Proper capitalization enhances the clarity and professionalism of your writing by following standard grammar rules such as capitalizing the first word of a sentence, proper nouns, and titles. Consistent use of capitalization helps convey your message effectively and prevents misunderstandings. Discover essential tips and common mistakes to improve your capitalization skills in the rest of the article.

Table of Comparison

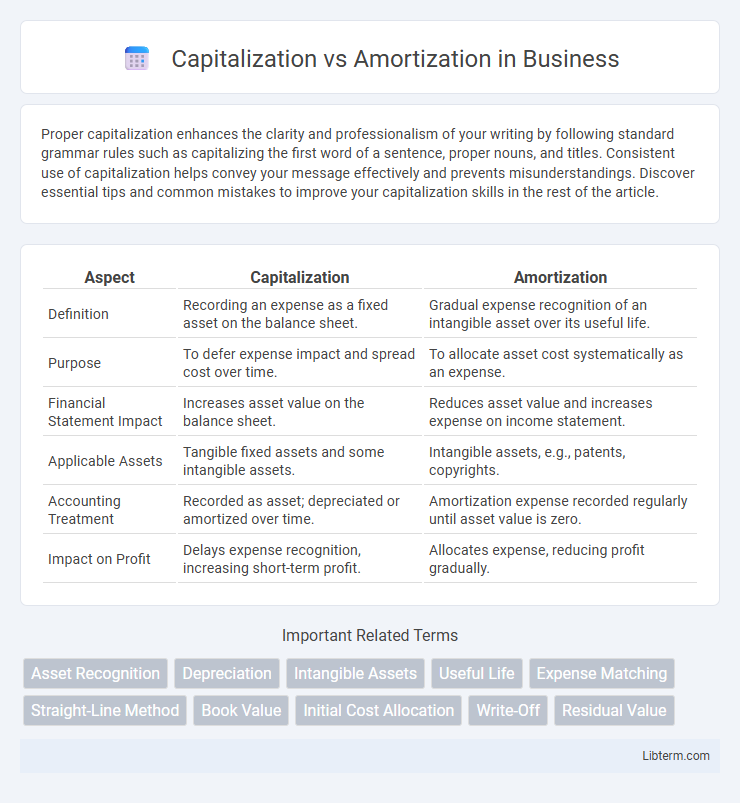

| Aspect | Capitalization | Amortization |

|---|---|---|

| Definition | Recording an expense as a fixed asset on the balance sheet. | Gradual expense recognition of an intangible asset over its useful life. |

| Purpose | To defer expense impact and spread cost over time. | To allocate asset cost systematically as an expense. |

| Financial Statement Impact | Increases asset value on the balance sheet. | Reduces asset value and increases expense on income statement. |

| Applicable Assets | Tangible fixed assets and some intangible assets. | Intangible assets, e.g., patents, copyrights. |

| Accounting Treatment | Recorded as asset; depreciated or amortized over time. | Amortization expense recorded regularly until asset value is zero. |

| Impact on Profit | Delays expense recognition, increasing short-term profit. | Allocates expense, reducing profit gradually. |

Introduction to Capitalization and Amortization

Capitalization records the cost of an asset on the balance sheet, spreading its expense over its useful life, which enhances accuracy in financial reporting. Amortization systematically allocates the cost of intangible assets, such as patents or trademarks, over a period reflecting their consumption or expiration. Both processes align expenses with revenues, adhering to the matching principle in accounting standards like GAAP and IFRS.

Defining Capitalization in Accounting

Capitalization in accounting is the process of recording a cost or expense as a long-term asset on the balance sheet rather than immediately expensing it on the income statement. This practice allows businesses to spread the cost of an asset over its useful life, matching the expense to the periods that benefit from the asset's use. Proper capitalization impacts financial statements by increasing assets and deferring expenses, thereby affecting profitability and tax calculations.

Understanding Amortization: Meaning and Process

Amortization refers to the systematic allocation of the cost of an intangible asset over its useful life, reflecting its consumption and reduction in value. The process involves spreading out the initial expense in equal periodic charges, typically monthly or annually, to match revenues generated by the asset. Understanding amortization is essential for accurate financial reporting and tax deductions related to patents, trademarks, or goodwill.

Key Differences between Capitalization and Amortization

Capitalization involves recording a cost as an asset on the balance sheet, spreading its expense over multiple periods, while amortization refers to gradually expensing the cost of an intangible asset over its useful life. Capitalization impacts the balance sheet by increasing asset value, whereas amortization affects the income statement by reducing net income through periodic expense recognition. The key difference lies in capitalization's role in asset recognition versus amortization's function in systematically allocating the cost of intangible assets.

Types of Assets: Capitalization vs Amortization

Capitalization applies to acquiring long-term assets such as property, plant, and equipment, where costs are recorded as assets on the balance sheet and expensed over time. Amortization pertains primarily to intangible assets like patents, copyrights, and trademarks, systematically expensing their cost over their useful life. Proper differentiation between these asset types ensures accurate financial reporting and compliance with accounting standards.

Capitalization Criteria and Accounting Standards

Capitalization involves recording an expenditure as an asset on the balance sheet rather than an expense, based on criteria such as the asset's useful life extending beyond one accounting period and its cost exceeding a materiality threshold. Accounting standards like IFRS (IAS 16) and US GAAP (ASC 360) emphasize that capitalization requires future economic benefits and control over the asset, ensuring proper matching of costs with revenues. The decision to capitalize costs directly impacts financial statements, affecting asset valuation, depreciation, and overall profitability reporting.

Amortization Methods and Schedules

Amortization methods primarily include the straight-line method, which allocates equal expense amounts over the asset's useful life, and the declining balance method, which accelerates expense recognition in earlier periods. Amortization schedules detail the periodic allocation of intangible asset costs, reflecting factors such as asset lifespan, residual value, and usage patterns. Accurate amortization ensures compliance with accounting standards like GAAP and IFRS, impacting financial statements and tax calculations.

Impact on Financial Statements

Capitalization increases asset values on the balance sheet, reflecting long-term benefits, while amortization systematically allocates the cost of intangible assets over their useful life, reducing net income on the income statement. Capitalizing expenses defers recognition of costs, enhancing current profitability, whereas amortization expense directly lowers earnings, impacting retained earnings and cash flow indirectly through tax effects. The interplay between capitalization and amortization significantly affects key financial ratios, such as return on assets and earnings per share, influencing investor perception and decision-making.

Tax Implications: Capitalization vs Amortization

Capitalization allows businesses to spread out the expense of an asset over its useful life, which reduces taxable income gradually through depreciation or amortization deductions. Amortization specifically applies to intangible assets, enabling firms to allocate the cost over a set period, aligning with IRS tax codes that often require systematic expense recognition. Tax implications differ as capitalizing an asset delays immediate tax benefits, while amortization provides a more consistent expense flow, influencing cash flow and tax strategy decisions.

Best Practices for Businesses

Capitalization involves recording a cost as a long-term asset on the balance sheet, while amortization systematically expense the cost over its useful life to match revenues. Best practices for businesses include accurately distinguishing between capital expenditures and operational expenses to ensure compliance with accounting standards like GAAP or IFRS. Maintaining detailed documentation and regular reviews of asset lifespans supports accurate financial reporting and tax optimization.

Capitalization Infographic

libterm.com

libterm.com