A Letter of Credit is a financial instrument issued by a bank guaranteeing a buyer's payment to a seller upon meeting specified conditions, ensuring secure international trade transactions. It reduces risks by providing assurance that payment will be made only when the seller fulfills the contractual terms. Explore the article to understand how Letters of Credit can protect Your business and streamline global trade.

Table of Comparison

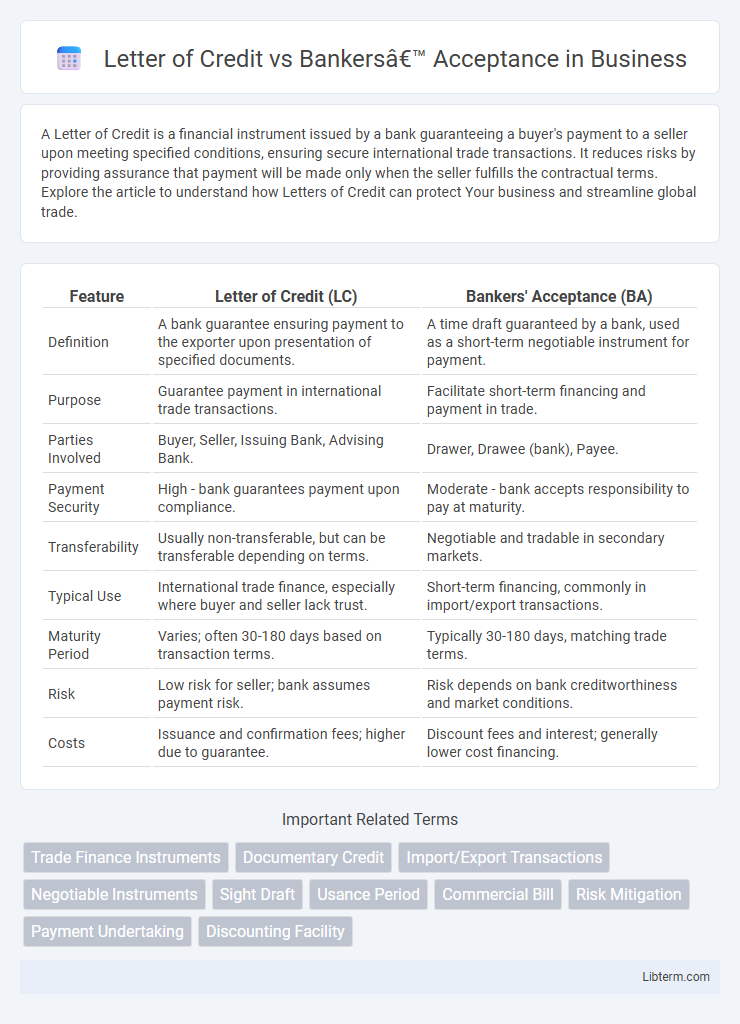

| Feature | Letter of Credit (LC) | Bankers' Acceptance (BA) |

|---|---|---|

| Definition | A bank guarantee ensuring payment to the exporter upon presentation of specified documents. | A time draft guaranteed by a bank, used as a short-term negotiable instrument for payment. |

| Purpose | Guarantee payment in international trade transactions. | Facilitate short-term financing and payment in trade. |

| Parties Involved | Buyer, Seller, Issuing Bank, Advising Bank. | Drawer, Drawee (bank), Payee. |

| Payment Security | High - bank guarantees payment upon compliance. | Moderate - bank accepts responsibility to pay at maturity. |

| Transferability | Usually non-transferable, but can be transferable depending on terms. | Negotiable and tradable in secondary markets. |

| Typical Use | International trade finance, especially where buyer and seller lack trust. | Short-term financing, commonly in import/export transactions. |

| Maturity Period | Varies; often 30-180 days based on transaction terms. | Typically 30-180 days, matching trade terms. |

| Risk | Low risk for seller; bank assumes payment risk. | Risk depends on bank creditworthiness and market conditions. |

| Costs | Issuance and confirmation fees; higher due to guarantee. | Discount fees and interest; generally lower cost financing. |

Introduction to Trade Finance Instruments

Letters of Credit and Bankers' Acceptances are essential trade finance instruments facilitating international and domestic transactions by mitigating payment risks. A Letter of Credit guarantees payment to exporters upon meeting specified documentary conditions, ensuring security between buyers and sellers. In contrast, a Bankers' Acceptance is a time-draft accepted by a bank, providing financing by allowing importers to extend payment terms while offering assurance to exporters.

