A putable bond grants the bondholder the right to sell the bond back to the issuer at a predetermined price before maturity, offering greater flexibility and protection against interest rate fluctuations. This feature can reduce the bond's yield compared to non-putable bonds because it lowers the investor's risk. Discover how putable bonds can fit into your investment strategy by exploring the details in the rest of this article.

Table of Comparison

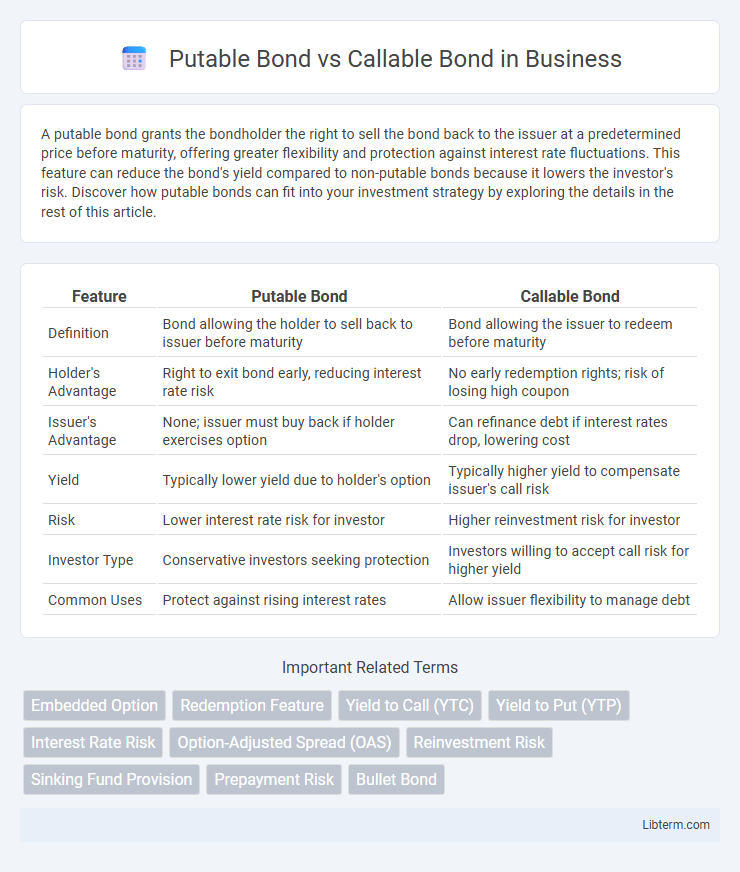

| Feature | Putable Bond | Callable Bond |

|---|---|---|

| Definition | Bond allowing the holder to sell back to issuer before maturity | Bond allowing the issuer to redeem before maturity |

| Holder's Advantage | Right to exit bond early, reducing interest rate risk | No early redemption rights; risk of losing high coupon |

| Issuer's Advantage | None; issuer must buy back if holder exercises option | Can refinance debt if interest rates drop, lowering cost |

| Yield | Typically lower yield due to holder's option | Typically higher yield to compensate issuer's call risk |

| Risk | Lower interest rate risk for investor | Higher reinvestment risk for investor |

| Investor Type | Conservative investors seeking protection | Investors willing to accept call risk for higher yield |

| Common Uses | Protect against rising interest rates | Allow issuer flexibility to manage debt |

Introduction to Bonds: Putable vs Callable

Putable bonds grant the bondholder the right to sell the bond back to the issuer before maturity, offering protection against rising interest rates and declining bond prices. Callable bonds allow the issuer to redeem the bond before maturity, enabling them to refinance debt at lower interest rates when market rates fall. Understanding these distinct embedded options is essential for investors assessing risk, yield, and potential price volatility in fixed-income securities.

Understanding Putable Bonds

Putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, providing downside protection during interest rate hikes or credit deterioration. This feature reduces the bond's price volatility and interest rate risk, making putable bonds attractive in uncertain markets. In contrast, callable bonds allow issuers to redeem the bond early, which typically benefits issuers when interest rates decline, exposing investors to reinvestment risk.

Understanding Callable Bonds

Callable bonds allow issuers to redeem the bond before its maturity date, usually at a premium, to refinance debt at lower interest rates during favorable market conditions. Investors face reinvestment risk because the bond might be called when interest rates decline, reducing potential income. These bonds typically offer higher yields to compensate for the call risk and the possibility of losing future interest payments.

Key Features of Putable Bonds

Putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, providing a risk management tool against interest rate increases or credit deterioration. These bonds typically offer lower yields compared to callable bonds due to the added value of the put option, which enhances investor protection by limiting potential losses. Key features include a specified put date or multiple put dates, defined put prices, and the ability to improve liquidity and flexibility for bondholders in volatile markets.

Key Features of Callable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity at a predefined call price, often resulting in reinvestment risk for investors if interest rates decline. These bonds typically offer higher yields to compensate investors for the call risk and may include call protection periods during which the bond cannot be called. The call feature allows issuers to refinance debt at lower rates, making callable bonds less attractive in falling interest rate environments compared to putable bonds, which allow investors to sell the bond back to the issuer.

Similarities Between Putable and Callable Bonds

Putable bonds and callable bonds both provide issuers and investors with options that influence the bond's longevity and yield, where callable bonds allow issuers to redeem before maturity and putable bonds permit investors to sell back to issuers early. These embedded options impact pricing and risk profiles, leading to adjusted coupon rates that reflect the value of the call or put feature. Both types of bonds are used strategically to manage interest rate risk and cash flow flexibility in fixed income portfolios.

Differences Between Putable and Callable Bonds

Putable bonds give investors the right to sell the bond back to the issuer before maturity, providing downside protection when interest rates rise or credit quality declines. Callable bonds allow issuers to redeem the bond early, typically when interest rates fall, enabling refinancing at lower borrowing costs. The key difference lies in the option holder: putable bonds benefit investors, while callable bonds benefit issuers.

Risks and Rewards for Investors

Putable bonds reduce risk for investors by allowing early redemption at par value before maturity, providing protection against interest rate rises and issuer credit deterioration. Callable bonds carry higher risk because issuers can redeem the bond early, limiting upside potential and forcing reinvestment at lower rates, but they offer higher yields as compensation. Investors must balance putable bonds' lower yields and downside protection against callable bonds' higher income and call risk exposure.

Suitability: Which Bond Type Fits Your Portfolio?

Putable bonds suit conservative investors seeking downside protection, allowing them to sell the bond back to the issuer before maturity if interest rates rise or credit quality deteriorates. Callable bonds appeal to investors willing to accept reinvestment risk in exchange for higher yields, as issuers can redeem these bonds early when interest rates fall. Portfolio suitability depends on risk tolerance, income needs, and market outlook, with putable bonds offering security and callable bonds providing potential for enhanced returns.

Conclusion: Choosing Between Putable and Callable Bonds

Choosing between putable and callable bonds depends on risk tolerance and market outlook; putable bonds offer investors protection by allowing bondholders to sell the bond back to the issuer before maturity, reducing interest rate risk. Callable bonds provide issuers flexibility to refinance debt when interest rates decline but increase reinvestment risk for investors. Investors seeking downside protection should prefer putable bonds, while those willing to accept call risk for potentially higher yields might consider callable bonds.

Putable Bond Infographic

libterm.com

libterm.com