Mezzanine financing bridges the gap between traditional debt and equity, offering businesses flexible capital to fuel growth or acquisitions. This hybrid funding often involves subordinated debt with equity conversion options, balancing higher returns for investors with manageable risk for borrowers. Explore the full article to discover how mezzanine financing can strategically enhance your company's financial structure.

Table of Comparison

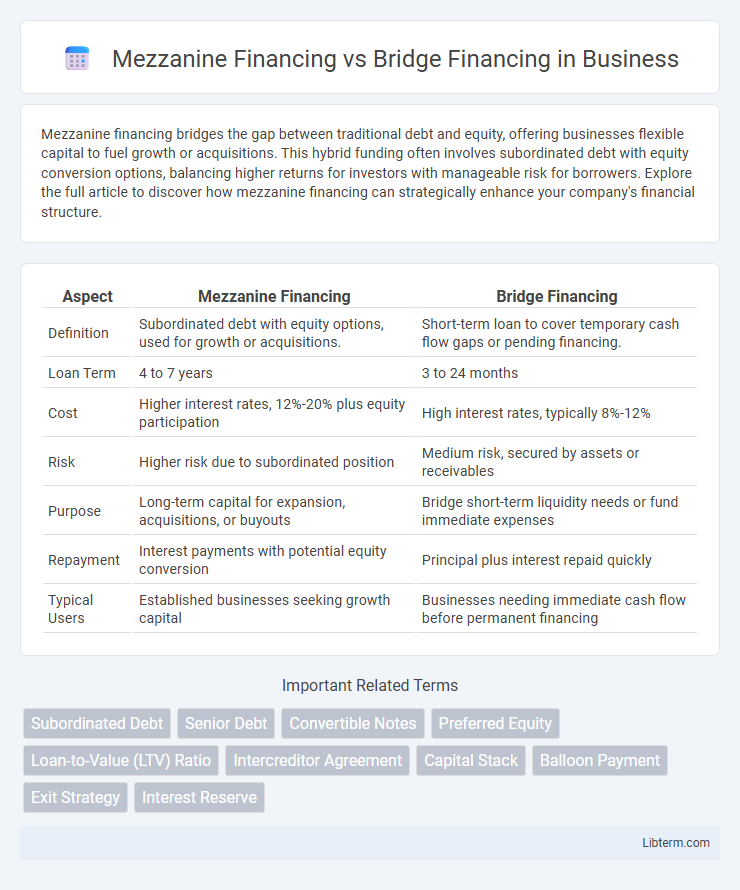

| Aspect | Mezzanine Financing | Bridge Financing |

|---|---|---|

| Definition | Subordinated debt with equity options, used for growth or acquisitions. | Short-term loan to cover temporary cash flow gaps or pending financing. |

| Loan Term | 4 to 7 years | 3 to 24 months |

| Cost | Higher interest rates, 12%-20% plus equity participation | High interest rates, typically 8%-12% |

| Risk | Higher risk due to subordinated position | Medium risk, secured by assets or receivables |

| Purpose | Long-term capital for expansion, acquisitions, or buyouts | Bridge short-term liquidity needs or fund immediate expenses |

| Repayment | Interest payments with potential equity conversion | Principal plus interest repaid quickly |

| Typical Users | Established businesses seeking growth capital | Businesses needing immediate cash flow before permanent financing |

Introduction to Mezzanine and Bridge Financing

Mezzanine financing is a hybrid of debt and equity financing that gives lenders the right to convert to equity in case of default, typically used for business expansions or acquisitions and offering higher returns compared to traditional debt. Bridge financing serves as a short-term loan designed to provide immediate capital, bridging the gap until longer-term financing is secured or an asset is sold. Both financing options play crucial roles in corporate finance by addressing different funding needs and risk tolerance levels.

Defining Mezzanine Financing

Mezzanine financing is a hybrid form of capital that blends debt and equity, typically used by companies to finance expansion or acquisitions without diluting ownership excessively. It offers higher returns than senior debt due to its subordinate position in the capital structure and often includes warrants or conversion options to equity. This form of financing bridges the gap between senior debt and equity, providing flexible funding solutions tailored to mid-sized or growing enterprises seeking substantial capital injections.

