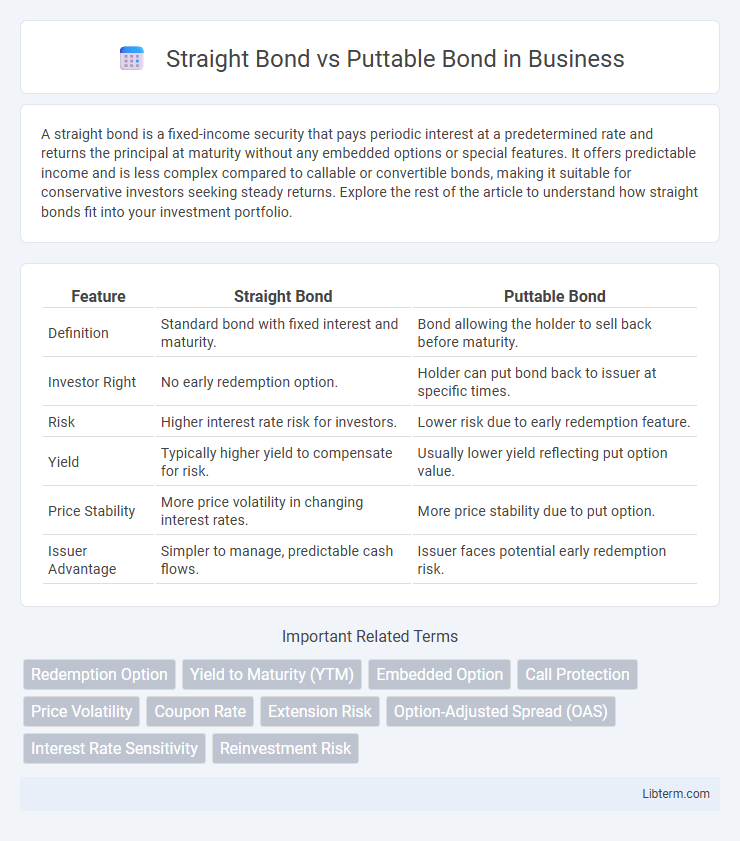

Table of Comparison

| Feature | Straight Bond | Puttable Bond |

|---|---|---|

| Definition | Standard bond with fixed interest and maturity. | Bond allowing the holder to sell back before maturity. |

| Investor Right | No early redemption option. | Holder can put bond back to issuer at specific times. |

| Risk | Higher interest rate risk for investors. | Lower risk due to early redemption feature. |

| Yield | Typically higher yield to compensate for risk. | Usually lower yield reflecting put option value. |

| Price Stability | More price volatility in changing interest rates. | More price stability due to put option. |

| Issuer Advantage | Simpler to manage, predictable cash flows. | Issuer faces potential early redemption risk. |

Introduction to Straight Bonds and Puttable Bonds

Straight bonds are fixed-income securities that provide investors with regular interest payments and return the principal at maturity without any embedded options. Puttable bonds grant holders the right to sell the bond back to the issuer at predetermined dates before maturity, offering increased protection against interest rate rises or credit deterioration. Understanding these distinctions helps investors select bonds aligned with their risk tolerance and market outlook.

Key Definitions: Straight Bond vs Puttable Bond

A straight bond, also known as a plain vanilla bond, is a fixed-income security that pays a predetermined interest rate over a specified period until maturity, with no embedded options attached. A puttable bond grants the bondholder the right, but not the obligation, to sell the bond back to the issuer at a predetermined price before maturity, providing downside protection in declining interest rate environments. This embedded put option affects the bond's pricing, generally resulting in a lower yield compared to otherwise similar straight bonds due to the added investor flexibility.

Structural Differences Between Straight and Puttable Bonds

Straight bonds feature fixed coupon payments and maturity dates with no embedded options, providing predictable cash flows to investors. Puttable bonds include an embedded put option, granting bondholders the right to sell the bond back to the issuer at predetermined dates before maturity. This structural difference enhances investor flexibility and reduces the bond's interest rate risk compared to straight bonds.

Features and Characteristics of Straight Bonds

Straight bonds are fixed-income securities with a specified maturity date and a constant coupon rate, offering predictable interest payments without embedded options. They lack the issuer or holder rights to redeem or sell the bond before maturity, making them less flexible but often lower in cost compared to puttable bonds. Investors prefer straight bonds for their simplicity and stable cash flow, especially in environments with stable or declining interest rates.

Features and Characteristics of Puttable Bonds

Puttable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, providing downside protection against interest rate rises or issuer credit deterioration. These bonds typically offer lower coupon rates compared to straight bonds due to the embedded put option, which enhances investor flexibility. The put option feature reduces interest rate risk and credit risk, making puttable bonds a conservative fixed-income investment choice.

Interest Rate Sensitivity: Straight vs Puttable Bonds

Straight bonds have fixed interest payments and longer durations, making their prices more sensitive to interest rate fluctuations. Puttable bonds offer the holder the right to sell the bond back to the issuer at a predetermined price before maturity, effectively limiting interest rate risk and reducing price volatility. This embedded put option decreases the bond's duration, resulting in lower sensitivity to rising interest rates compared to straight bonds.

Risk and Return Comparison

Straight bonds offer fixed interest payments and principal repayment at maturity, presenting lower risk due to predictable cash flows but typically providing moderate returns. Puttable bonds grant investors the right to sell the bond back to the issuer before maturity, reducing interest rate risk and credit risk, which lowers the bond's yield compared to straight bonds. The added flexibility in puttable bonds results in lower returns but enhanced risk protection, making them suitable for conservative investors seeking downside risk mitigation.

Investor Suitability and Preferences

Straight bonds appeal to investors seeking predictable income and lower risk due to their fixed coupon payments and maturity dates. Puttable bonds suit risk-averse investors prioritizing flexibility, as they offer the option to sell the bond back to the issuer before maturity, providing protection against interest rate rises or issuer credit deterioration. Institutional investors and conservative portfolios often prefer straight bonds for stable returns, while puttable bonds attract those needing market risk mitigation and liquidity options.

Market Scenarios Favoring Each Bond Type

Straight bonds perform well in stable or declining interest rate environments where investors seek predictable income and low risk, as these bonds have fixed coupon payments and no embedded options. Puttable bonds gain value in volatile or rising interest rate markets, offering investors the flexibility to redeem the bond before maturity, thereby reducing interest rate risk and providing downside protection. Institutional investors often prefer puttable bonds during economic uncertainty, while straight bonds attract those prioritizing steady returns in low volatility periods.

Conclusion: Choosing Between Straight and Puttable Bonds

Choosing between straight bonds and puttable bonds depends on risk tolerance and market conditions, as straight bonds offer fixed income with no early redemption option, while puttable bonds grant investors the right to sell back the bond before maturity, providing liquidity and downside protection. Investors seeking stable, predictable returns may prefer straight bonds, whereas those valuing flexibility and risk management might opt for puttable bonds. Assessing interest rate trends and credit risk is crucial in determining which bond type aligns best with investment objectives.

Straight Bond Infographic

libterm.com

libterm.com