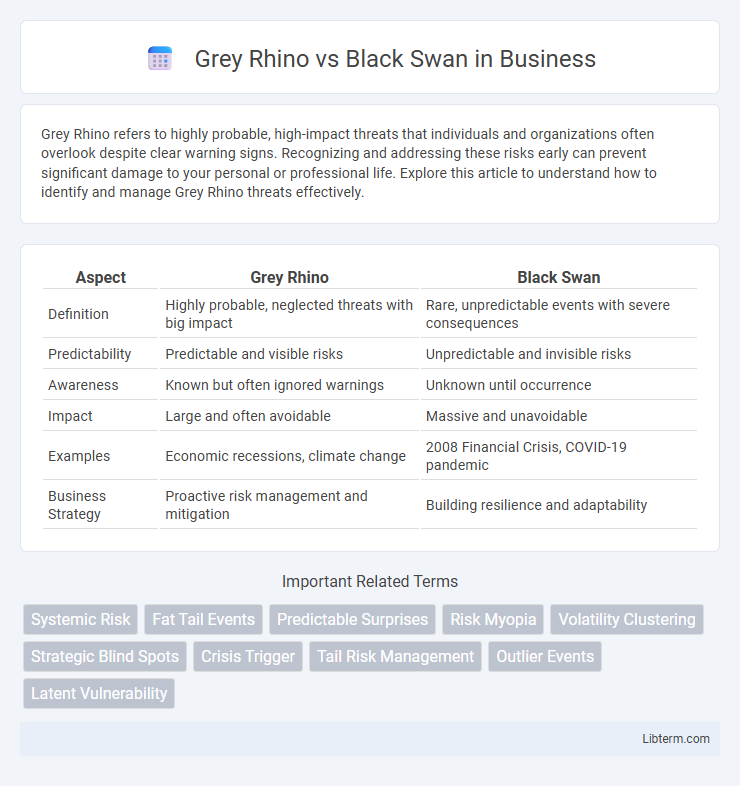

Grey Rhino refers to highly probable, high-impact threats that individuals and organizations often overlook despite clear warning signs. Recognizing and addressing these risks early can prevent significant damage to your personal or professional life. Explore this article to understand how to identify and manage Grey Rhino threats effectively.

Table of Comparison

| Aspect | Grey Rhino | Black Swan |

|---|---|---|

| Definition | Highly probable, neglected threats with big impact | Rare, unpredictable events with severe consequences |

| Predictability | Predictable and visible risks | Unpredictable and invisible risks |

| Awareness | Known but often ignored warnings | Unknown until occurrence |

| Impact | Large and often avoidable | Massive and unavoidable |

| Examples | Economic recessions, climate change | 2008 Financial Crisis, COVID-19 pandemic |

| Business Strategy | Proactive risk management and mitigation | Building resilience and adaptability |

Understanding the Grey Rhino and Black Swan Concepts

The Grey Rhino concept describes highly probable, high-impact risks that are often neglected despite clear warning signs, emphasizing predictable threats in economic, environmental, or political landscapes. The Black Swan concept refers to rare, unforeseen events with severe consequences that are difficult to predict, highlighting the limitations of traditional risk management. Understanding both concepts enables organizations to prepare for both imminently visible dangers and unexpected shocks, enhancing resilience and strategic planning.

Key Differences Between Grey Rhinos and Black Swans

Grey Rhinos represent highly probable, high-impact risks that are often ignored despite clear warning signs, while Black Swans are rare, unpredictable events with massive consequences that cannot be anticipated. Grey Rhinos are characterized by their visibility and predictability, making proactive risk management possible, whereas Black Swans emerge unexpectedly, challenging traditional risk assessment frameworks. Understanding these distinctions improves strategic planning by addressing both foreseeable and unforeseeable threats effectively.

Historical Examples of Grey Rhinos and Black Swans

The 2008 financial crisis serves as a classic Grey Rhino event, marked by clear warning signs ignored despite evident risks in the housing market and credit derivatives. The 9/11 terrorist attacks exemplify a Black Swan event, characterized by their extreme rarity and unforeseen impact on global security and economic systems. Historical analysis reveals Grey Rhinos as predictable threats requiring proactive mitigation, while Black Swans demand adaptive resilience due to their unpredictability and transformative effects.

Detecting Grey Rhinos: Warning Signs and Indicators

Grey Rhinos are high-impact, predictable risks often overlooked despite clear warning signs such as consistent market volatility, mounting debt levels, and shifts in regulatory policies. Indicators include persistent negative trends in financial statements, prolonged industry downturns, and repeated management warnings that signal impending crises. Early detection involves vigilant monitoring of these signals through risk assessments, scenario planning, and proactive strategic adjustments to mitigate potential damage.

The Unpredictability Factor: What Makes an Event a Black Swan

Black Swan events are characterized by their extreme unpredictability and rarity, often occurring outside the realm of regular expectations and defying historical data. These events have massive impacts, such as the 2008 financial crisis or the COVID-19 pandemic, and are typically unforeseen despite extensive prior data analysis. Unlike Grey Rhino events, which are highly probable and often ignored warnings, Black Swan events stem from complex systems with unknown unknowns, making them profoundly difficult to predict or prepare for.

Impact on Risk Management Strategies

Grey Rhino events, characterized by highly probable yet neglected risks, compel risk management strategies to prioritize early identification and proactive mitigation, emphasizing scenario planning and continuous monitoring. Black Swan events, defined by their extreme rarity and unpredictability, challenge traditional risk models, prompting the integration of flexible contingency plans and robust stress testing to absorb unforeseen shocks. Effective risk management balances these approaches by strengthening resilience against predictable threats while maintaining adaptability for unpredictable disruptions.

Business and Economic Implications

Grey Rhino events are highly probable, visible risks that businesses often underestimate, leading to significant economic disruptions when ignored. Black Swan events represent rare, unpredictable occurrences with severe consequences, challenging traditional risk management and demanding adaptive strategies. Companies that integrate both Grey Rhino and Black Swan awareness into their planning enhance resilience and better navigate economic volatility.

Preventative Measures and Response Tactics

Grey Rhino risks demand proactive identification and continuous monitoring to implement effective preventative measures, including stress testing, scenario planning, and robust risk management frameworks. Black Swan events require flexible response tactics centered on rapid adaptability, crisis communication strategies, and creating reserves or buffers to absorb unexpected shocks. Combining these approaches strengthens organizational resilience and minimizes impact from both predictable high-probability threats and rare, unpredictable disruptions.

Lessons Learned from Past Events

Grey Rhino events represent highly probable, high-impact threats often ignored despite clear warning signs, emphasizing the necessity of proactive risk management and early intervention. Black Swan events are rare, unpredictable occurrences with severe consequences that reveal the limitations of traditional forecasting models, highlighting the importance of building resilient systems and flexibility in strategic planning. Lessons learned from both phenomena underscore the value of combining anticipatory vigilance with adaptive responses to mitigate potential disruptions effectively.

Integrating Both Concepts Into Future Planning

Integrating Grey Rhino and Black Swan concepts into future planning enhances risk management by addressing both highly probable, high-impact events and unpredictable, rare shocks. Businesses and policymakers should establish adaptive strategies that combine scenario analysis for foreseeable threats with robust contingency plans for unforeseen disruptions. Leveraging data analytics and flexible resource allocation ensures preparedness for a spectrum of risks, promoting resilience and sustained growth.

Grey Rhino Infographic

libterm.com

libterm.com