A compliance audit systematically reviews an organization's adherence to regulatory guidelines and internal policies, ensuring legal and operational standards are met. This process identifies potential risks and mitigates costly penalties by verifying that your business practices align with industry requirements. Explore the rest of the article to understand how a compliance audit can safeguard your organization's integrity.

Table of Comparison

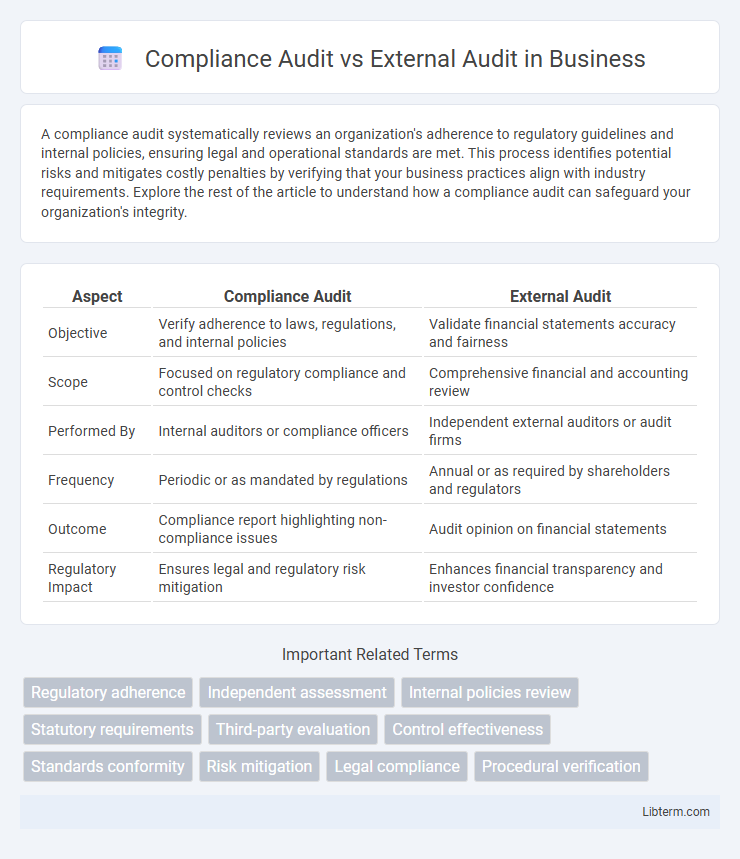

| Aspect | Compliance Audit | External Audit |

|---|---|---|

| Objective | Verify adherence to laws, regulations, and internal policies | Validate financial statements accuracy and fairness |

| Scope | Focused on regulatory compliance and control checks | Comprehensive financial and accounting review |

| Performed By | Internal auditors or compliance officers | Independent external auditors or audit firms |

| Frequency | Periodic or as mandated by regulations | Annual or as required by shareholders and regulators |

| Outcome | Compliance report highlighting non-compliance issues | Audit opinion on financial statements |

| Regulatory Impact | Ensures legal and regulatory risk mitigation | Enhances financial transparency and investor confidence |

Understanding Compliance Audits

Compliance audits assess an organization's adherence to regulatory requirements, internal policies, and contractual obligations by systematically reviewing processes, documentation, and controls. These audits focus on identifying gaps in compliance with laws such as GDPR, HIPAA, or industry-specific standards, ensuring risk mitigation and operational integrity. Unlike external audits, which primarily evaluate financial statements for accuracy and completeness, compliance audits emphasize regulatory conformity and organizational accountability.

What Is an External Audit?

An external audit is an independent examination of an organization's financial statements and accounting records conducted by certified public accountants or external auditors. Its primary purpose is to provide an objective assessment of the accuracy and fairness of financial reporting, ensuring compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). External audits enhance stakeholder confidence by verifying that financial disclosures are free from material misstatement and comply with regulatory requirements.

Key Differences Between Compliance and External Audits

Compliance audits focus on evaluating an organization's adherence to regulatory requirements, internal policies, and contractual obligations, ensuring legal and procedural conformity. External audits primarily assess the accuracy and fairness of financial statements, providing an independent opinion to stakeholders such as investors, creditors, and regulators. While compliance audits emphasize rule-based verification, external audits concentrate on financial transparency and reporting integrity.

Objectives of Compliance Audits

Compliance audits aim to verify adherence to laws, regulations, and internal policies, ensuring organizations meet mandatory standards and contractual obligations. These audits identify gaps in regulatory compliance to mitigate risks of penalties, legal action, or reputational damage. Unlike external financial audits, compliance audits focus specifically on regulatory frameworks such as GDPR, SOX, or HIPAA, providing assurance on governance and operational controls.

Objectives of External Audits

External audits primarily aim to provide an independent assessment of an organization's financial statements to ensure accuracy, transparency, and adherence to accounting standards such as GAAP or IFRS. These audits help stakeholders, including investors and regulators, gain confidence in the financial health and reporting integrity of the company. External auditors also evaluate internal controls related to financial reporting to identify risks of material misstatements or fraud.

Processes Involved in Compliance Audits

Compliance audits involve systematic evaluations of an organization's adherence to regulatory requirements, internal policies, and contractual obligations by examining documentation, interviewing personnel, and testing controls. The processes include planning the audit scope, identifying applicable compliance standards, gathering evidence through inspection and observation, analyzing findings for non-compliance or risks, and preparing a detailed report with recommendations for corrective actions. Unlike external audits focused on financial statements, compliance audits prioritize verifying operational procedures and regulatory conformity to minimize legal and reputational risks.

Processes Involved in External Audits

External audits involve a systematic examination of financial statements and internal controls to ensure accuracy and adherence to regulatory standards. The process includes planning and risk assessment, evidence gathering through testing transactions and balances, and evaluation of compliance with accounting principles. Auditors then prepare detailed reports highlighting findings, discrepancies, and recommendations for corrective actions.

Benefits of Compliance and External Audits

Compliance audits ensure organizations adhere to regulatory standards, reducing legal risks and enhancing operational transparency. External audits provide independent verification of financial statements, increasing stakeholder confidence and supporting investment decisions. Both audits improve accountability, strengthen internal controls, and promote trust among investors, regulators, and customers.

Challenges in Conducting Compliance vs External Audits

Compliance audits face challenges in navigating complex and evolving regulatory requirements, demanding specialized knowledge to ensure adherence to specific laws and standards. External audits encounter difficulties in maintaining independence while thoroughly assessing financial statements, requiring meticulous verification of accuracy and completeness. Both types of audits must manage risks related to data integrity, scope limitations, and stakeholder communication to deliver reliable and objective findings.

Choosing the Right Audit for Your Organization

Choosing the right audit for your organization depends on its specific goals and regulatory requirements. A compliance audit evaluates adherence to laws, regulations, and internal policies, ensuring your organization meets industry standards and avoids legal risks. An external audit assesses the accuracy of financial statements to provide stakeholders with independent assurance on financial health and operational transparency.

Compliance Audit Infographic

libterm.com

libterm.com