A futures contract is a standardized legal agreement to buy or sell an asset at a predetermined price on a specified future date, commonly used in commodities and financial markets. It enables investors to hedge against price fluctuations or speculate on market movements with leverage. Explore the rest of this article to understand how futures contracts can impact your trading strategy and risk management.

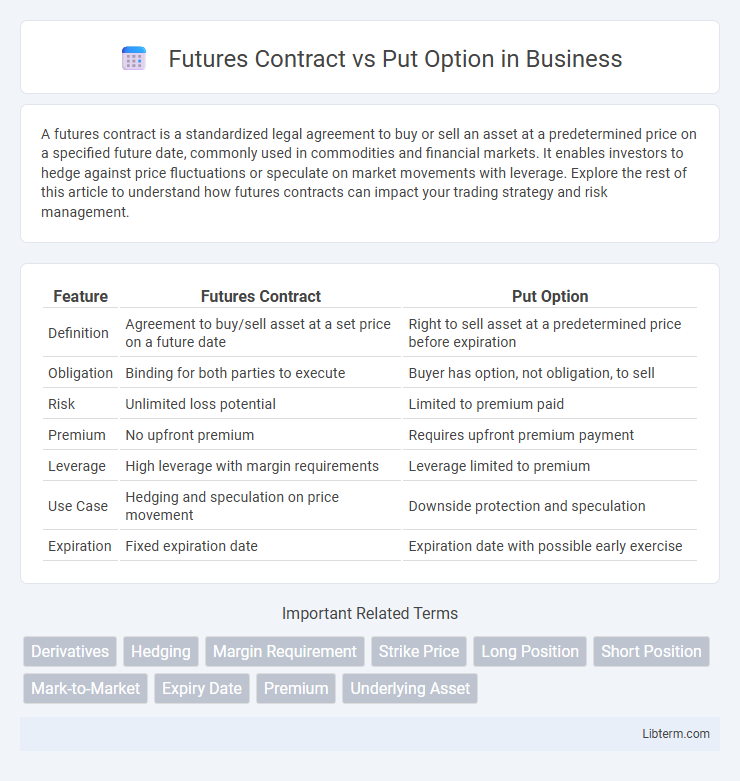

Table of Comparison

| Feature | Futures Contract | Put Option |

|---|---|---|

| Definition | Agreement to buy/sell asset at a set price on a future date | Right to sell asset at a predetermined price before expiration |

| Obligation | Binding for both parties to execute | Buyer has option, not obligation, to sell |

| Risk | Unlimited loss potential | Limited to premium paid |

| Premium | No upfront premium | Requires upfront premium payment |

| Leverage | High leverage with margin requirements | Leverage limited to premium |

| Use Case | Hedging and speculation on price movement | Downside protection and speculation |

| Expiration | Fixed expiration date | Expiration date with possible early exercise |

Introduction to Futures Contracts and Put Options

Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a specified future date, commonly used for commodities, currencies, and financial instruments. Put options grant the holder the right, but not the obligation, to sell an underlying asset at a set strike price before or on the option's expiration date, providing a form of downside protection or speculative opportunity. Both instruments serve as essential tools for hedging and risk management in financial markets, with futures obligating execution and puts offering flexibility through rights.

Key Differences Between Futures Contracts and Put Options

Futures contracts obligate the buyer to purchase and the seller to sell an asset at a predetermined price on a specific future date, whereas put options grant the buyer the right, but not the obligation, to sell an asset at a set strike price before expiration. Futures involve unlimited risk and potential profit as both parties must fulfill the contract, while put options limit the buyer's risk to the premium paid for the option, offering asymmetric risk-reward. Margin requirements are mandatory in futures trading, contrasting with put options where the maximum loss is the upfront premium, influencing leverage and capital allocation strategies.

How Futures Contracts Work

Futures contracts obligate the buyer to purchase, and the seller to sell, an asset at a predetermined price on a specified future date, providing a standardized and legally binding agreement. They are commonly used for commodities, currencies, and financial instruments, with margins required to manage risk and daily mark-to-market settlements ensuring price fluctuations are accounted for. Unlike put options, futures contracts carry the obligation of execution, lacking the right--but not the obligation--feature.

How Put Options Work

Put options grant the buyer the right, but not the obligation, to sell an underlying asset at a specified strike price before or on the expiration date, serving as a hedge against price declines. Unlike futures contracts that obligate the holder to buy or sell the asset at a set price on a future date, put options limit potential losses to the premium paid, offering risk management flexibility. Traders utilize put options to speculate on downward price movements or to protect long positions from adverse market shifts.

Risk and Reward Profiles

Futures contracts involve obligation to buy or sell an asset at a predetermined price, exposing traders to unlimited risk and potential reward based on market fluctuations. Put options grant the right, but not the obligation, to sell an asset at a strike price, limiting risk to the premium paid while offering significant downside protection. The asymmetric risk profile of put options contrasts with the symmetric exposure in futures contracts, making options preferable for hedging against adverse price movements.

Margin Requirements and Costs

Futures contracts require traders to post an initial margin, typically a percentage of the contract's value, with daily variation margin adjustments based on market fluctuations, ensuring continuous collateral coverage. Put options involve an upfront premium payment, which is the maximum cost and eliminates margin calls, providing a predefined risk exposure without the need for additional collateral. While futures demand ongoing margin maintenance that can increase capital requirements, put options offer more controlled costs but may result in premium loss if the option expires worthless.

Suitability for Different Types of Investors

Futures contracts suit experienced investors and institutions seeking direct exposure to asset price movements with high leverage and obligatory settlement. Put options appeal to risk-averse investors looking for downside protection and limited loss potential while maintaining the right, not the obligation, to sell the underlying asset. Both instruments offer strategic advantages but cater to different risk tolerances, capital availability, and investment objectives.

Use Cases in Hedging and Speculation

Futures contracts are commonly used for hedging commodity price risk by locking in prices for producers and consumers, offering standardized contracts and margin requirements that facilitate predictable cost management. Put options provide the right, without obligation, to sell an asset at a predetermined price, allowing investors to hedge against downside risk while maintaining upside potential, making them ideal for portfolio protection. Speculators use futures to capitalize on price movements with leverage, aiming for profit through price changes, whereas put options offer strategic moves to profit from declines or to insure investments.

Liquidity and Trading Strategies

Futures contracts generally offer higher liquidity compared to put options due to their standardized nature and widespread use in hedging and speculative trading across major exchanges. Traders utilize futures contracts for direct exposure to the underlying asset with margin efficiency, while put options enable strategic downside protection or leverage through limited risk premium payments. Liquidity in put options can vary significantly based on strike price and expiration, making futures contracts more favorable for large-volume, short-term trading strategies.

Summary: Choosing Between Futures Contracts and Put Options

Futures contracts offer obligation to buy or sell assets at a predetermined price and date, providing high leverage but with significant risk exposure. Put options grant the right, without obligation, to sell assets at a set price before expiration, offering downside protection with limited loss confined to the premium paid. Selecting between futures contracts and put options depends on risk tolerance, investment goals, and market outlook, where futures suit aggressive strategies and puts serve as insurance or hedging tools.

Futures Contract Infographic

libterm.com

libterm.com