The auction market plays a crucial role in setting prices through competitive bidding, where buyers and sellers determine value based on supply and demand dynamics. This transparent environment helps you discover true market value efficiently and can lead to better deals. Explore the rest of the article to understand how auction markets function and impact your investment decisions.

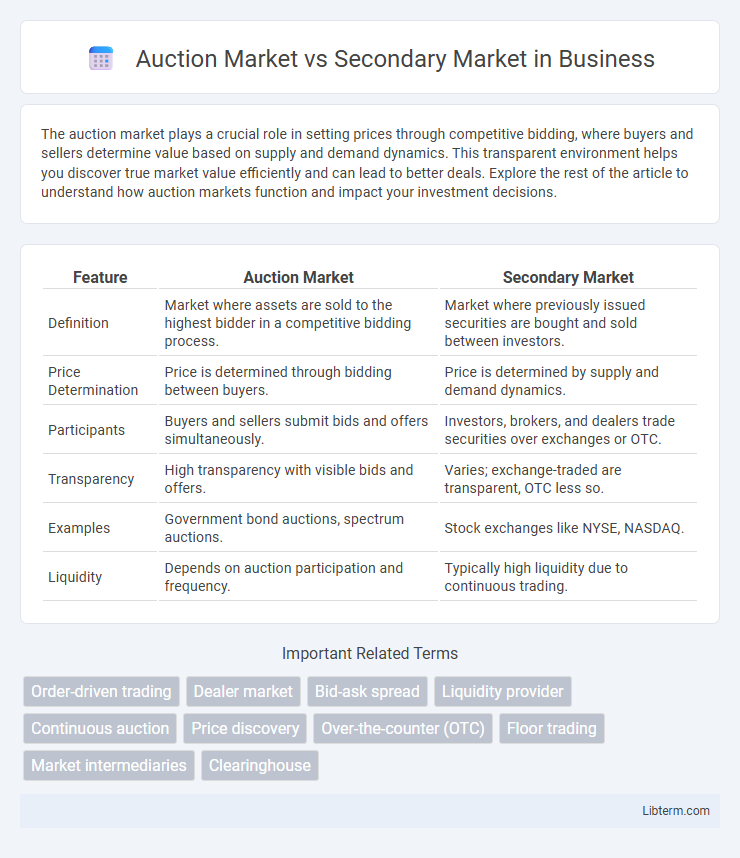

Table of Comparison

| Feature | Auction Market | Secondary Market |

|---|---|---|

| Definition | Market where assets are sold to the highest bidder in a competitive bidding process. | Market where previously issued securities are bought and sold between investors. |

| Price Determination | Price is determined through bidding between buyers. | Price is determined by supply and demand dynamics. |

| Participants | Buyers and sellers submit bids and offers simultaneously. | Investors, brokers, and dealers trade securities over exchanges or OTC. |

| Transparency | High transparency with visible bids and offers. | Varies; exchange-traded are transparent, OTC less so. |

| Examples | Government bond auctions, spectrum auctions. | Stock exchanges like NYSE, NASDAQ. |

| Liquidity | Depends on auction participation and frequency. | Typically high liquidity due to continuous trading. |

Introduction to Auction and Secondary Markets

An auction market is a platform where buyers and sellers engage in competitive bidding to determine prices, commonly used for stocks, commodities, and collectibles. The secondary market refers to the trading of securities after their initial issuance, providing liquidity and enabling investors to buy and sell existing assets. Both markets facilitate price discovery but differ in mechanisms, with auction markets relying on real-time bids and offers, while secondary markets operate through organized exchanges or over-the-counter systems.

Key Differences Between Auction and Secondary Markets

Auction markets involve buyers and sellers bidding openly, enabling price discovery through competition, while secondary markets facilitate direct trading of existing securities between investors at prevailing market prices. In auction markets, transactions occur via centralized order matching systems, providing transparency and liquidity, whereas secondary markets operate over-the-counter or through exchanges, emphasizing convenience and continuous trading. Key differences include pricing mechanisms, market structure, and participant roles, with auctions driving price formation and secondary markets enabling efficient asset transfer post-issuance.

How Auction Markets Operate

Auction markets operate by bringing buyers and sellers together in a centralized location or platform where bids and offers are matched through a competitive bidding process. Prices are determined dynamically based on supply and demand, with transactions occurring when the highest bid meets the lowest ask. This mechanism contrasts with secondary markets, where securities are traded after the initial issuance, but auction markets specifically facilitate price discovery and liquidity through open competition.

How Secondary Markets Function

Secondary markets function by enabling investors to buy and sell existing securities without involving the issuing company, providing liquidity and price discovery through continuous trading on platforms like stock exchanges. Trades occur between investors, with prices determined by supply and demand dynamics, reflecting real-time information and market sentiment. This mechanism contrasts with auction markets, where securities are initially offered directly to investors through bidding processes.

Types of Assets Traded in Each Market

Auction markets primarily facilitate the trading of securities such as stocks and bonds, where buyers and sellers meet to exchange these standardized financial assets through bidding processes. Secondary markets, on the other hand, include a broader range of tradable assets such as equities, derivatives, commodities, and real estate, allowing investors to trade previously issued securities. The liquidity and price discovery mechanisms differ, as auction markets emphasize transparency and immediate price matching while secondary markets provide ongoing trading opportunities across diverse asset classes.

Price Discovery Mechanisms

Auction markets utilize competitive bidding among buyers and sellers to reveal the fair market price through transparent price discovery mechanisms, reflecting real-time supply and demand. Secondary markets facilitate continuous trading of securities after the initial issuance, with price discovery driven by buyer-seller interactions and prevailing market conditions. These mechanisms ensure efficient allocation of resources by incorporating diverse information and participant expectations into asset pricing.

Participants in Auction vs Secondary Markets

Auction markets primarily involve buyers and sellers who place competitive bids or offers simultaneously, with a centralized exchange facilitating transparent price discovery. In contrast, secondary markets consist of individual or institutional investors trading previously issued securities through brokers or electronic platforms, emphasizing continuous order flow and liquidity. Market makers and specialists play key roles in auction markets to maintain order, while secondary markets rely more on over-the-counter transactions and electronic communication networks for trade execution.

Liquidity Comparison

The auction market typically offers higher liquidity due to the centralized matching of buy and sell orders, allowing for faster execution and tighter bid-ask spreads. In contrast, the secondary market, while broad and diverse, can experience varying liquidity levels depending on the specific asset and trading platform. High liquidity in auction markets enhances price discovery efficiency, whereas secondary market liquidity often depends on market participants and trading volume.

Advantages and Disadvantages of Each Market

Auction markets offer transparent price discovery through competitive bidding, ensuring fair market values but may lead to price volatility and limited transaction speed during low participation. Secondary markets provide high liquidity and quick execution of trades, benefiting investors seeking immediate asset liquidation; however, prices can be influenced by market sentiment and may lack the price-finding efficiency of a true auction setting. Both markets facilitate asset exchange but differ in structure, affecting pricing accuracy, liquidity, and transaction dynamics.

Choosing the Right Market for Your Investment

Auction markets, such as stock exchanges, provide transparent price discovery through competitive bidding, making them ideal for investors seeking real-time pricing and liquidity. Secondary markets facilitate the buying and selling of existing securities, offering greater flexibility and access to a broader range of investment options. Selecting the right market depends on factors like investment goals, risk tolerance, and the need for liquidity or price transparency.

Auction Market Infographic

libterm.com

libterm.com