Retail investors participate in financial markets by purchasing securities for personal accounts rather than for organizational investment. Understanding the risks, benefits, and strategies unique to retail investors can significantly improve your investment decisions and portfolio performance. Explore the rest of the article to learn how retail investing works and how to maximize your returns.

Table of Comparison

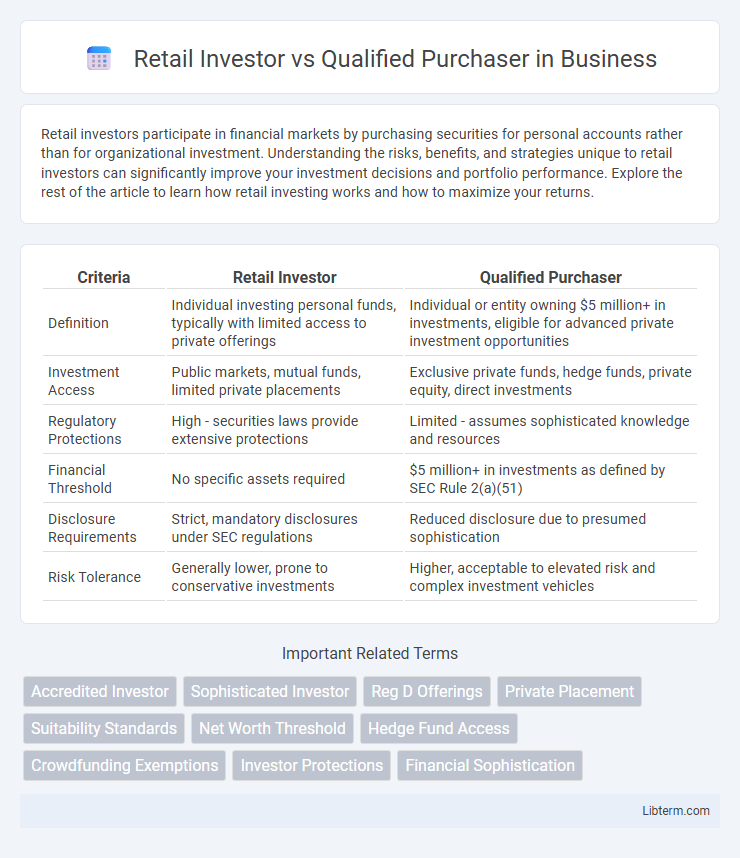

| Criteria | Retail Investor | Qualified Purchaser |

|---|---|---|

| Definition | Individual investing personal funds, typically with limited access to private offerings | Individual or entity owning $5 million+ in investments, eligible for advanced private investment opportunities |

| Investment Access | Public markets, mutual funds, limited private placements | Exclusive private funds, hedge funds, private equity, direct investments |

| Regulatory Protections | High - securities laws provide extensive protections | Limited - assumes sophisticated knowledge and resources |

| Financial Threshold | No specific assets required | $5 million+ in investments as defined by SEC Rule 2(a)(51) |

| Disclosure Requirements | Strict, mandatory disclosures under SEC regulations | Reduced disclosure due to presumed sophistication |

| Risk Tolerance | Generally lower, prone to conservative investments | Higher, acceptable to elevated risk and complex investment vehicles |

Introduction to Retail Investors and Qualified Purchasers

Retail investors are individual investors who buy and sell securities for their personal accounts, typically with smaller asset volumes and less regulatory sophistication. Qualified purchasers are high-net-worth individuals or entities meeting specific criteria, such as owning at least $5 million in investments, granting them access to exclusive investment opportunities with fewer regulatory restrictions. Understanding these distinctions is crucial for navigating investment options and compliance requirements in financial markets.

Defining Retail Investors: Characteristics and Criteria

Retail investors are individual investors who buy securities for personal accounts rather than for business or institutional purposes, typically characterized by smaller investment amounts and less sophisticated financial knowledge. They are subject to regulatory protections under securities laws due to their limited access to complex investment opportunities and reliance on public disclosures. Retail investors generally do not meet the financial thresholds or experience level required to be classified as qualified purchasers, who possess significant investment portfolios valued at $5 million or more.

