Credit risk measures the possibility that a borrower will fail to meet their debt obligations, impacting lenders and investors financially. Effective credit risk management involves assessing borrower creditworthiness, monitoring credit exposures, and implementing strategies to mitigate potential losses. Explore the rest of the article to understand how managing credit risk can protect your financial interests.

Table of Comparison

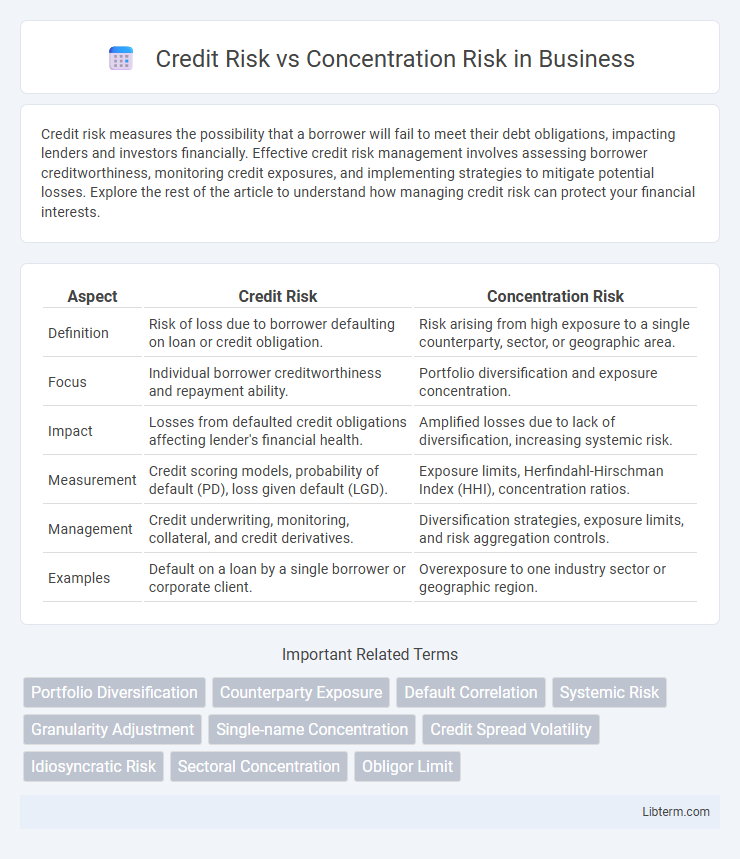

| Aspect | Credit Risk | Concentration Risk |

|---|---|---|

| Definition | Risk of loss due to borrower defaulting on loan or credit obligation. | Risk arising from high exposure to a single counterparty, sector, or geographic area. |

| Focus | Individual borrower creditworthiness and repayment ability. | Portfolio diversification and exposure concentration. |

| Impact | Losses from defaulted credit obligations affecting lender's financial health. | Amplified losses due to lack of diversification, increasing systemic risk. |

| Measurement | Credit scoring models, probability of default (PD), loss given default (LGD). | Exposure limits, Herfindahl-Hirschman Index (HHI), concentration ratios. |

| Management | Credit underwriting, monitoring, collateral, and credit derivatives. | Diversification strategies, exposure limits, and risk aggregation controls. |

| Examples | Default on a loan by a single borrower or corporate client. | Overexposure to one industry sector or geographic region. |

Introduction to Credit Risk and Concentration Risk

Credit risk refers to the possibility of a borrower failing to meet their debt obligations, leading to financial loss for the lender. Concentration risk is a subset of credit risk that arises from a portfolio's exposure being heavily weighted toward a single counterparty, industry, or geographic region, increasing vulnerability to specific economic shocks. Understanding both risks is essential for effective risk management and maintaining portfolio diversification to minimize potential losses.

Defining Credit Risk: Key Concepts

Credit risk refers to the potential financial loss a lender faces when a borrower fails to meet contractual debt obligations. This risk encompasses default probability, exposure at default, and loss given default, which are central to credit risk assessment models. Concentration risk, a subset of credit risk, arises from excessive exposure to a single borrower, sector, or geographic region, increasing vulnerability to correlated losses.