What is a Letter of Credit (LC)?

A Letter of Credit (LC) is a financial document issued by a bank guaranteeing a buyer's payment to a seller, provided that the seller meets specified terms and conditions. It serves as a crucial tool in international trade, reducing the risk of non-payment by assuring sellers of payment once documents like shipping and inspection certificates comply with the contract. Unlike Bankers' Acceptance, which represents a time draft payable at a future date and is primarily used for short-term financing, an LC is focused on payment assurance and transaction security between trading partners.

Key Parties Involved in Letters of Credit

Letters of Credit involve key parties such as the applicant (buyer), the issuing bank, the beneficiary (seller), and often an advising or confirming bank that adds security and trust to international trade transactions. The issuing bank guarantees payment to the beneficiary upon presentation of compliant documents, ensuring seller protection, while the applicant retains control by specifying terms and conditions. This structured involvement contrasts with Bankers' Acceptance, where the focus is on bank-guaranteed drafts facilitating short-term credit without requiring documentary compliance.

What is a Bankers’ Acceptance (BA)?

A Bankers' Acceptance (BA) is a short-term, negotiable financial instrument guaranteed by a bank, commonly used in international trade to finance the purchase of goods. It functions as a time draft or post-dated check that the bank accepts and commits to pay at a future date, reducing credit risk for exporters. Unlike a Letter of Credit, which serves as a payment guarantee to the seller upon compliance with terms, a BA can be bought or sold in secondary markets, providing liquidity to the holder.

Key Participants in Bankers’ Acceptances

Key participants in bankers' acceptances include the drawer, who creates the draft or bill of exchange; the acceptor, typically a bank, which guarantees payment by accepting the draft; and the payee, the party receiving payment. Unlike letters of credit that involve an issuing bank providing a payment guarantee to the seller, bankers' acceptances revolve around the bank's acceptance of a time draft for payment at maturity. These roles facilitate trade financing by ensuring the seller receives payment and the bank assumes credit risk.

Main Differences Between Letters of Credit and Bankers’ Acceptances

Letters of Credit (LCs) are guarantees issued by banks ensuring payment to sellers upon fulfillment of specified terms, primarily used in international trade to reduce payment risk. Bankers' Acceptances (BAs) function as short-term, negotiable time drafts guaranteed by a bank, commonly utilized in domestic or international trade finance to provide liquidity and facilitate payment timing. The main differences lie in their core purpose--LCs secure payment obligations while BAs represent a time draft for deferred payment--and their negotiability, with BAs being marketable instruments that can be traded or discounted.

Advantages of Using Letters of Credit

Letters of Credit provide a secure payment mechanism for international trade by guaranteeing payment from a reputable bank upon fulfillment of shipment terms, reducing risk for exporters. They offer negotiable, documentary evidence of payment, facilitating smoother transactions and credit management compared to Bankers' Acceptances. Furthermore, Letters of Credit enhance trust between trading partners by ensuring compliance with contract terms before funds are released.

Benefits of Bankers’ Acceptances

Bankers' Acceptances provide businesses with a secure and reliable method for financing international trade transactions by converting time drafts into guaranteed payments by a bank. They enhance liquidity by allowing holders to sell the acceptance in secondary markets before maturity, offering flexibility and improved cash flow management. These instruments also carry lower credit risk compared to other receivables, as the payment is backed by reputable financial institutions, facilitating smoother global trade operations.

Which Instrument is Best for Your Business?

Letter of Credit offers guaranteed payment and mitigates risk in international trade by ensuring the seller receives funds once terms are met, making it ideal for high-value transactions or new trading relationships. Bankers' Acceptance provides a short-term credit instrument commonly used in domestic and international trade, offering liquidity and financing flexibility but with less payment certainty compared to a Letter of Credit. Choosing between the two depends on your business needs for risk management, transaction value, and the level of trust between trading partners.

Conclusion: Choosing the Right Trade Finance Tool

Selecting the appropriate trade finance tool depends on the specific needs of the transaction, with Letters of Credit offering secure payment guarantees ideal for international trade, and Bankers' Acceptances providing short-term financing solutions suitable for domestic and export transactions. Letters of Credit mitigate credit risk by ensuring payment upon compliance with terms, while Bankers' Acceptances facilitate liquidity by allowing negotiable time drafts to be sold in secondary markets. Understanding the risk profile, transaction size, and time frame is critical for exporters and importers to optimize cash flow and minimize financial exposure.

Letter of Credit Infographic

libterm.com

libterm.com