Information asymmetry occurs when one party in a transaction possesses more or better information than the other, often leading to imbalanced decisions and market inefficiencies. This phenomenon can result in adverse selection, moral hazard, and reduced trust between buyers and sellers. Explore the rest of this article to understand how information asymmetry impacts your choices and ways to mitigate its effects.

Table of Comparison

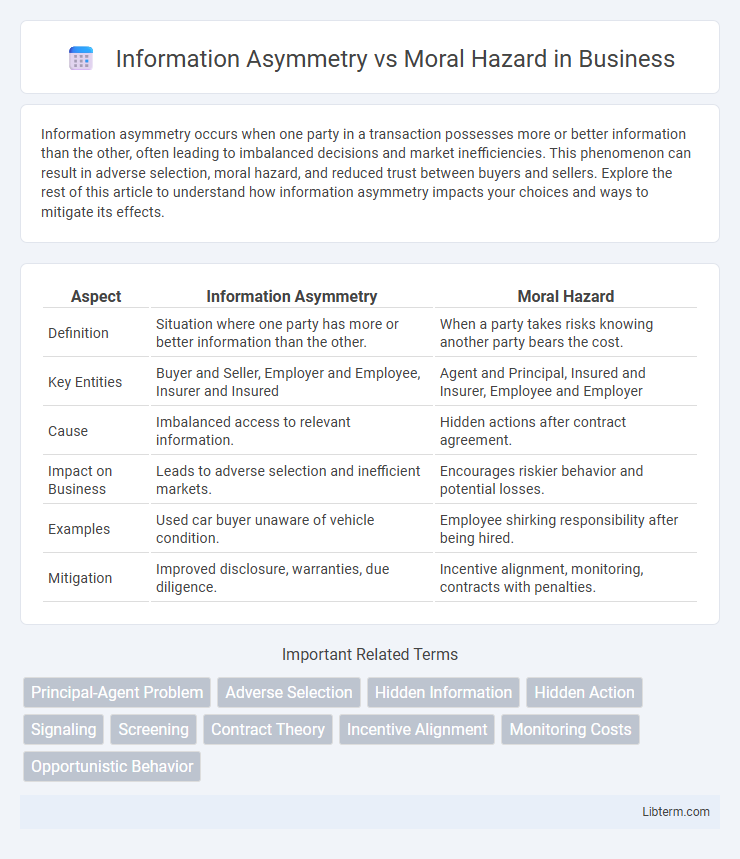

| Aspect | Information Asymmetry | Moral Hazard |

|---|---|---|

| Definition | Situation where one party has more or better information than the other. | When a party takes risks knowing another party bears the cost. |

| Key Entities | Buyer and Seller, Employer and Employee, Insurer and Insured | Agent and Principal, Insured and Insurer, Employee and Employer |

| Cause | Imbalanced access to relevant information. | Hidden actions after contract agreement. |

| Impact on Business | Leads to adverse selection and inefficient markets. | Encourages riskier behavior and potential losses. |

| Examples | Used car buyer unaware of vehicle condition. | Employee shirking responsibility after being hired. |

| Mitigation | Improved disclosure, warranties, due diligence. | Incentive alignment, monitoring, contracts with penalties. |

Introduction to Information Asymmetry and Moral Hazard

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, leading to imbalances in decision-making power and potential inefficiencies in markets. Moral hazard arises when one party engages in riskier behavior because they do not bear the full consequences of their actions, often as a result of information asymmetry between involved parties. Understanding these concepts is crucial in economics and finance because they influence contract design, insurance markets, and regulatory policies aimed at mitigating adverse effects.

Defining Information Asymmetry

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, creating an imbalance that can lead to suboptimal decision-making. This disparity often results in adverse selection, where the party with less information faces higher risks or costs due to hidden information. Understanding the nuances of information asymmetry is crucial in addressing moral hazard, as both concepts involve asymmetrical knowledge affecting behavior and outcomes in economic transactions.

Understanding Moral Hazard

Moral hazard arises when one party takes on excessive risks because they do not bear the full consequences of their actions, often due to information asymmetry between involved parties. This behavior typically occurs in financial markets, insurance contracts, and employment relationships where the risk-taker's incentives are misaligned with those of the principal. Understanding moral hazard is crucial for designing effective contracts and regulatory frameworks that mitigate risky behavior and protect stakeholders.

Key Differences Between Information Asymmetry and Moral Hazard

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, leading to an imbalance during decision-making processes. Moral hazard arises when one party takes on excessive risks because they do not bear the full consequences of their actions, often due to hidden behaviors post-contract. The key difference lies in information asymmetry being about uneven information distribution before a transaction, while moral hazard concerns risk-taking behaviors that emerge after the agreement is made.

Real-World Examples of Information Asymmetry

Information asymmetry occurs when one party in a transaction possesses more or better information than the other, leading to imbalances in decision-making, such as used car sales where sellers know more about vehicle defects than buyers. In the financial sector, borrowers often have superior knowledge about their ability to repay loans compared to lenders, contributing to adverse selection and credit risk. Healthcare markets also exemplify information asymmetry, as patients may lack sufficient knowledge about medical treatments or provider expertise, potentially impacting care quality and insurance dynamics.

Common Scenarios Illustrating Moral Hazard

Moral hazard commonly arises in insurance markets where insured individuals may take greater risks because they do not bear the full cost of their actions, such as drivers increasing reckless behavior after obtaining full coverage. In financial lending, borrowers might engage in riskier projects once receiving a loan, knowing that losses are partially borne by lenders. Employment contracts can also exhibit moral hazard when employees reduce effort or shirk responsibilities due to guaranteed salaries or lack of performance-based incentives.

Impacts on Markets and Economic Outcomes

Information asymmetry creates imbalances where one party holds more or better information than the other, leading to suboptimal market outcomes such as adverse selection and market inefficiencies. Moral hazard arises when individuals or firms take on excessive risks because they do not bear the full consequences of their actions, often resulting in increased market volatility and inefficient allocation of resources. Both phenomena distort economic incentives, reduce trust in markets, and contribute to higher transaction costs and reduced overall welfare.

Strategies to Reduce Information Asymmetry

Employing signaling mechanisms such as warranties, certifications, and transparent disclosure enhances trust between parties and reduces information asymmetry in markets. Screening strategies like background checks, audits, and due diligence enable the less-informed party to assess the quality or risk associated with a transaction. Utilizing technology platforms and data analytics improves information flow, allowing more accurate assessments and mitigating the adverse effects of asymmetric information.

Solutions for Managing Moral Hazard

Managing moral hazard involves implementing robust monitoring systems that align the interests of agents and principals through incentive-compatible contracts. Utilizing performance-based compensation and increasing transparency reduces information gaps that enable opportunistic behavior. Regulatory oversight and risk-sharing mechanisms, such as deductibles or co-payments, encourage responsible decision-making and mitigate excessive risk-taking.

Conclusion: Navigating Risk in Economic Transactions

Information asymmetry creates an imbalance where one party possesses more or better information than the other, increasing the potential for adverse selection. Moral hazard arises when one party changes their behavior after a transaction, knowing the other party bears the risk, leading to inefficient outcomes. Effective contract design and monitoring mechanisms are essential to mitigate these risks, ensuring better alignment of incentives and more efficient economic transactions.

Information Asymmetry Infographic

libterm.com

libterm.com