Defining Concentration Risk: Essential Elements

Concentration risk refers to the potential for significant losses resulting from an exposure to a single counterparty, sector, geographic area, or financial instrument, which lacks diversification. Essential elements of concentration risk include the degree of exposure, correlation among assets, and the lack of risk dispersion across the portfolio. This risk is critical in credit risk management because high concentration can amplify the impact of default or adverse economic events.

Core Differences Between Credit Risk and Concentration Risk

Credit risk refers to the potential loss arising from a borrower's failure to repay a loan or meet contractual obligations, while concentration risk involves the increased exposure caused by high levels of investment or lending to a single counterparty, sector, or geographic region. Core differences include credit risk's focus on individual borrower default probability and loss severity, whereas concentration risk centers on portfolio imbalances that amplify losses due to lack of diversification. Effective risk management requires distinguishing credit risk as borrower-specific and concentration risk as a systemic issue tied to aggregation of exposures.

Causes and Drivers of Credit Risk

Credit risk arises primarily from the likelihood of borrower default due to factors such as deteriorating financial health, adverse economic conditions, and poor credit underwriting standards. Drivers include borrower-specific issues like low credit scores, cash flow problems, and industry downturns, while concentration risk stems from excessive exposure to a single borrower, sector, or geographic region, amplifying the impact of a default event. Effective credit risk management requires identifying these causes to prevent portfolio losses and ensure diversified loan exposures.

Causes and Drivers of Concentration Risk

Concentration risk arises when a financial institution's exposure is heavily weighted toward a single counterparty, industry, or geographic region, increasing vulnerability to adverse events affecting that segment. Key drivers include excessive loan portfolios in specific sectors, limited diversification in credit exposures, and correlated economic factors that amplify losses during downturns. Unlike general credit risk, which considers individual borrower defaults, concentration risk emphasizes the systemic impact of correlated exposures on portfolio stability.

Measuring Credit Risk: Tools and Techniques

Credit risk measurement employs tools such as credit scoring models, probability of default (PD), exposure at default (EAD), and loss given default (LGD) to quantify potential losses from borrower defaults. Concentration risk assessment involves analyzing the distribution of credit exposures across sectors, counterparties, and geographies, often using metrics like the Herfindahl-Hirschman Index (HHI) and concentration indices. Advanced techniques such as stress testing and scenario analysis further enhance the evaluation of vulnerabilities due to concentrated credit exposures.

Assessing Concentration Risk: Methods and Metrics

Assessing concentration risk involves analyzing the exposure of a credit portfolio to a single counterparty, sector, or geographic region to prevent significant losses from correlated defaults. Key metrics include the Herfindahl-Hirschman Index (HHI), concentration ratios, and exposure at default (EAD) calculations, which quantify risk levels and diversification. Stress testing and scenario analysis also provide insights into potential impacts of concentrated exposures under adverse economic conditions.

Impact of Risk Types on Financial Institutions

Credit risk directly affects financial institutions by increasing the likelihood of loan defaults, leading to potential losses that can erode capital reserves and reduce profitability. Concentration risk amplifies these effects by exposing institutions to significant losses from overexposure to a single borrower, sector, or geographic region, limiting diversification benefits. Effective management of both risks is critical to maintaining financial stability and regulatory compliance, as failure to address them can result in severe liquidity issues and damaged reputations.

Strategies to Mitigate Credit and Concentration Risks

Effective strategies to mitigate credit risk include thorough credit assessments, diversified lending portfolios, and continuous monitoring of borrowers' financial health to identify early signs of default. Concentration risk mitigation involves setting exposure limits across sectors, geographic regions, and individual clients to avoid excessive reliance on a single source of risk. Employing risk transfer methods such as credit derivatives and insurance can further reduce the impact of adverse credit events on the overall portfolio.

Credit Risk Infographic

libterm.com

libterm.com