The Accounting Rate of Return (ARR) measures the profitability of an investment by comparing average annual accounting profit to the initial investment cost, providing a straightforward profitability metric. This method focuses solely on accounting profits without considering cash flows or the time value of money, which can influence investment decisions. Discover how understanding ARR can enhance your financial analysis and decision-making by exploring the rest of this article.

Table of Comparison

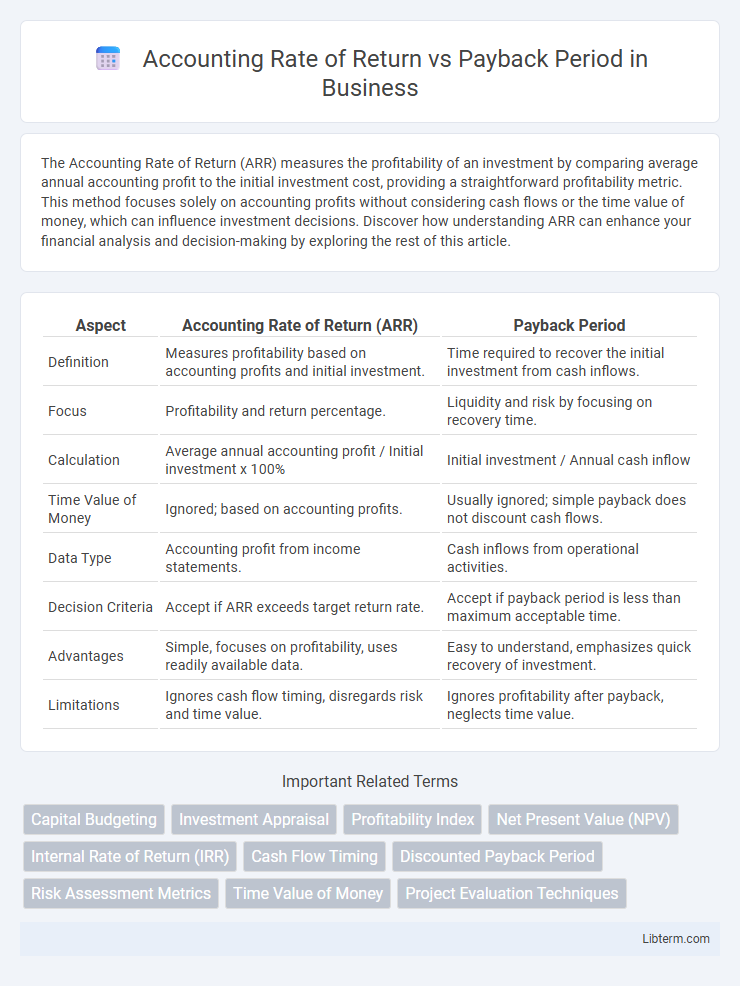

| Aspect | Accounting Rate of Return (ARR) | Payback Period |

|---|---|---|

| Definition | Measures profitability based on accounting profits and initial investment. | Time required to recover the initial investment from cash inflows. |

| Focus | Profitability and return percentage. | Liquidity and risk by focusing on recovery time. |

| Calculation | Average annual accounting profit / Initial investment x 100% | Initial investment / Annual cash inflow |

| Time Value of Money | Ignored; based on accounting profits. | Usually ignored; simple payback does not discount cash flows. |

| Data Type | Accounting profit from income statements. | Cash inflows from operational activities. |

| Decision Criteria | Accept if ARR exceeds target return rate. | Accept if payback period is less than maximum acceptable time. |

| Advantages | Simple, focuses on profitability, uses readily available data. | Easy to understand, emphasizes quick recovery of investment. |

| Limitations | Ignores cash flow timing, disregards risk and time value. | Ignores profitability after payback, neglects time value. |

Introduction to Accounting Rate of Return and Payback Period

Accounting Rate of Return (ARR) measures the profitability of an investment by calculating the average annual accounting profit as a percentage of the initial investment. Payback Period determines the time required for an investment to generate cash flows sufficient to recover its initial cost, emphasizing liquidity and risk. Both metrics aid decision-making by assessing financial viability from profit and cash flow perspectives.