Understanding Bridge Financing

Bridge financing provides short-term capital to cover immediate expenses or cash flow gaps until permanent financing is secured, often used in real estate or business acquisitions. It typically involves higher interest rates and faster approval compared to mezzanine financing, making it suitable for urgent funding needs. Unlike mezzanine financing, which blends debt and equity with longer terms, bridge loans focus on immediacy and are repaid quickly upon arranging long-term financing.

Key Differences Between Mezzanine and Bridge Financing

Mezzanine financing is a hybrid of debt and equity, typically used for long-term growth capital with higher interest rates and equity participation, while bridge financing is short-term, designed to provide immediate liquidity until permanent financing is secured. Mezzanine loans often involve subordinated debt with warrants or options, whereas bridge loans are secured by collateral, offering faster access with higher interest rates. The primary difference lies in their purpose: mezzanine financing supports expansion or acquisitions, while bridge financing addresses temporary cash flow gaps or acquisition funding.

Use Cases: When to Choose Mezzanine Financing

Mezzanine financing is ideal for companies seeking growth capital without diluting control, typically during expansion phases, acquisitions, or significant capital investments. It suits businesses with stable cash flows that can support higher interest payments and prefer flexible repayment terms compared to traditional debt. This type of financing bridges the gap between equity and senior debt, making it optimal when equity funding is insufficient and bank loans are constrained.

Use Cases: When to Opt for Bridge Financing

Bridge financing serves as a short-term funding solution ideal for businesses requiring immediate capital to cover gaps between financing rounds or asset acquisitions. It is commonly used when companies await long-term financing approval or need quick liquidity to seize time-sensitive opportunities such as property purchases or business expansions. Unlike mezzanine financing, which suits growth and expansion phases with more extended repayment timelines, bridge loans prioritize speed and flexibility over extended terms.

Funding Structure and Terms Comparison

Mezzanine financing typically involves subordinated debt or preferred equity with higher interest rates and equity participation, positioned between senior debt and equity in the capital stack, providing flexible repayment terms often tied to company performance. Bridge financing is short-term debt designed to provide immediate liquidity, usually secured by assets with higher interest rates and a defined maturity date ranging from six months to three years, aimed at covering temporary funding gaps until long-term financing is secured. The funding structure of mezzanine financing offers a hybrid risk-reward profile with longer tenors, while bridge loans prioritize speed and collateral, generally demanding quicker repayment and less flexibility.

Risk Factors in Mezzanine vs Bridge Financing

Mezzanine financing carries higher risk due to its subordinate position in the capital structure, often secured by equity warrants or convertible features that increase exposure to company performance volatility. Bridge financing typically involves short-term loans with senior secured status, reducing risk compared to mezzanine but exposing lenders to refinancing risk if permanent capital is delayed. The risk profile of mezzanine financing demands higher interest rates to compensate for potential default or dilution, whereas bridge financing's risk hinges on timing and liquidity of subsequent funding rounds.

Pros and Cons of Each Financing Option

Mezzanine financing offers flexible capital with less dilution of equity but typically carries higher interest rates and often requires warrants or equity participation, increasing long-term costs. Bridge financing provides quick access to short-term funds ideal for immediate cash flow needs, yet it usually imposes higher fees and must be repaid rapidly, posing refinancing risks. Evaluating project timelines and cost tolerance helps determine the optimal balance between mezzanine's growth potential and bridge financing's rapid liquidity.

Choosing the Right Financing Solution for Your Business

Mezzanine financing offers long-term capital with equity participation, making it ideal for growing businesses needing flexible funding without immediate dilution. Bridge financing provides short-term liquidity to cover immediate cash flow gaps or facilitate transactions until permanent financing is secured. Selecting the right solution depends on your business timeline, financial structure, and growth objectives to ensure optimal capital efficiency and operational stability.

Mezzanine Financing Infographic

libterm.com

libterm.com