Market risk refers to the potential financial losses caused by fluctuations in market prices, including equities, interest rates, currencies, and commodities. This type of risk impacts investment portfolios and business operations, making it crucial to understand and manage effectively. Explore how understanding market risk can protect Your assets and guide smarter financial decisions in the full article.

Table of Comparison

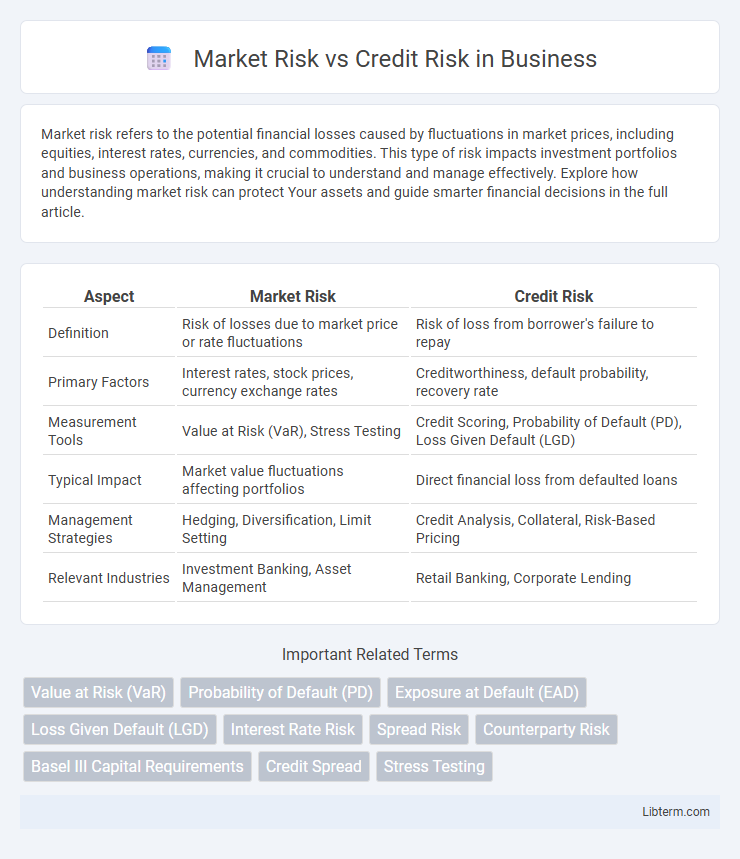

| Aspect | Market Risk | Credit Risk |

|---|---|---|

| Definition | Risk of losses due to market price or rate fluctuations | Risk of loss from borrower's failure to repay |

| Primary Factors | Interest rates, stock prices, currency exchange rates | Creditworthiness, default probability, recovery rate |

| Measurement Tools | Value at Risk (VaR), Stress Testing | Credit Scoring, Probability of Default (PD), Loss Given Default (LGD) |

| Typical Impact | Market value fluctuations affecting portfolios | Direct financial loss from defaulted loans |

| Management Strategies | Hedging, Diversification, Limit Setting | Credit Analysis, Collateral, Risk-Based Pricing |

| Relevant Industries | Investment Banking, Asset Management | Retail Banking, Corporate Lending |

Introduction to Market Risk and Credit Risk

Market risk refers to the potential financial loss resulting from fluctuations in market prices, including equities, interest rates, foreign exchange, and commodities. Credit risk involves the possibility that a borrower or counterparty fails to meet their contractual obligations, causing a loss to the lender or investor. Both risks are fundamental in financial risk management, with market risk emphasizing price volatility and credit risk focusing on counterparty default.

Defining Market Risk

Market risk refers to the potential for financial losses due to fluctuations in market prices, interest rates, exchange rates, or commodity prices. It primarily affects trading portfolios and investment valuations exposed to market volatility and economic factors. This risk type contrasts with credit risk, which centers on the likelihood of counterparty default and failure to meet contractual obligations.

Defining Credit Risk

Credit risk refers to the potential for loss due to a borrower's failure to meet contractual debt obligations, impacting lenders and investors. It encompasses the likelihood of default and the severity of loss in such cases, requiring thorough assessment of creditworthiness and repayment capacity. Effective credit risk management involves analyzing borrower history, collateral, and macroeconomic factors to minimize financial exposure.

Key Differences Between Market Risk and Credit Risk

Market risk involves potential losses due to fluctuations in asset prices, interest rates, currencies, or commodities, impacting portfolio value directly. Credit risk arises from a borrower's failure to fulfill contractual debt obligations, leading to defaults or delayed payments. Key differences include market risk being driven by market volatility and systemic factors, while credit risk centers on counterparty creditworthiness and default probabilities.

Sources of Market Risk

Market risk arises primarily from fluctuations in market variables such as interest rates, equity prices, currency exchange rates, and commodity prices, which can impact portfolio values and investment returns. These sources include systematic risks driven by macroeconomic factors, geopolitical events, and market sentiment, as well as unsystematic risks linked to specific sectors or issuers. Credit risk, by contrast, stems from the possibility of a counterparty defaulting on contractual obligations, highlighting the fundamental difference in risk origin between market volatility and counterparty creditworthiness.

Sources of Credit Risk

Sources of credit risk primarily stem from counterparty defaults, including borrowers failing to meet debt obligations and counterparties in derivatives contracts not honoring agreements. Factors such as poor credit quality, economic downturns, and inadequate collateral amplify this risk, impacting financial institutions' asset quality and liquidity. Unlike market risk driven by market price fluctuations, credit risk is intrinsically linked to the likelihood of loss due to a debtor's inability or unwillingness to repay loans or fulfill contractual commitments.

Measurement Techniques for Market Risk

Market risk measurement techniques primarily include Value at Risk (VaR), which estimates potential losses in a portfolio over a target horizon with a given confidence level, and Stress Testing, assessing the portfolio's resilience under extreme market conditions. Other methods such as Expected Shortfall, also known as Conditional VaR, provide insights into tail risk beyond VaR's threshold, while Historical Simulation leverages past market data to model potential outcomes. These techniques enable institutions to quantify exposure to fluctuations in equity prices, interest rates, foreign exchange, and commodity prices, differentiating market risk measurement from credit risk analysis focused on counterparty default probabilities.

Measurement Techniques for Credit Risk

Credit risk measurement techniques primarily involve quantitative models such as Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD), which collectively estimate potential losses from borrower defaults. Credit scoring models and credit rating systems assess borrower creditworthiness using historical data, financial ratios, and behavioral factors. Unlike market risk models that focus on price volatility using Value at Risk (VaR) and stress testing, credit risk measurement requires detailed analysis of counterparty credit quality and default probabilities.

Risk Management Strategies for Each Type

Market risk management employs strategies such as diversification, hedging using derivatives like options and futures, and real-time monitoring of market trends to mitigate losses from price volatility. Credit risk management focuses on assessing borrower creditworthiness through credit scoring models, setting exposure limits, and using collateral or credit derivatives like credit default swaps to minimize default impact. Both risk types require continuous risk assessment and stress testing to ensure portfolio resilience under varying economic conditions.

Impact of Market Risk vs Credit Risk on Financial Institutions

Market risk affects financial institutions by causing potential losses from fluctuations in interest rates, foreign exchange rates, and equity prices, impacting trading portfolios and asset valuations. Credit risk leads to losses when borrowers or counterparties default on their obligations, directly harming loan portfolios and reducing capital adequacy. Financial institutions must balance these risks through diversified risk management strategies to maintain stability and regulatory compliance.

Market Risk Infographic

libterm.com

libterm.com