Controlling interest refers to ownership of a sufficient number of voting shares in a company to influence or determine corporate decisions and policies. It enables a shareholder to control board elections, strategic direction, and major business actions. Explore the rest of the article to understand how controlling interest impacts your investments and corporate governance.

Table of Comparison

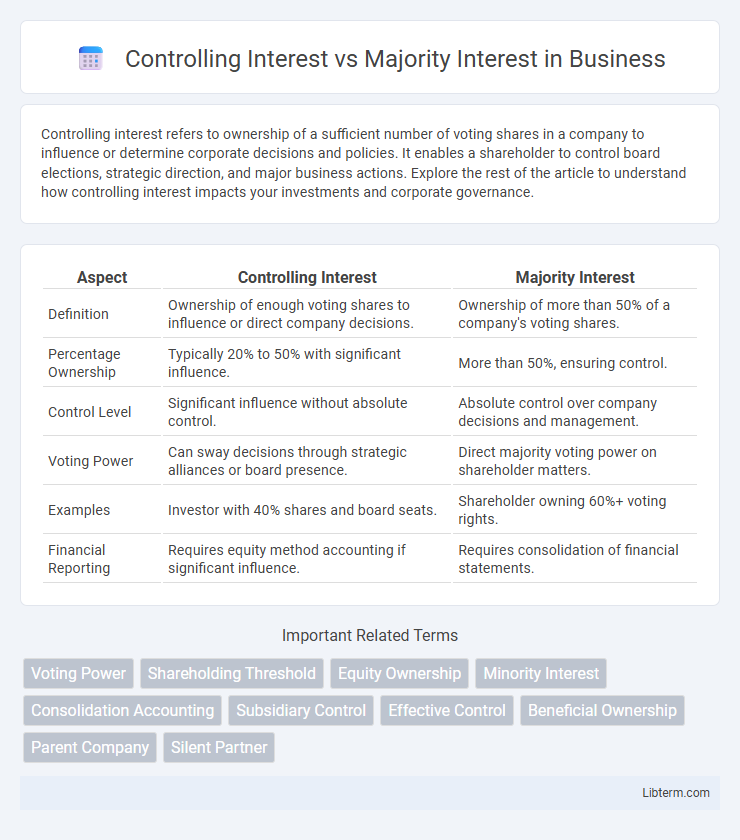

| Aspect | Controlling Interest | Majority Interest |

|---|---|---|

| Definition | Ownership of enough voting shares to influence or direct company decisions. | Ownership of more than 50% of a company's voting shares. |

| Percentage Ownership | Typically 20% to 50% with significant influence. | More than 50%, ensuring control. |

| Control Level | Significant influence without absolute control. | Absolute control over company decisions and management. |

| Voting Power | Can sway decisions through strategic alliances or board presence. | Direct majority voting power on shareholder matters. |

| Examples | Investor with 40% shares and board seats. | Shareholder owning 60%+ voting rights. |

| Financial Reporting | Requires equity method accounting if significant influence. | Requires consolidation of financial statements. |

Understanding Controlling Interest

Controlling interest refers to ownership of more than 50% of a company's voting shares, granting the power to influence or direct management and key decisions. This level of control enables the holder to determine policies, appoint board members, and significantly impact the company's strategic direction. Unlike majority interest, which simply denotes holding more than half of shares, controlling interest emphasizes the ability to exercise authority over corporate governance.

Defining Majority Interest

Majority Interest refers to owning more than 50% of a company's voting shares, granting the shareholder significant influence over corporate decisions and board appointments. This ownership stake typically confers the power to control key business policies and strategic directions. While Controlling Interest may involve less than a majority stake if it includes decisive voting agreements, Majority Interest inherently establishes control through ownership percentage alone.

Key Differences Between Controlling and Majority Interest

Controlling interest refers to ownership of enough voting shares in a company to influence or direct its management and policies, typically over 50% of the voting stock, whereas majority interest simply indicates ownership of more than half the shares without necessarily implying effective control. A key difference lies in the level of influence: controlling interest ensures decision-making power, while majority interest may not guarantee control if voting rights are distributed differently. Understanding these distinctions is crucial in mergers and acquisitions, corporate governance, and shareholder rights assessments.

Legal Implications of Controlling Interest

Controlling interest grants an entity the legal authority to direct corporate policies and decisions, often through owning more than 50% of voting shares, enabling control over board appointments and strategic initiatives. This legal dominance imposes fiduciary duties on the controlling shareholder to act in the best interests of all shareholders, preventing abuses such as self-dealing or minority shareholder oppression. Courts frequently scrutinize controlling interest transactions to ensure compliance with corporate governance laws and protect minority shareholder rights.

How Majority Interest Affects Decision-Making

Majority interest, defined as owning more than 50% of a company's voting shares, grants significant influence over corporate decisions, including board appointments and strategic direction. This controlling stake enables shareholders to effectively determine company policies, approve mergers, and influence key financial decisions. The concentration of voting power in majority interest holders streamlines decision-making but may also limit minority shareholders' influence.

Methods of Acquiring Controlling Interest

Controlling interest is commonly acquired through purchasing a majority of voting shares, enabling the investor to direct company policies and decisions. Methods include outright stock acquisition in the open market, negotiated private transactions, or tender offers targeting a controlling stake. Additionally, acquiring controlling interest can occur via proxy battles or amalgamations where control is consolidated without necessarily owning over 50% of shares but commanding decision-making power.

Minority Rights in Majority-Controlled Companies

Controlling interest refers to ownership of more than 50% of a company's voting shares, granting significant decision-making power, while majority interest specifically denotes holding the largest single stake, which may or may not exceed 50%. Minority rights are critical protections for shareholders without controlling interest, ensuring fair treatment in majority-controlled companies through mechanisms such as voting rights limitations, access to information, and approval requirements for major transactions. Legal frameworks and corporate governance policies work together to prevent majority shareholders from abusing power, safeguarding minority investors' interests and promoting equitable corporate operations.

Examples of Controlling Interest Without Majority Ownership

Controlling interest occurs when an investor holds enough voting shares to influence decisions, typically exceeding 50%, but control can also be achieved with less than a majority stake through dispersed ownership or special voting rights. For example, a 40% ownership in a company where the remaining shares are widely distributed among many shareholders allows the minority stakeholder to exercise effective control. Another case is dual-class share structures, where shareholders with fewer shares hold superior voting power, enabling control without majority ownership.

Impact on Corporate Governance

Controlling interest refers to ownership of more than 50% of a company's voting shares, granting decisive influence over corporate governance decisions such as board appointments, strategic direction, and policy implementation. Majority interest, often synonymous with controlling interest, ensures the shareholder or group can unilaterally direct corporate actions and operational control. This dominant position significantly shapes governance structures, affecting minority shareholder rights and corporate accountability mechanisms.

Choosing Between Controlling and Majority Interest

Choosing between controlling interest and majority interest depends on the level of influence desired in corporate decisions. Controlling interest, typically owning more than 50% of voting shares, grants decisive power over company policies and board decisions. Majority interest indicates ownership exceeding 50% but may not guarantee absolute control if voting rights are distributed unevenly among shareholders.

Controlling Interest Infographic

libterm.com

libterm.com