Basel III is a comprehensive regulatory framework designed to strengthen bank capital requirements and improve risk management to enhance financial system stability. It introduces higher quality capital standards, liquidity requirements, and leverage ratios to ensure banks can withstand economic stress and reduce the likelihood of insolvency. Explore the rest of the article to understand how Basel III impacts your banking and investment decisions.

Table of Comparison

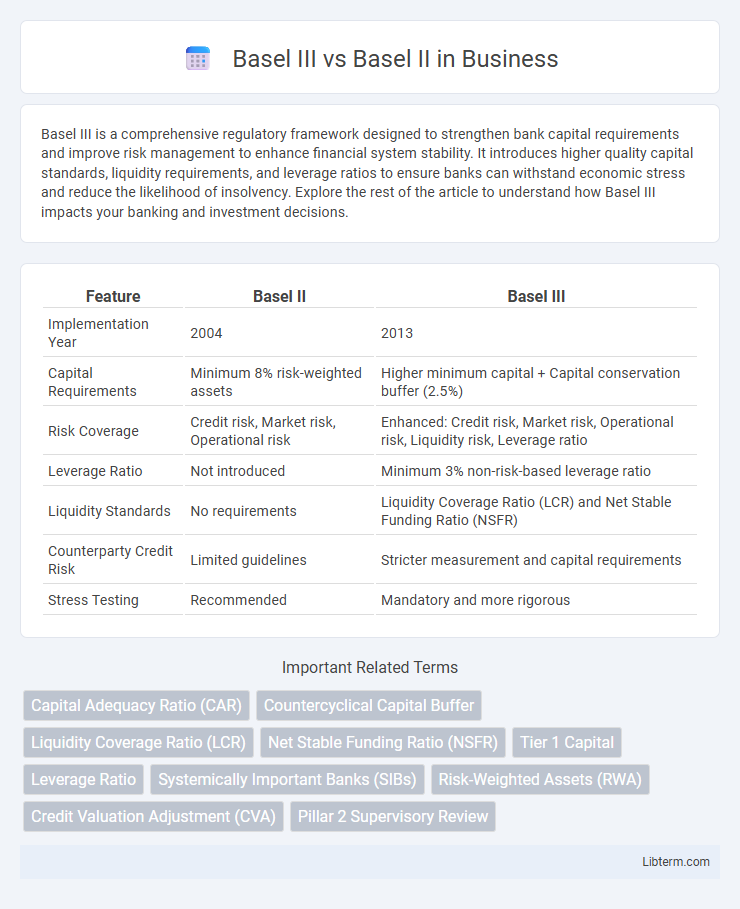

| Feature | Basel II | Basel III |

|---|---|---|

| Implementation Year | 2004 | 2013 |

| Capital Requirements | Minimum 8% risk-weighted assets | Higher minimum capital + Capital conservation buffer (2.5%) |

| Risk Coverage | Credit risk, Market risk, Operational risk | Enhanced: Credit risk, Market risk, Operational risk, Liquidity risk, Leverage ratio |

| Leverage Ratio | Not introduced | Minimum 3% non-risk-based leverage ratio |

| Liquidity Standards | No requirements | Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) |

| Counterparty Credit Risk | Limited guidelines | Stricter measurement and capital requirements |

| Stress Testing | Recommended | Mandatory and more rigorous |

Introduction to Basel II and Basel III

Basel II established a framework for banking supervision centered on three pillars: minimum capital requirements, supervisory review, and market discipline, enhancing risk sensitivity compared to Basel I. Basel III builds upon Basel II by introducing stricter capital adequacy standards, incorporating buffers like the capital conservation buffer and countercyclical buffer, and improving liquidity risk management through the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). These enhancements address the shortcomings revealed during the 2008 financial crisis, aiming to strengthen the resilience of the global banking system.

Key Objectives of Basel II and Basel III

Basel II primarily aimed to create more risk-sensitive capital requirements, improve supervisory review processes, and enhance market discipline through increased disclosure. Basel III expanded on these by addressing weaknesses exposed during the 2008 financial crisis, introducing stricter capital requirements, leverage ratios, and liquidity standards to strengthen the banking sector's resilience. Both frameworks focus on maintaining financial stability, but Basel III emphasizes improved risk management and systemic risk mitigation.

