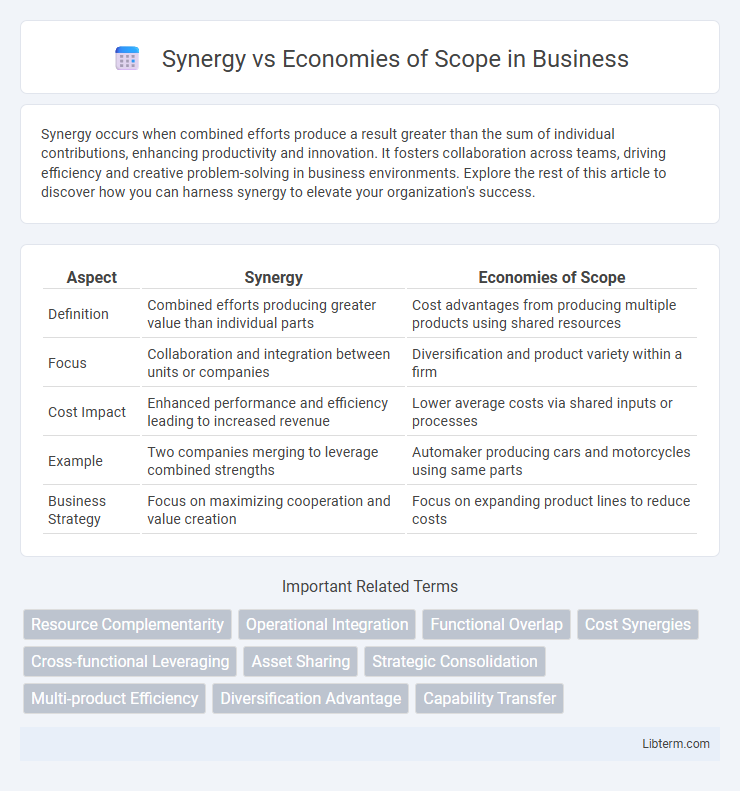

Synergy occurs when combined efforts produce a result greater than the sum of individual contributions, enhancing productivity and innovation. It fosters collaboration across teams, driving efficiency and creative problem-solving in business environments. Explore the rest of this article to discover how you can harness synergy to elevate your organization's success.

Table of Comparison

| Aspect | Synergy | Economies of Scope |

|---|---|---|

| Definition | Combined efforts producing greater value than individual parts | Cost advantages from producing multiple products using shared resources |

| Focus | Collaboration and integration between units or companies | Diversification and product variety within a firm |

| Cost Impact | Enhanced performance and efficiency leading to increased revenue | Lower average costs via shared inputs or processes |

| Example | Two companies merging to leverage combined strengths | Automaker producing cars and motorcycles using same parts |

| Business Strategy | Focus on maximizing cooperation and value creation | Focus on expanding product lines to reduce costs |

Understanding Synergy: Definition and Key Concepts

Synergy refers to the concept where combined efforts or resources produce a greater outcome than the sum of individual contributions, often measured in enhanced productivity or cost savings. Key concepts include operational synergy, which streamlines business processes, and financial synergy, where optimized capital structure lowers the cost of capital. Understanding synergy involves recognizing how integration of assets or activities leads to increased value creation beyond standalone performance.

What Are Economies of Scope?

Economies of scope occur when a company efficiently utilizes shared resources to produce a variety of products, reducing overall costs compared to producing each product separately. This cost advantage arises from spreading fixed costs, leveraging shared marketing channels, or utilizing common technology across multiple product lines. Companies experiencing economies of scope enhance operational efficiency and competitiveness by diversifying without significant increases in total production costs.

Synergy: Types and Real-World Examples

Synergy refers to the enhanced value or performance achieved when two or more entities combine their resources, capabilities, or efforts, generating results greater than the sum of their individual contributions. Types of synergy include operational synergy, where companies streamline processes to reduce costs, financial synergy through improved capital access or tax benefits, and managerial synergy by leveraging combined expertise to drive innovation. Real-world examples encompass Disney's acquisition of Pixar, which leveraged creative and distribution synergies, and the ExxonMobil merger, illustrating operational and financial synergies through optimized resource allocation and cost efficiencies.

Economies of Scope: How They Create Value

Economies of scope create value by enabling firms to reduce costs through the efficient use of resources across multiple products or services, leveraging shared capabilities and infrastructure. This strategic approach enhances operational flexibility and market responsiveness, allowing companies to spread fixed costs over a diverse output, thereby improving overall profitability. Businesses that successfully implement economies of scope often gain competitive advantages by delivering a broader portfolio while maintaining cost efficiency.

Synergy vs. Economies of Scope: Core Differences

Synergy refers to the enhanced value created when two or more entities combine operations, resulting in greater efficiency or performance beyond individual contributions. Economies of scope arise when producing multiple products together reduces overall costs compared to producing them separately, often through resource sharing. The core difference lies in synergy emphasizing value creation through collaboration and integration, while economies of scope focus on cost savings from diversified production.

Strategic Importance: When to Pursue Synergy

Synergy becomes strategically important when combining businesses or resources creates greater overall value than operating separately, often through enhanced efficiencies or innovation. It is crucial during mergers and acquisitions where integrated strengths can lead to competitive advantages and higher market power. Pursuing synergy is optimal in industries with complementary assets, overlapping capabilities, or potential for cost reduction and revenue enhancement.

Advantages of Achieving Economies of Scope

Achieving economies of scope reduces costs by efficiently sharing resources and capabilities across multiple products or services, enhancing operational flexibility. It enables firms to exploit existing assets, such as technology or distribution channels, to diversify their offerings without proportional increases in expense. This strategic advantage promotes innovation, market expansion, and competitive resilience by leveraging complementary strengths within the organization.

Challenges in Realizing Synergy and Economies of Scope

Realizing synergy and economies of scope often faces challenges such as organizational complexity, cultural clashes, and misaligned incentives that hinder effective integration and operational efficiency. Achieving synergy requires seamless coordination across different business units, while economies of scope demand flexible resource allocation and knowledge sharing, often complicated by managerial resistance and communication barriers. Furthermore, measurement difficulties and uncertain cost-benefit outcomes create obstacles in fully capturing the value from combined activities or diversified product lines.

Measuring Success: Metrics for Synergy and Scope

Measuring success in synergy involves evaluating combined financial performance metrics such as increased revenue growth, cost savings from consolidated operations, and enhanced market share. Economies of scope are assessed by analyzing cost efficiencies gained through shared resources across multiple products or services, including reductions in average production costs and improved resource utilization rates. Key metrics for distinguishing synergy from economies of scope include return on investment (ROI), operational cost ratios, and customer retention rates within diversified product lines.

Choosing the Right Approach: Factors to Consider

Choosing the right approach between synergy and economies of scope depends on the nature of the business, resource capabilities, and target market diversity. Synergy focuses on integrating complementary business units to enhance efficiency and create additional value through combined operations, while economies of scope emphasize cost savings by sharing resources across related products or services. Key factors include assessing potential cost reductions, market overlap, operational compatibility, and the strategic fit of combining activities to achieve sustainable competitive advantage.

Synergy Infographic

libterm.com

libterm.com