Who Qualifies as a Qualified Purchaser?

A Qualified Purchaser is an individual or family-owned business that owns at least $5 million in investments, including assets such as stocks, bonds, and real estate. Institutional investors like trusts, companies, and investment funds qualify if they collectively hold $25 million or more in investments. This status allows access to certain private investment opportunities and exemptions under the Investment Company Act of 1940, unlike retail investors who have fewer regulatory privileges.

Key Legal and Regulatory Differences

Retail investors are individuals who purchase securities for personal accounts and are subject to extensive regulatory protections under laws like the Securities Act of 1933 and the Investment Company Act of 1940. Qualified purchasers, defined under the Investment Company Act of 1940 as individuals or entities with at least $5 million in investments, qualify for exemptions allowing access to exclusive investment opportunities with fewer regulatory restrictions. Key legal differences include the scope of disclosure requirements, eligibility for private placements, and limitations on investment offering registrations.

Investment Opportunities: Access and Limitations

Retail investors face limitations in accessing certain high-yield private equity funds and hedge funds, which are typically reserved for qualified purchasers meeting asset thresholds of $5 million or more. Qualified purchasers benefit from broader investment opportunities, including unregistered securities and complex financial products not available to retail investors. Regulatory frameworks such as the Investment Company Act of 1940 distinguish these categories, influencing the range and exclusivity of investment options.

Risk Profiles: Retail Investors vs Qualified Purchasers

Retail investors typically face higher risk exposure due to limited access to sophisticated financial instruments and less stringent regulatory protections, often resulting in more conservative investment portfolios. Qualified purchasers, due to their substantial net worth or investment holdings exceeding $5 million, can access complex, higher-risk opportunities like hedge funds and private equity, reflecting a more aggressive risk profile. The distinct regulatory frameworks governing each group emphasize the differing risk tolerances and investment sophistication between retail investors and qualified purchasers.

Investment Strategies and Asset Classes

Retail investors typically focus on more accessible investment strategies such as mutual funds, ETFs, and individual stocks, prioritizing liquidity and diversification in asset classes like equities and bonds. Qualified purchasers, leveraging a higher net worth threshold defined by the SEC (typically $5 million or more in investments), engage in advanced strategies including private equity, hedge funds, and real estate partnerships, allowing access to alternative asset classes often restricted to them. This distinction in investor classification significantly influences portfolio complexity, risk tolerance, and regulatory constraints on investment choices.

Protections and Disclosures for Each Group

Retail investors benefit from extensive regulatory protections and mandatory disclosures designed to safeguard their interests, including comprehensive prospectus requirements and suitability standards enforced by the SEC. Qualified purchasers, typically high-net-worth individuals or entities with at least $5 million in investments, face fewer regulatory disclosures and protections due to their presumed financial sophistication and ability to bear investment risks. The distinction influences the level of oversight, with retail investors receiving enhanced transparency and risk warnings, while qualified purchasers access more complex investment opportunities with limited disclosure obligations.

Pros and Cons: Choosing Your Investor Category

Retail investors benefit from lower investment minimums and broader regulatory protections but face restrictions on certain high-risk or complex investments. Qualified purchasers enjoy access to exclusive investment opportunities like hedge funds and private equity, along with potentially higher returns, though they must meet stringent asset thresholds and face fewer regulatory safeguards. Evaluating your financial resources, risk tolerance, and investment goals helps determine the most appropriate investor category for maximizing benefits and managing risks.

Conclusion: Implications for Individual Investors

Individual investors categorized as retail investors face more regulatory protections but encounter limited access to exclusive investment opportunities compared to qualified purchasers, who meet higher financial thresholds and can invest in private funds with fewer restrictions. Understanding these distinctions is crucial for retail investors aiming to expand their portfolios, as qualifying status opens doors to diversified assets and potentially higher returns. Strategic financial planning and meeting qualification criteria can help individual investors transition to qualified purchaser status, unlocking broader investment possibilities.

Retail Investor Infographic

libterm.com

libterm.com