Equity swaps allow investors to exchange future cash flows based on the performance of an equity asset without directly owning it, offering flexibility in managing exposure and risk. These derivatives are crucial for hedging portfolios, enhancing returns, and gaining access to market opportunities without buying shares outright. Explore the rest of the article to understand how your investment strategy can benefit from equity swaps.

Table of Comparison

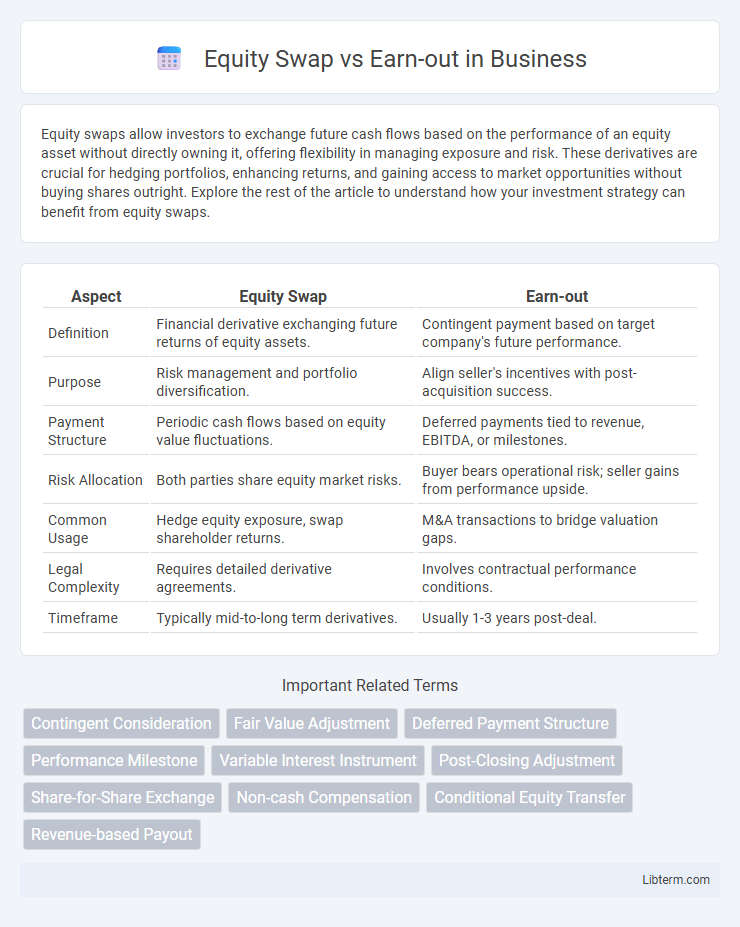

| Aspect | Equity Swap | Earn-out |

|---|---|---|

| Definition | Financial derivative exchanging future returns of equity assets. | Contingent payment based on target company's future performance. |

| Purpose | Risk management and portfolio diversification. | Align seller's incentives with post-acquisition success. |

| Payment Structure | Periodic cash flows based on equity value fluctuations. | Deferred payments tied to revenue, EBITDA, or milestones. |

| Risk Allocation | Both parties share equity market risks. | Buyer bears operational risk; seller gains from performance upside. |

| Common Usage | Hedge equity exposure, swap shareholder returns. | M&A transactions to bridge valuation gaps. |

| Legal Complexity | Requires detailed derivative agreements. | Involves contractual performance conditions. |

| Timeframe | Typically mid-to-long term derivatives. | Usually 1-3 years post-deal. |

Introduction to Equity Swaps and Earn-outs

Equity swaps involve exchanging cash flows based on the performance of equity assets without transferring ownership, allowing investors to hedge risks or gain exposure to stock returns. Earn-outs are contractual agreements in mergers and acquisitions where a portion of the payment is contingent on future financial performance, aligning seller incentives with business success. Both instruments serve strategic financial goals--equity swaps for risk management and liquidity, earn-outs for bridging valuation gaps in transactions.