Major Differences in Capital Requirements

Basel III introduces more stringent capital requirements compared to Basel II, increasing the minimum common equity tier 1 (CET1) capital ratio to 4.5% from Basel II's 2%. It also establishes a capital conservation buffer of 2.5% and a countercyclical buffer ranging up to 2.5%, enhancing banks' resilience during economic downturns. Basel III further tightens leverage ratios and introduces more comprehensive risk coverage, including higher capital charges for counterparty credit risk and stressed exposures.

Risk Coverage: Basel II vs Basel III

Basel III significantly enhances risk coverage compared to Basel II by introducing stricter capital requirements and incorporating new regulatory measures such as the leverage ratio and liquidity standards. It expands the scope of risk assessment to include systemic risks, counterparty credit risk through the Credit Valuation Adjustment (CVA), and market risk with improved sensitivity to stressed conditions. These advances ensure banks hold more robust capital buffers, reducing the likelihood of financial instability and promoting greater resilience in the global banking system.

Introduction of Liquidity Standards in Basel III

Basel III introduced comprehensive liquidity standards, including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), which were absent in Basel II, to enhance banks' ability to withstand short-term liquidity stress and promote long-term funding stability. These standards require banks to hold high-quality liquid assets sufficient to cover net cash outflows over a 30-day stress period, improving resilience against liquidity crises. The introduction of these measures marks a significant advancement in regulatory frameworks by addressing liquidity risk explicitly, complementing the existing capital requirements under Basel II.

Leverage Ratio: New Addition in Basel III

The Leverage Ratio introduced in Basel III serves as a critical regulatory measure to restrict excessive borrowing by requiring banks to maintain a minimum level of capital against their total exposure, unlike Basel II which lacked this non-risk based safeguard. Basel III mandates a minimum Leverage Ratio of 3%, calculated as Tier 1 capital over the bank's average total consolidated assets, enhancing financial stability by curbing the buildup of systemic risk. This new addition addresses the limitations of Basel II by providing a transparent, straightforward metric that complements risk-based capital requirements and prevents undercapitalization in times of market stress.

Impact on Banking Supervision

Basel III introduces more stringent capital requirements and enhanced risk management standards compared to Basel II, significantly strengthening banking supervision frameworks worldwide. It mandates higher-quality capital reserves, improved liquidity ratios, and stricter leverage ratios, enabling regulators to better assess banks' resilience against financial shocks. This evolution in regulatory standards improves the stability and transparency of the banking sector, reducing systemic risk and protecting global financial systems.

Implementation Timeline and Global Adoption

Basel III implementation began in 2013 with phased deadlines extending through 2023, aiming to enhance bank capital requirements and risk management compared to Basel II, which was introduced in 2004. Basel III adoption has been more gradual and stringent globally, with major economies like the US, EU, and Japan enforcing stricter capital buffers and liquidity ratios over a decade, while many emerging markets implemented Basel II at a slower pace due to limited regulatory capacity. The extended timeline and broader scope of Basel III reflect the global banking community's response to the 2008 financial crisis, driving widespread reforms in banking supervision and financial stability frameworks worldwide.

Effects on Banks and Financial Stability

Basel III introduces higher capital requirements and stricter liquidity standards compared to Basel II, significantly enhancing banks' resilience to financial shocks. It mandates global systemically important banks (G-SIBs) to hold additional capital buffers, reducing the risk of bank failures and systemic crises. These reforms improve overall financial stability by minimizing the likelihood of credit crunches and promoting more prudent risk management in the banking sector.

Future Reforms and Outlook Beyond Basel III

Future reforms beyond Basel III aim to address remaining systemic risks by enhancing capital quality, leverage ratios, and liquidity standards to strengthen banking resilience. Emphasis on incorporating climate-related financial risks and integrating technological advancements reflects evolving macroeconomic challenges and regulatory priorities. The outlook envisions a dynamic regulatory framework adapting to market innovations and global financial stability demands post-Basel II and III implementations.

Basel III Infographic

libterm.com

libterm.com