Horizontal integration expands a company's market share by acquiring or merging with competitors operating at the same stage of the production process. This strategy enhances economies of scale, reduces competition, and increases bargaining power within the industry. Discover how horizontal integration can transform Your business landscape by exploring the detailed insights in the rest of this article.

Table of Comparison

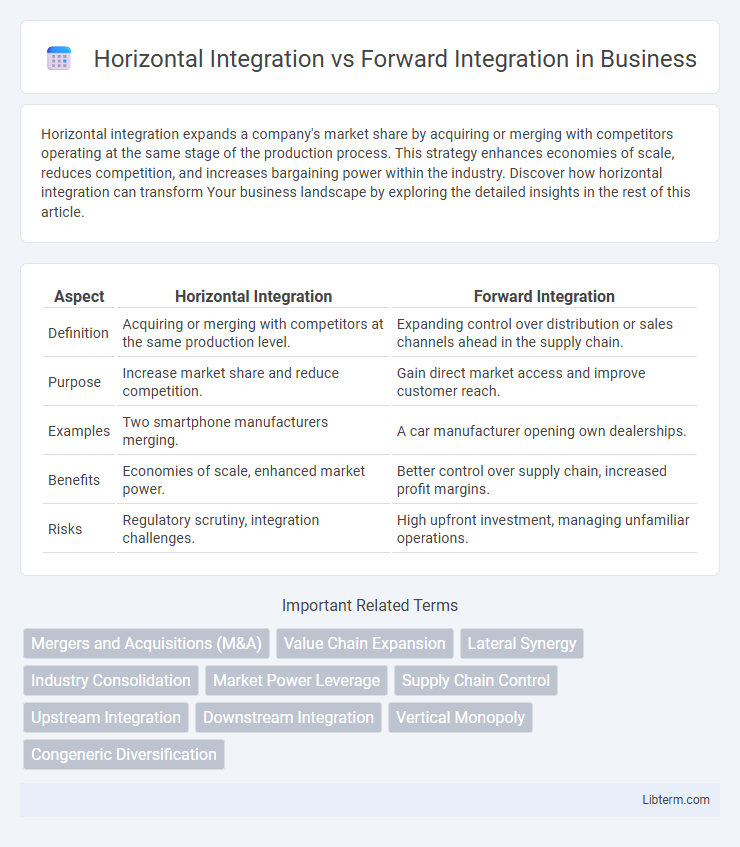

| Aspect | Horizontal Integration | Forward Integration |

|---|---|---|

| Definition | Acquiring or merging with competitors at the same production level. | Expanding control over distribution or sales channels ahead in the supply chain. |

| Purpose | Increase market share and reduce competition. | Gain direct market access and improve customer reach. |

| Examples | Two smartphone manufacturers merging. | A car manufacturer opening own dealerships. |

| Benefits | Economies of scale, enhanced market power. | Better control over supply chain, increased profit margins. |

| Risks | Regulatory scrutiny, integration challenges. | High upfront investment, managing unfamiliar operations. |

Understanding Horizontal Integration: Definition and Key Concepts

Horizontal integration involves the consolidation of companies operating in the same industry and at the same stage of production, aiming to increase market share, reduce competition, and achieve economies of scale. Key concepts include acquiring or merging with competitors to expand product offerings, optimize operations, and enhance bargaining power. This strategy contrasts with forward integration, which focuses on controlling the distribution or retail aspect of the supply chain.

What is Forward Integration? An Overview

Forward integration is a growth strategy where a company expands its business activities toward the distribution or retail end of the supply chain, effectively gaining greater control over its product delivery to customers. This approach allows firms to reduce dependency on intermediaries, improve profit margins by capturing downstream value, and enhance market access or customer reach. Prominent examples include manufacturers opening their own retail outlets or acquiring distributors to streamline operations and boost competitive advantage.

Core Differences Between Horizontal and Forward Integration

Horizontal integration involves acquiring or merging with competitors at the same stage of the supply chain to increase market share and reduce competition. Forward integration entails expanding a company's operations to control distribution or retail functions, moving closer to the end consumer. The core difference lies in horizontal integration focusing on consolidation within the same industry level, while forward integration targets control over subsequent downstream activities in the value chain.

Strategic Objectives of Horizontal Integration

Horizontal integration focuses on expanding a company's market share by acquiring or merging with competitors operating at the same stage of the supply chain, aiming to achieve economies of scale, reduce competition, and increase market power. Strategic objectives include enhancing product offerings, increasing geographic reach, and leveraging synergies to improve cost efficiency and profitability. This approach strengthens a firm's position within its industry, enabling better control over pricing and distribution while fostering innovation through combined resources.

Strategic Objectives of Forward Integration

Forward integration aims to increase control over the distribution and retail aspects of the supply chain, enabling companies to capture higher profit margins and improve market access. This strategic approach enhances customer experience by ensuring better product availability and service quality while reducing dependency on intermediaries. By directly managing sales channels, businesses can gain valuable consumer insights and strengthen brand loyalty, driving long-term competitive advantage.

Advantages and Disadvantages of Horizontal Integration

Horizontal integration enables businesses to expand market share by acquiring or merging with competitors within the same industry, leading to economies of scale, increased customer base, and enhanced competitive positioning. However, it can result in antitrust issues, reduced innovation due to decreased competition, and challenges in integrating organizational cultures and systems. While horizontal integration boosts market dominance and operational efficiency, it risks regulatory scrutiny and potential internal inefficiencies.

Pros and Cons of Forward Integration

Forward integration grants companies direct control over distribution and sales channels, improving profit margins and customer experience by reducing intermediaries. This strategy demands substantial investment and operational expertise, increasing financial risk and complexity in managing downstream activities. However, it strengthens market position by securing supply chain control and enhancing competitive advantage through direct market access.

Real-World Examples of Horizontal and Forward Integration

Horizontal integration occurs when companies like Facebook acquire Instagram to consolidate market share and eliminate competition within the same industry. Forward integration is demonstrated by Tesla opening its own retail stores, bypassing traditional dealerships to control the customer experience and supply chain. Both strategies enhance market control but target different stages of the value chain for competitive advantage.

Choosing the Right Integration Strategy for Your Business

Choosing the right integration strategy depends on your business goals: horizontal integration focuses on acquiring or merging with competitors to increase market share and reduce competition, while forward integration involves expanding control over the distribution or sales channels to enhance customer reach and improve profit margins. Analyze your industry's competitive dynamics and supply chain structure to determine whether consolidating with peers or moving closer to the end consumer offers more strategic advantage. Evaluating cost efficiencies, market penetration opportunities, and long-term scalability will guide the decision between horizontal and forward integration.

Impact of Integration Strategies on Competitive Advantage

Horizontal integration expands a company's market share by acquiring or merging with competitors, reducing competition and achieving economies of scale that strengthen market positioning. Forward integration involves controlling distribution or retail channels, enhancing customer access and increasing control over the supply chain, which results in higher profit margins and improved market responsiveness. Both strategies enhance competitive advantage by leveraging operational efficiencies and increasing market power, but horizontal integration emphasizes market dominance while forward integration focuses on supply chain control and customer proximity.

Horizontal Integration Infographic

libterm.com

libterm.com