Zero working capital means a business's current assets exactly match its current liabilities, indicating efficient use of resources without excess cash or inventory. This approach minimizes idle funds and can improve operational efficiency, but it requires careful management to avoid liquidity issues. Discover how understanding zero working capital can optimize Your company's financial health in the rest of this article.

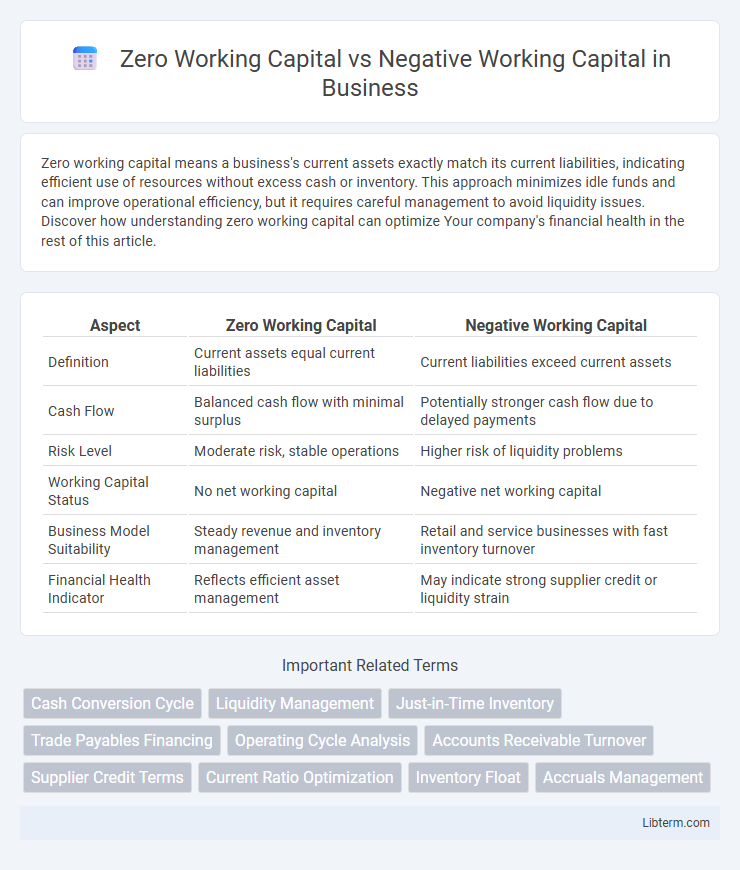

Table of Comparison

| Aspect | Zero Working Capital | Negative Working Capital |

|---|---|---|

| Definition | Current assets equal current liabilities | Current liabilities exceed current assets |

| Cash Flow | Balanced cash flow with minimal surplus | Potentially stronger cash flow due to delayed payments |

| Risk Level | Moderate risk, stable operations | Higher risk of liquidity problems |

| Working Capital Status | No net working capital | Negative net working capital |

| Business Model Suitability | Steady revenue and inventory management | Retail and service businesses with fast inventory turnover |

| Financial Health Indicator | Reflects efficient asset management | May indicate strong supplier credit or liquidity strain |

Introduction to Working Capital Concepts

Working capital represents the difference between a company's current assets and current liabilities, serving as a key indicator of operational liquidity. Zero working capital occurs when current assets exactly equal current liabilities, indicating a balanced state where a company efficiently manages cash flow without excess resources tied up. Negative working capital arises when current liabilities exceed current assets, often suggesting a company leverages supplier credit or has cash flow constraints, potentially impacting its ability to meet short-term obligations.

Defining Zero Working Capital

Zero working capital occurs when a company's current assets exactly equal its current liabilities, indicating no excess funds tied up in operations. This balance optimizes liquidity by ensuring that short-term obligations are covered without holding unnecessary inventory or receivables. Negative working capital, in contrast, means current liabilities exceed current assets, which can signal efficient cash management in some industries or potential liquidity risks in others.

Understanding Negative Working Capital

Negative working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity issues but also signaling efficient management of payables and inventory in certain industries. Unlike zero working capital, where current assets equal current liabilities and the company breaks even in short-term financial obligations, negative working capital can free up cash flow for operations and investments. Understanding negative working capital helps assess a firm's financial strategy and operational efficiency, particularly in sectors like retail or utilities where rapid inventory turnover and favorable payment terms are common.

Key Differences Between Zero and Negative Working Capital

Zero working capital indicates a company's current assets exactly equal its current liabilities, signaling balanced liquidity without surplus or deficit. Negative working capital occurs when current liabilities exceed current assets, often reflecting efficient inventory management or potential liquidity issues. Key differences include liquidity risk, with zero working capital representing neutral risk, while negative working capital suggests either strong cash flow efficiency or potential short-term solvency challenges.

Benefits of Zero Working Capital

Zero working capital ensures that a company's current assets precisely match its current liabilities, optimizing cash flow and minimizing idle resources. This balance reduces financing costs and enhances operational efficiency, allowing businesses to maintain liquidity without tying up excess funds. Firms with zero working capital can respond swiftly to market changes, improving agility and financial stability.

Risks and Advantages of Negative Working Capital

Negative working capital occurs when a company's current liabilities exceed its current assets, which can indicate strong operational efficiency by minimizing inventory and accelerating payables but also poses liquidity risks if obligations cannot be met promptly. Advantages include improved cash flow management and the ability to use supplier financing to fund operations without relying heavily on external debt. However, risks involve potential insolvency during economic downturns or supply chain disruptions, as insufficient working capital may hinder the ability to cover short-term liabilities.

Industry Examples of Zero vs Negative Working Capital

Retail giants like Amazon and Walmart often operate with negative working capital, leveraging rapid inventory turnover and extended supplier payment terms to fund operations without additional capital. Conversely, tech companies such as Apple maintain near zero working capital by balancing receivables, payables, and inventory efficiently to optimize liquidity. These contrasting strategies reflect industry-specific cash flow management tailored to operational cycles and competitive advantages.

Impact on Business Liquidity and Cash Flow

Zero working capital indicates that a company's current assets exactly match its current liabilities, leading to tight liquidity with limited buffer for unexpected expenses, which can strain cash flow management. Negative working capital occurs when current liabilities exceed current assets, often improving cash flow by delaying payments and efficiently using supplier credit but increasing risk if obligations cannot be met timely. Businesses with negative working capital might experience stronger short-term liquidity but face potential solvency issues during market downturns or sudden cash demands.

Strategies for Managing Working Capital Levels

Effective strategies for managing working capital levels include optimizing accounts receivable through timely invoicing and stringent credit policies to reduce days sales outstanding. Managing inventory turnover by implementing just-in-time inventory systems helps prevent excess stock that can lead to negative working capital. Negotiating better payment terms with suppliers allows businesses to extend accounts payable periods, balancing cash flow without compromising relationships.

Choosing the Optimal Working Capital Approach for Your Business

Zero Working Capital ensures that current assets exactly match current liabilities, optimizing liquidity without tying up excess resources, ideal for businesses with stable cash flows. Negative Working Capital, where current liabilities exceed current assets, can enhance cash flow by leveraging supplier credit but increases risk and may signal liquidity issues. Selecting the optimal working capital approach depends on industry dynamics, cash flow predictability, and risk tolerance, balancing operational efficiency with financial stability.

Zero Working Capital Infographic

libterm.com

libterm.com