Alliance refers to a strategic partnership between two or more parties aimed at achieving common goals, often enhancing competitive advantage and resource sharing. This cooperation can take various forms, including business alliances, military coalitions, or political agreements, each designed to leverage complementary strengths. Discover how forming the right alliance can transform your ventures and unlock new opportunities by reading the full article.

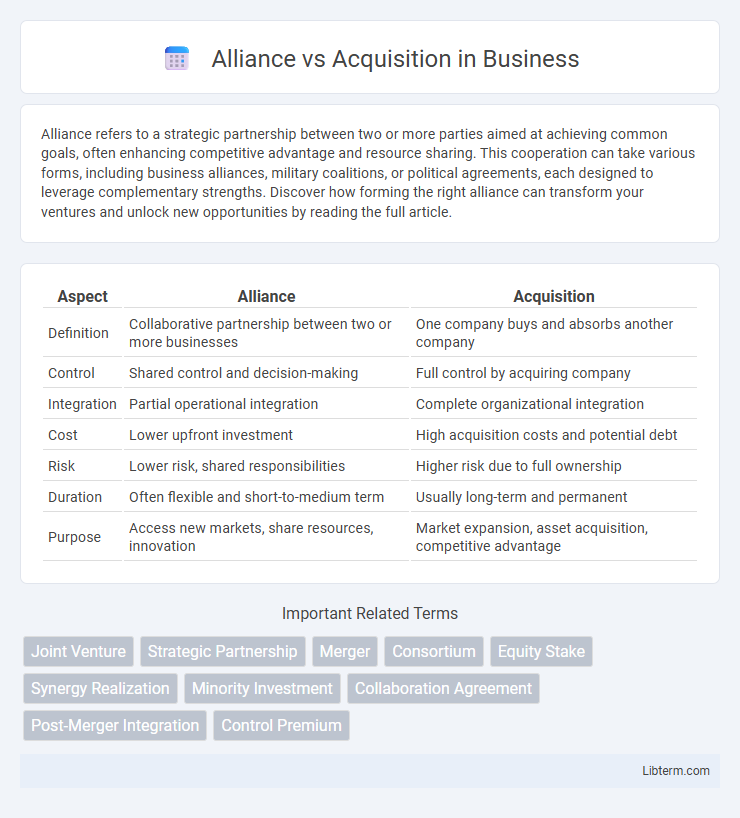

Table of Comparison

| Aspect | Alliance | Acquisition |

|---|---|---|

| Definition | Collaborative partnership between two or more businesses | One company buys and absorbs another company |

| Control | Shared control and decision-making | Full control by acquiring company |

| Integration | Partial operational integration | Complete organizational integration |

| Cost | Lower upfront investment | High acquisition costs and potential debt |

| Risk | Lower risk, shared responsibilities | Higher risk due to full ownership |

| Duration | Often flexible and short-to-medium term | Usually long-term and permanent |

| Purpose | Access new markets, share resources, innovation | Market expansion, asset acquisition, competitive advantage |

Understanding Strategic Alliances and Acquisitions

Strategic alliances involve collaborative agreements between companies to share resources and achieve mutual goals without changing ownership, fostering innovation and market expansion while maintaining operational independence. Acquisitions entail one company purchasing another, leading to full control and integration of assets, streamlining operations, and potentially achieving economies of scale. Understanding the distinctions helps businesses choose the best approach for growth, risk management, and competitive advantage in dynamic markets.

Key Differences Between Alliances and Acquisitions

Alliances involve collaborative partnerships where companies share resources and expertise to achieve common goals without merging ownership, while acquisitions entail one company purchasing another to gain full control and integration. Alliances typically offer flexibility and risk-sharing, whereas acquisitions require substantial investment and involve complete operational integration. Strategic objectives in alliances center on cooperation and market expansion, contrasting with acquisitions focused on consolidation and control of assets.

Advantages of Strategic Alliances

Strategic alliances enable companies to share resources, expertise, and risks without the high costs and complexities associated with acquisitions. These partnerships foster innovation through collaborative efforts while maintaining organizational independence and flexibility. Access to new markets and technologies becomes more efficient, enhancing competitive advantage with lower financial commitment.

Benefits of Business Acquisitions

Business acquisitions provide immediate access to established customer bases and market share, accelerating growth and competitive advantage. They enable companies to acquire valuable assets, technologies, and intellectual property that enhance operational capabilities and innovation potential. Cost synergies and increased economies of scale from acquisitions often result in improved profitability and financial performance.

Risks and Challenges in Alliances

Strategic alliances present unique risks such as misaligned objectives, cultural clashes, and inconsistent commitment levels among partners, which can hinder collaboration and value creation. Intellectual property leaks and confidentiality breaches pose significant challenges, especially when sharing proprietary technologies or sensitive data. The complexity of managing inter-organizational governance increases operational risks, often requiring robust conflict resolution mechanisms to mitigate potential disputes and ensure alignment.

Potential Pitfalls of Acquisitions

Acquisitions often encounter potential pitfalls such as cultural clashes, which can disrupt employee morale and integration efforts, leading to decreased productivity. Financial risks arise from overestimating synergies and underestimating costs, resulting in diminished shareholder value. Regulatory hurdles and antitrust issues further complicate acquisitions, causing delays or even deals falling through.

Case Studies: Successful Alliances vs. Successful Acquisitions

Successful alliances like the Starbucks-PepsiCo partnership leveraged combined distribution channels to dominate the ready-to-drink coffee market, while acquisitions such as Facebook's purchase of Instagram for $1 billion enabled rapid expansion into social media photo sharing with immediate market control. The alliance between Spotify and Uber demonstrated how strategic collaboration enhanced user experience without full ownership, contrasting with Amazon's acquisition of Whole Foods for $13.7 billion, which provided complete entry into the grocery sector and direct operational control. These case studies highlight how alliances optimize shared resources for mutual growth, whereas acquisitions deliver immediate market acquisition and integrated synergies.

Choosing the Right Growth Strategy: Alliance or Acquisition?

Choosing the right growth strategy between alliance and acquisition depends on factors such as resource availability, market access, and risk tolerance. Alliances enable shared expertise and lower investment while maintaining autonomy, ideal for entering new markets or innovation without full commitment. Acquisitions provide complete control and faster market penetration but require significant capital and integration effort, suitable for companies aiming for rapid expansion and consolidation.

Factors Influencing the Decision Between Alliance and Acquisition

Factors influencing the decision between alliance and acquisition include the level of control desired, resource availability, and risk tolerance. Alliances offer flexibility and shared risks, making them suitable for accessing complementary capabilities without full integration, while acquisitions provide complete control and faster market entry but require significant investment and integration efforts. Strategic objectives, cultural compatibility, and regulatory considerations also play critical roles in determining the optimal approach.

Future Trends in Corporate Partnerships and Acquisitions

Future trends in corporate partnerships and acquisitions highlight a growing preference for strategic alliances over acquisitions due to their flexibility and lower financial risk. Companies leverage digital transformation and cross-industry collaborations to innovate rapidly without the complexities of full mergers. The rise of sustainable and ESG-focused investments drives partnerships that align with long-term value creation and regulatory compliance.

Alliance Infographic

libterm.com

libterm.com