A proforma invoice serves as a preliminary bill of sale sent to buyers before the final shipment of goods, detailing the products, prices, and terms of sale. It helps You understand the costs involved and facilitates customs clearance, ensuring a smoother transaction process. Explore the rest of this article to learn how to effectively create and use a proforma invoice for your business needs.

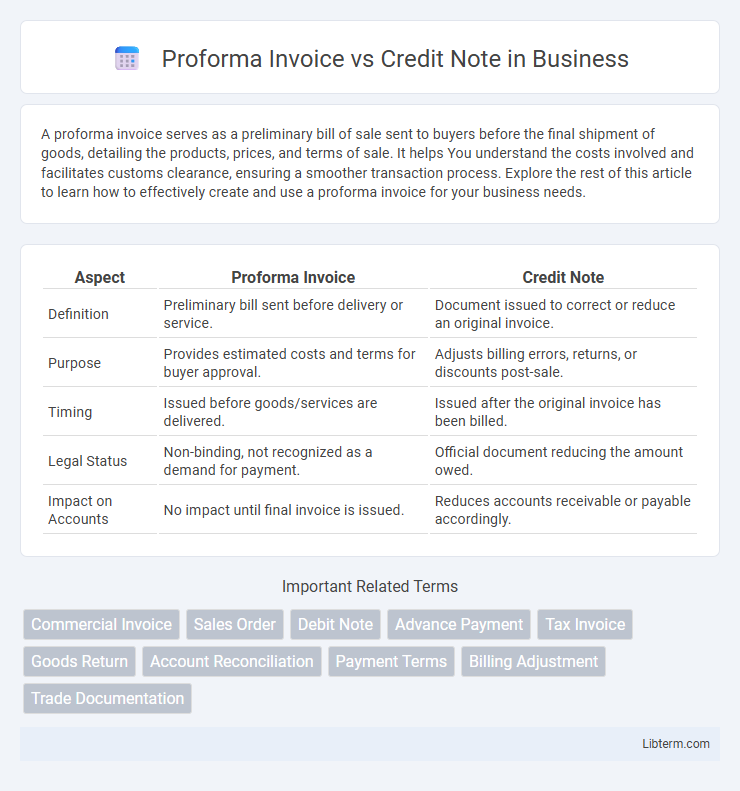

Table of Comparison

| Aspect | Proforma Invoice | Credit Note |

|---|---|---|

| Definition | Preliminary bill sent before delivery or service. | Document issued to correct or reduce an original invoice. |

| Purpose | Provides estimated costs and terms for buyer approval. | Adjusts billing errors, returns, or discounts post-sale. |

| Timing | Issued before goods/services are delivered. | Issued after the original invoice has been billed. |

| Legal Status | Non-binding, not recognized as a demand for payment. | Official document reducing the amount owed. |

| Impact on Accounts | No impact until final invoice is issued. | Reduces accounts receivable or payable accordingly. |

Understanding Proforma Invoice: Definition and Purpose

A Proforma Invoice is a preliminary bill of sale sent to buyers before a shipment or delivery, detailing the goods or services, estimated costs, and terms of sale without serving as a legally binding document. It functions primarily as a quotation or an agreement of sale, enabling buyers to understand expected costs and arrange for payment or import documentation in advance. Proforma Invoices are essential in international trade for customs declarations and cost estimation before final invoicing.

What is a Credit Note? Key Features Explained

A credit note is a financial document issued by a seller to a buyer, reducing the amount owed due to returned goods, overcharges, or errors in the original invoice. Key features include a unique reference number, the original invoice details, the reason for issuance, and the adjusted amount credited to the buyer's account. It serves as proof of the transaction adjustment and can be used to offset future payments or claim refunds.

Proforma Invoice vs Credit Note: Main Differences

Proforma Invoice vs Credit Note: Main differences lie in their purpose and timing; a Proforma Invoice is issued before goods or services are delivered, serving as a preliminary bill or quotation, while a Credit Note is issued after a transaction to correct or reduce an invoice amount due to returns, errors, or discounts. Proforma Invoices do not demand payment but outline estimated costs, whereas Credit Notes adjust already issued invoices by providing a credit to the buyer. Understanding these distinctions is essential for accurate financial documentation and effective accounts receivable management.

When to Use a Proforma Invoice

A Proforma Invoice is used before a sale is finalized to provide a detailed estimate of goods or services, enabling the buyer to understand costs and terms for approval or financing. This document is essential when confirming order details, customs declarations, or advance payments prior to shipment. In contrast, a Credit Note is issued after a transaction to correct or refund amounts on a previously issued invoice.

When to Issue a Credit Note

A credit note should be issued when a customer returns goods, cancels an order, or when there is an overbilling or pricing error on the original invoice. It serves as an official document to adjust the amount owed by reducing the customer's outstanding balance in the accounting system. Unlike a proforma invoice, which is a preliminary bill of sale sent before the goods or services are delivered, a credit note is used post-transaction to reflect refunds or corrections.

Legal Implications: Proforma Invoice vs Credit Note

A proforma invoice serves as a preliminary bill of sale, outlining the terms of a transaction without creating an enforceable legal obligation, whereas a credit note legally documents a reduction in the amount owed by the buyer, often due to returns or billing errors. Proforma invoices lack official status for tax or accounting purposes, while credit notes are legally binding financial documents that must comply with tax regulations and are recorded in both seller and buyer accounts. Failure to issue a proper credit note when required can result in legal disputes, tax penalties, and accounting discrepancies.

Key Components of a Proforma Invoice

A proforma invoice includes key components such as the seller's and buyer's contact details, detailed description of goods or services, estimated prices, quantity, and total amount, along with payment terms and validity period. It also specifies the shipment method, expected delivery date, and applicable taxes or duties to provide transparency before the final sale. This document serves as a preliminary agreement, facilitating international trade by clarifying transaction expectations without representing a demand for payment.

Essential Elements in a Credit Note

A credit note includes essential elements such as the date of issuance, a unique credit note number, reference to the original invoice, buyer and seller details, a detailed list of returned or refunded items with quantities and prices, reasons for issuance, total credited amount, and payment terms or adjustments. These components ensure clarity in accounting records and provide a formal document to adjust or correct previous transactions. Accurate inclusion of these elements facilitates seamless financial reconciliation and audit trails.

Proforma Invoice and Credit Note in Accounting Practices

Proforma invoices serve as preliminary bills issued before the final sale to outline the estimated costs and terms, helping businesses and customers agree on transaction details without affecting accounting records. Credit notes are issued post-sale to document reductions in amounts owed due to returns, allowances, or errors, directly impacting accounts receivable and ensuring accurate financial statements. Both tools play essential roles in maintaining transparent and accurate accounting practices by managing transaction adjustments before and after invoicing.

Quick Comparison Table: Proforma Invoice vs Credit Note

A Proforma Invoice serves as a preliminary bill outlining goods or services before shipment, detailing estimated costs without demanding payment, while a Credit Note is a formal document issued post-sale to correct or reduce the amount owed due to returns or discounts. The Proforma Invoice is used for customer approval and customs clearance, showing tentative pricing and terms; the Credit Note adjusts the original invoice, reflecting refunds or credits. Key differences include timing--Proforma issued pre-sale, Credit Note post-sale--and purpose, with Proforma for quotation and Credit Note for financial correction.

Proforma Invoice Infographic

libterm.com

libterm.com