Bank loans offer flexible financing options tailored to meet personal or business needs, with varying terms and interest rates. Understanding loan types, eligibility criteria, and repayment plans can help you secure the best deal. Discover more insights to make informed decisions and manage your borrowing effectively in the rest of this article.

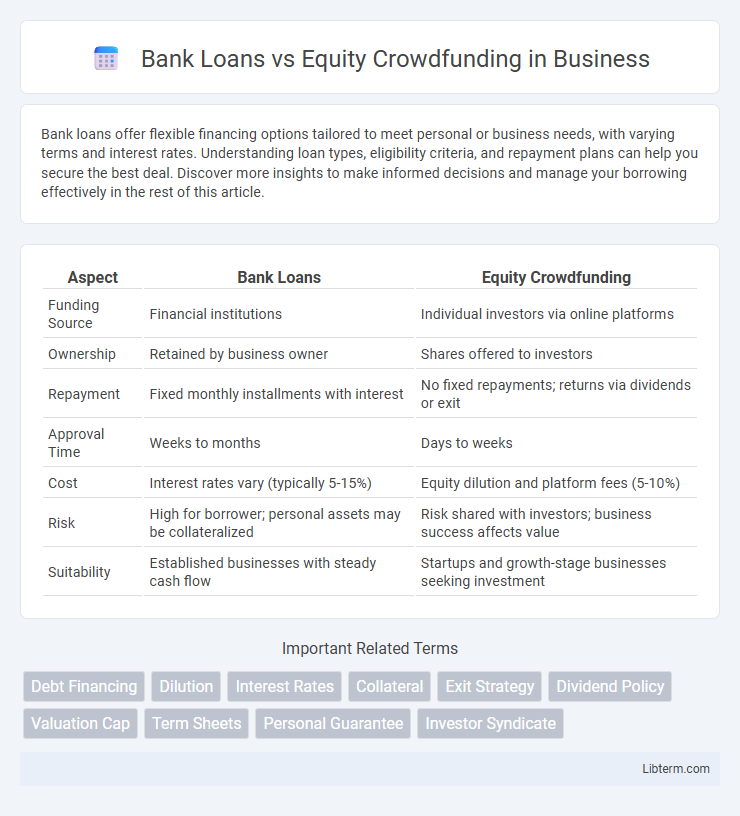

Table of Comparison

| Aspect | Bank Loans | Equity Crowdfunding |

|---|---|---|

| Funding Source | Financial institutions | Individual investors via online platforms |

| Ownership | Retained by business owner | Shares offered to investors |

| Repayment | Fixed monthly installments with interest | No fixed repayments; returns via dividends or exit |

| Approval Time | Weeks to months | Days to weeks |

| Cost | Interest rates vary (typically 5-15%) | Equity dilution and platform fees (5-10%) |

| Risk | High for borrower; personal assets may be collateralized | Risk shared with investors; business success affects value |

| Suitability | Established businesses with steady cash flow | Startups and growth-stage businesses seeking investment |

Introduction to Bank Loans and Equity Crowdfunding

Bank loans provide businesses with fixed amounts of capital repayable over time with interest, typically requiring established credit history and collateral. Equity crowdfunding involves raising funds by selling shares of the company to multiple investors via online platforms, allowing startups and small businesses to access capital without incurring debt. Choosing between bank loans and equity crowdfunding depends on factors such as funding amount, repayment flexibility, ownership dilution, and business growth potential.

Key Differences Between Bank Loans and Equity Crowdfunding

Bank loans require borrowers to repay principal with interest over a fixed term, creating a debt obligation, while equity crowdfunding involves selling company shares to investors in exchange for capital without repayment requirements. Bank loans typically involve strict credit evaluations and provide immediate, lump-sum funding, whereas equity crowdfunding allows for diverse investor participation with potential for continuous capital through multiple funding rounds. Ownership dilution occurs in equity crowdfunding, contrasting with bank loans where business control remains intact but financial risk increases due to fixed repayment schedules.

How Bank Loans Work: Process and Requirements

Bank loans require a detailed application process including credit checks, financial statements, and collateral evaluation to assess borrower creditworthiness and risk. Borrowers must meet strict eligibility criteria such as income stability, good credit scores, and sufficient assets to secure funding. Funds are disbursed in lump sums or installments with fixed interest rates and defined repayment schedules, imposing regular payments over the loan term.

Understanding Equity Crowdfunding: Models and Platforms

Equity crowdfunding enables startups and small businesses to raise capital by offering shares to a broad base of investors through online platforms like Seedrs, Crowdcube, and Wefunder. Different models include donation-based, reward-based, debt-based, and equity-based crowdfunding, with equity crowdfunding specifically involving the exchange of company shares for investment. Understanding platform fees, regulatory compliance, investor rights, and the potential for dilution is essential for businesses seeking growth capital through this alternative to traditional bank loans.

Pros and Cons of Bank Loans for Businesses

Bank loans provide businesses with predictable repayment schedules and retain full ownership control, often offering lower interest rates compared to other financing options. However, securing a bank loan requires strong credit history, collateral, and can involve lengthy approval processes that may delay funding. Rigid repayment terms and potential penalties for missed payments pose risks, especially for startups or businesses with fluctuating cash flow.

Advantages and Disadvantages of Equity Crowdfunding

Equity crowdfunding allows startups to raise capital from a large pool of investors without incurring debt, providing access to funding without monthly repayments. Advantages include increased brand exposure, a broader investor base, and potential for community engagement, while disadvantages encompass equity dilution, regulatory compliance costs, and the time-consuming process of managing numerous small investors. Unlike bank loans, equity crowdfunding eliminates interest payments but subjects founders to loss of control and profit sharing with shareholders.

Comparing Approval Criteria and Accessibility

Bank loans typically require strong credit scores, detailed financial statements, and collateral as approval criteria, limiting accessibility for startups or businesses with limited assets. Equity crowdfunding offers broader accessibility by allowing companies to raise capital from a wide pool of investors based on business potential rather than credit history or collateral. The approval process for crowdfunding is more flexible and investor-driven, making it a viable alternative for early-stage ventures seeking funding without stringent qualification hurdles.

Impact on Business Ownership and Control

Bank loans require repayment with interest and do not dilute business ownership, allowing entrepreneurs to maintain full control over their company's decisions. Equity crowdfunding involves selling shares to multiple investors, which dilutes ownership and introduces external stakeholders who may influence business strategies. The choice between these financing options significantly affects governance structure, decision-making authority, and long-term control of the business.

Financial Implications and Repayment Obligations

Bank loans require fixed repayments with interest over a set period, directly impacting cash flow and potentially limiting financial flexibility. Equity crowdfunding involves selling ownership stakes, leading to dilution of control but no mandatory repayments, as returns depend on business performance and investor dividends. Choosing between the two depends on the company's cash flow stability and willingness to share future profits with investors.

Choosing the Right Funding Option for Your Business

Selecting the right funding option depends on your business's financial needs, risk tolerance, and growth goals. Bank loans offer fixed repayment schedules with lower interest rates but require strong credit and collateral, making them suitable for established businesses seeking predictable costs. Equity crowdfunding provides access to capital from numerous investors without immediate repayment, ideal for startups or companies willing to share ownership and leverage investor networks for growth.

Bank Loans Infographic

libterm.com

libterm.com