Definition of Accounting Rate of Return (ARR)

The Accounting Rate of Return (ARR) measures the expected profitability of an investment by calculating the ratio of average annual accounting profit to the initial or average investment cost. ARR provides a percentage return based on accounting profits rather than cash flows, distinguishing it from methods like the Payback Period which focuses on the time to recover the initial investment. This metric is widely used for capital budgeting decisions to evaluate financial performance over the life of a project.

Definition of Payback Period

The Payback Period measures the time required for an investment to generate cash flows sufficient to recover its initial cost, emphasizing liquidity and risk reduction. In contrast, the Accounting Rate of Return (ARR) calculates the average annual accounting profit relative to the initial investment, focusing on profitability rather than cash flow timing. Payback Period is favored for its simplicity and focus on cash recovery speed, making it a vital metric in capital budgeting decisions.

Key Differences Between ARR and Payback Period

The Accounting Rate of Return (ARR) measures the profitability of an investment by calculating the average annual accounting profit as a percentage of the initial investment, while the Payback Period focuses on the time required to recover the original investment through cash inflows. ARR considers net income and accounting profits, incorporating depreciation and expenses, whereas Payback Period ignores profit and only accounts for cash flow timing. ARR is useful for evaluating overall profitability, whereas Payback Period emphasizes investment risk and liquidity by highlighting how quickly funds are recouped.

Calculation Methods for ARR and Payback Period

The Accounting Rate of Return (ARR) is calculated by dividing the average annual accounting profit by the initial investment cost, expressed as a percentage. The Payback Period is determined by adding annual cash inflows until the initial investment is recovered, representing the time needed to break even. Both methods evaluate investment profitability, with ARR focusing on accounting income and Payback Period emphasizing liquidity and risk through time.

Advantages of Using ARR

The Accounting Rate of Return (ARR) offers the advantage of simplicity in evaluating investment projects by using accounting profits rather than cash flows, making it easily understandable for managers familiar with financial statements. ARR incorporates the entire lifespan of the project, providing a comprehensive measure of profitability, unlike the Payback Period which only considers the time to recover initial investment. This method aligns closely with accounting performance metrics and helps in assessing the overall return relative to the assets invested.

Advantages of Using Payback Period

Payback Period offers a clear and simple measure of investment risk by indicating the time required to recover the initial cost, making it easy for managers to assess liquidity and cash flow impact. This method is advantageous for businesses prioritizing short-term financial safety, especially in volatile markets or industries with rapid technological change. Unlike Accounting Rate of Return, Payback Period emphasizes cash inflows rather than accounting profits, providing a more practical evaluation for decision-making.

Limitations and Drawbacks of ARR and Payback Period

Accounting Rate of Return (ARR) ignores the time value of money, which can lead to inaccurate project evaluations by emphasizing accounting profits over actual cash flows. The Payback Period method fails to consider cash flows occurring after the recovery period, disregarding overall profitability and potentially favoring short-term projects. Both methods lack sensitivity to risk and cash flow timing, limiting their effectiveness for comprehensive investment analysis.

Practical Applications in Capital Budgeting

The Accounting Rate of Return (ARR) evaluates investment profitability by comparing average annual accounting profit to initial investment, useful for assessing long-term project viability in capital budgeting. The Payback Period measures the time required to recover initial costs, providing a straightforward metric for liquidity and risk assessment. Combining ARR and Payback Period enables capital budgeting decisions that balance profitability with cash flow timing and investment risk.

ARR vs Payback Period: Which Method to Choose?

Accounting Rate of Return (ARR) measures profitability by comparing average annual accounting profit to initial investment, while Payback Period calculates the time needed to recover the initial investment. ARR provides insight into overall profitability and considers the entire project's lifespan, whereas Payback Period focuses on liquidity and risk by emphasizing quick capital recovery. Choosing between ARR and Payback Period depends on whether an investor prioritizes long-term profitability (ARR) or short-term risk and cash flow (Payback Period).

Accounting Rate of Return Infographic

libterm.com

libterm.com