Understanding the cost of a product or service is crucial for making informed financial decisions and maximizing value. Factors influencing cost include quality, demand, and market conditions, which directly impact affordability and benefits. Dive into the rest of the article to discover practical tips on managing your expenses effectively.

Table of Comparison

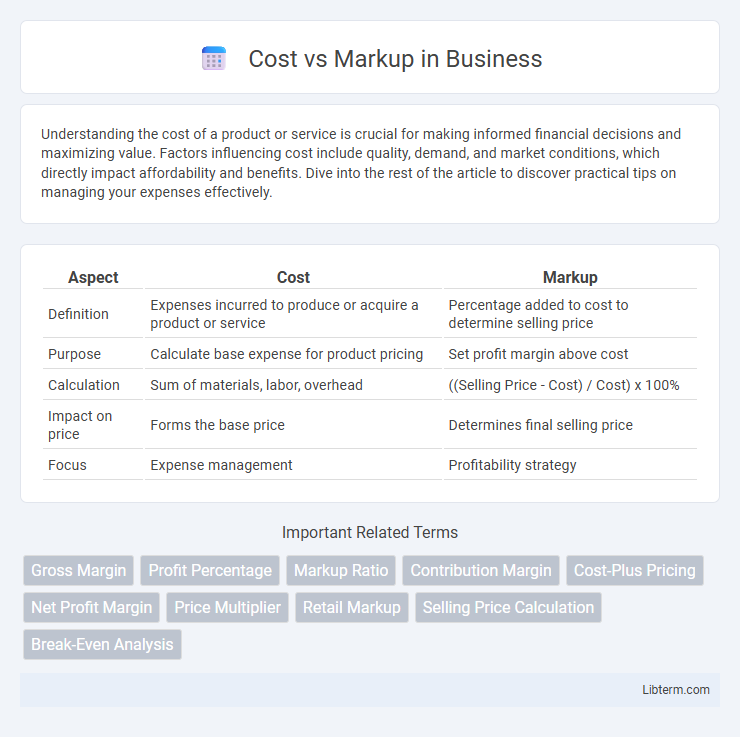

| Aspect | Cost | Markup |

|---|---|---|

| Definition | Expenses incurred to produce or acquire a product or service | Percentage added to cost to determine selling price |

| Purpose | Calculate base expense for product pricing | Set profit margin above cost |

| Calculation | Sum of materials, labor, overhead | ((Selling Price - Cost) / Cost) x 100% |

| Impact on price | Forms the base price | Determines final selling price |

| Focus | Expense management | Profitability strategy |

Understanding the Concepts: Cost vs Markup

Cost refers to the total expense incurred to produce or purchase a product, including materials, labor, and overhead. Markup is the amount added to the cost price to determine the selling price, typically expressed as a percentage of the cost. Understanding the distinction between cost and markup is essential for pricing strategies, ensuring profitability while remaining competitive in the market.

Key Differences Between Cost and Markup

Cost represents the actual expense incurred to produce or purchase a product, while markup refers to the amount added to the cost to determine the selling price. Key differences include that cost is absolute and reflects investment, whereas markup is a percentage or dollar value that reflects profit margin. Understanding the distinction between cost and markup is essential for pricing strategy, profit calculation, and financial analysis.

Why Markup Matters in Pricing Strategies

Markup directly influences profit margins by setting prices above production costs to ensure business sustainability and growth. Understanding the relationship between cost and markup allows companies to strategically position their products in competitive markets without sacrificing profitability. Effective markup application enhances pricing strategies by balancing consumer demand with desired financial outcomes.

Calculating Cost: Methods and Considerations

Calculating cost involves determining the total expenses incurred to produce a product or service, including direct costs like materials and labor, as well as indirect costs such as overhead and administrative expenses. Accurate cost calculation methods include job costing, process costing, and activity-based costing, each suited to different business models and production processes. Key considerations in cost calculation involve ensuring all variable and fixed costs are accounted for to establish a reliable baseline for pricing and markup strategies.

How to Determine the Right Markup Percentage

Determining the right markup percentage involves analyzing total product costs, including materials, labor, and overhead, to ensure profitability while remaining competitive. Markup is calculated by dividing the desired profit by the cost of the product and expressing it as a percentage. Businesses typically use industry benchmarks, market demand, and pricing strategies to adjust markup percentages for optimal balance between sales volume and profit margin.

Common Mistakes in Cost and Markup Calculations

Common mistakes in cost and markup calculations include confusing markup percentage with profit margin, leading to inaccurate pricing strategies that erode profitability. Another frequent error is failing to account for all direct and indirect costs in the total cost base, which results in undervalued product pricing. Misapplying markup percentages on selling price instead of cost price often causes overestimation of revenue and distorted financial forecasts.

Cost-Plus Pricing vs Markup Pricing Models

Cost-Plus Pricing calculates the selling price by adding a fixed percentage or amount to the total production cost, ensuring all expenses are covered plus a profit margin. Markup Pricing, on the other hand, involves setting the price based on a percentage added specifically to the cost of goods sold, often emphasizing gross profit targets. Understanding the distinction allows businesses to strategically balance competitive pricing with profitability by aligning pricing methods to their cost structure and market positioning.

Impact of Markup on Profit Margins

Markup directly influences profit margins by determining the percentage added to the cost price to establish the selling price. Higher markup percentages typically result in increased profit margins, assuming sales volume and costs remain constant. Businesses must carefully balance markup to optimize profitability while maintaining competitive pricing strategies.

Industry Benchmarks for Cost and Markup

Industry benchmarks for cost typically range between 30% to 50% of the final retail price, varying significantly by sector such as food service or retail apparel. Common markup percentages fall between 50% to 100%, enabling businesses to cover overhead and generate profit while remaining competitive. Understanding these benchmarks helps companies set prices strategically to align with market standards and achieve sustainable margins.

Best Practices for Managing Cost and Markup

Effective cost and markup management involves accurately calculating the cost of goods sold (COGS) and applying a strategic markup percentage that aligns with industry standards and profit objectives. Regularly reviewing and adjusting markup rates based on market trends, competitor pricing, and cost fluctuations ensures pricing remains competitive and profitable. Implementing inventory tracking systems and cost analysis tools enhances precision in cost calculation, enabling better pricing decisions and maximizing profit margins.

Cost Infographic

libterm.com

libterm.com