Key Definitions: Equity Swap vs Earn-out

An equity swap is a financial derivative contract where parties exchange future cash flows based on the performance of equity assets, allowing investors to gain exposure without owning the underlying shares. An earn-out is a contractual arrangement in M&A transactions where the seller receives additional compensation based on the acquired company's future performance metrics, such as revenue or EBITDA targets. While equity swaps facilitate risk management and speculative investment, earn-outs align seller incentives with company growth post-acquisition.

How Equity Swaps Work in M&A Transactions

Equity swaps in M&A transactions involve an agreement where two parties exchange future returns based on the performance of underlying equity assets without transferring ownership. This structure allows buyers and sellers to hedge risk or align incentives by linking payment terms to stock price fluctuations or company valuations over a specified period. Unlike earn-outs, which depend on post-acquisition financial targets, equity swaps provide a flexible financial derivative that supports tailored value exchange and risk management in complex merger deals.

Understanding Earn-out Agreements

Earn-out agreements are contractual arrangements in mergers and acquisitions where the seller receives additional compensation based on the future performance of the acquired business, often measured by revenue or EBITDA targets. Unlike equity swaps, which involve exchanging ownership stakes to align interests between parties, earn-outs provide sellers with performance-based incentives while mitigating buyer risk. These agreements require careful structuring to define clear milestones, valuation metrics, and dispute resolution mechanisms to ensure alignment and prevent post-transaction conflicts.

Comparative Advantages: Equity Swap vs Earn-out

Equity swaps offer immediate liquidity and risk transfer by exchanging equity interests without affecting cash flow, providing flexibility for companies seeking to manage ownership stakes efficiently. Earn-outs align seller and buyer incentives by tying part of the purchase price to future performance milestones, reducing valuation disputes in mergers and acquisitions. Compared to earn-outs, equity swaps minimize post-transaction integration complexities and enable quicker deal closure, while earn-outs better protect buyers against overpaying for overestimated projections.

Risks and Challenges of Each Structure

Equity swaps carry market risk exposure and counterparty risk, as the value fluctuates with underlying equity performance and depends on the swap counterparty's creditworthiness. Earn-outs face operational risks and valuation disputes since the final payment hinges on achieving specific financial targets post-transaction, often leading to conflicts over performance measurement and integration challenges. Both structures require careful contract design to mitigate uncertainty, enforceability issues, and alignment of incentives between parties.

Valuation Considerations in Equity Swaps and Earn-outs

Equity swaps involve exchanging future returns on a company's equity without transferring ownership, requiring valuation models that forecast stock performance and volatility over the contract period. Earn-outs link part of the purchase price to future financial metrics, necessitating precise projections of revenue, EBITDA, or other performance indicators to determine contingent payments. Both structures demand rigorous scenario analysis and risk assessment to accurately value the expected cash flows and align incentives between buyers and sellers.

Tax Implications and Regulatory Aspects

Equity swaps and earn-outs differ significantly in tax implications and regulatory treatment, with equity swaps often treated as derivatives subject to complex tax rules on gains and losses, while earn-outs are recognized as contingent payments impacting the timing and character of taxable income. Regulatory aspects for equity swaps involve derivative transaction reporting and compliance with securities laws, whereas earn-outs must comply with purchase agreement terms and may trigger tax reporting requirements under purchase price allocation rules. Understanding these distinctions is crucial for structuring transactions to optimize tax efficiency and regulatory compliance.

Practical Scenarios: When to Use Equity Swap or Earn-out

Equity swaps are ideal in mergers and acquisitions when both parties seek to align long-term interests through exchanging ownership stakes, particularly in joint ventures or strategic partnerships. Earn-outs are practical during acquisitions with valuation uncertainties, allowing sellers to receive additional payments based on future performance milestones, thus bridging gaps in price expectations. Companies use equity swaps to maintain control while achieving diversification, whereas earn-outs manage risk by linking payments to measurable financial targets or operational results.

Conclusion: Choosing the Right Deal Structure

Selecting the appropriate deal structure depends on the strategic goals and risk tolerance of the parties involved. Equity swaps offer flexibility in managing ownership stakes without immediate cash exchange, while earn-outs align payment with future performance, mitigating risk for buyers. Evaluating financial projections and control preferences ensures a tailored approach to maximize value and secure mutual interests.

Equity Swap Infographic

libterm.com

libterm.com