Restricted Stock Units (RSUs) are a popular form of employee compensation that grants company shares subject to vesting conditions, often tied to your continued employment or performance milestones. Understanding the tax implications and vesting schedules associated with RSUs can help you manage your financial planning and maximize your benefits. Explore the full article to learn how RSUs can impact your compensation strategy and financial goals.

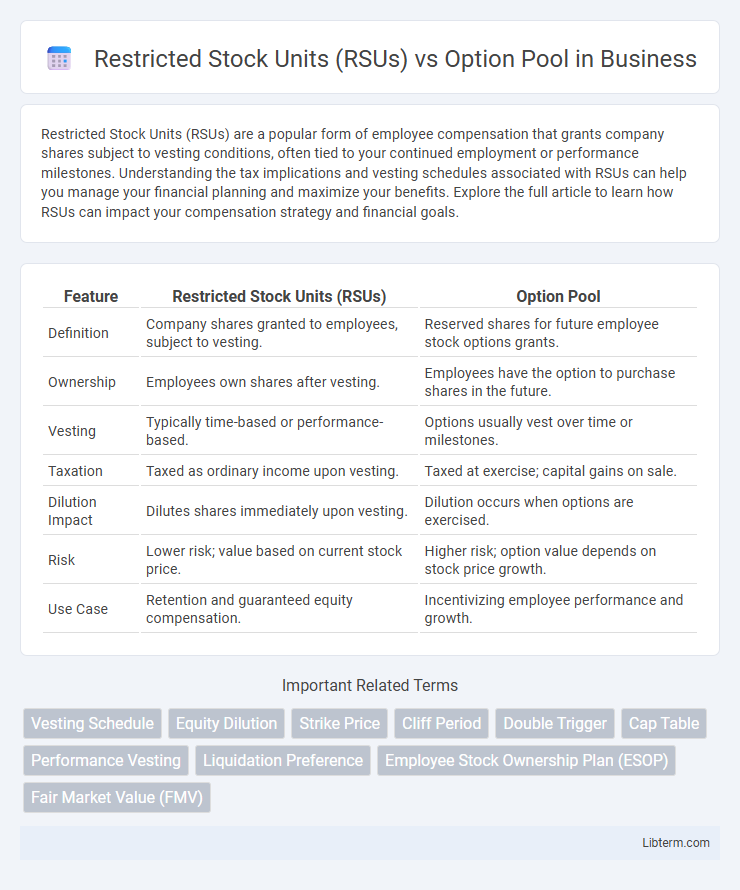

Table of Comparison

| Feature | Restricted Stock Units (RSUs) | Option Pool |

|---|---|---|

| Definition | Company shares granted to employees, subject to vesting. | Reserved shares for future employee stock options grants. |

| Ownership | Employees own shares after vesting. | Employees have the option to purchase shares in the future. |

| Vesting | Typically time-based or performance-based. | Options usually vest over time or milestones. |

| Taxation | Taxed as ordinary income upon vesting. | Taxed at exercise; capital gains on sale. |

| Dilution Impact | Dilutes shares immediately upon vesting. | Dilution occurs when options are exercised. |

| Risk | Lower risk; value based on current stock price. | Higher risk; option value depends on stock price growth. |

| Use Case | Retention and guaranteed equity compensation. | Incentivizing employee performance and growth. |

Understanding Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) represent company shares granted to employees as part of their compensation, vesting over time to confer ownership without requiring upfront purchase. Unlike an option pool, which consists of stock options giving employees the right to buy shares at a fixed price, RSUs are actual shares awarded upon vesting, reflecting immediate value based on the company's stock price. RSUs avoid dilution concerns prior to vesting and provide clear equity ownership, making them a straightforward tool for employee incentives and retention.

What Is an Option Pool?

An option pool is a designated portion of a company's equity reserved for employees, advisors, and consultants in the form of stock options, typically representing 10-20% of the total shares. This pool incentivizes talent by granting the right to purchase shares at a predetermined price, aligning employee interests with company growth. Unlike Restricted Stock Units (RSUs), which are outright equity grants subject to vesting, option pools require exercise before ownership is realized, impacting dilution and capitalization structure.

Key Differences Between RSUs and Option Pool

Restricted Stock Units (RSUs) represent actual company shares granted to employees with specific vesting schedules, whereas an option pool comprises stock options that give employees the right to purchase shares at a predetermined price. RSUs provide immediate equity value upon vesting and are typically taxed as ordinary income, while option pools require employees to exercise options, potentially benefiting from capital gains tax if held long-term. The option pool dilutes existing shareholders when options are exercised, whereas RSUs result in dilution when shares vest, impacting company ownership differently.

How RSUs Work in Startup Compensation

Restricted Stock Units (RSUs) in startup compensation represent company shares granted to employees, which vest over a specified period, aligning incentives with long-term company growth and retention. Unlike option pools that give employees the right to purchase shares at a fixed price, RSUs provide actual ownership once vested, reducing uncertainty related to stock price fluctuations. RSUs are often favored for their straightforward valuation and immediate equity stake, helping startups attract top talent with tangible rewards.

How Option Pools Impact Employee Equity

Option pools dilute existing shareholders by allocating a percentage of company shares specifically for future employee equity grants, which can reduce the ownership stake of founders and early investors. RSUs granted from the option pool provide employees with direct ownership of shares once vested, creating immediate equity value without the need for exercising options. The size of the option pool directly influences equity distribution, affecting employee motivation, retention, and the overall capitalization table structure.

Tax Implications: RSUs vs. Option Pool

Restricted Stock Units (RSUs) trigger ordinary income tax upon vesting based on the market value of shares, while subsequent gains are taxed as capital gains. Option Pool shares typically incur no tax at grant, but exercising options generates taxable income equal to the difference between exercise price and fair market value, with further capital gains on sales. Understanding the timing and type of tax liabilities is crucial for optimizing equity compensation strategies between RSUs and stock options.

Dilution Effects: RSUs Compared to Option Pool

Restricted Stock Units (RSUs) directly reduce ownership percentages upon vesting, resulting in immediate dilution to existing shareholders, while option pools create potential dilution only when options are exercised. RSUs typically have a clearer and more predictable impact on dilution since shares are granted upfront, whereas option pools may vary due to unexercised options and timing uncertainties. Companies need to carefully manage RSU grants and option pool sizes to balance employee incentives while minimizing unexpected dilution effects on current equity holders.

Vesting Schedules: RSUs and Option Pools Explained

Restricted Stock Units (RSUs) vest according to a predetermined schedule, typically involving a cliff period followed by gradual vesting, ensuring employees earn shares over time. Option pools allocate stock options that vest similarly but require employees to exercise options to convert them into shares, often with tax implications at exercise. Understanding the distinct vesting schedules and financial impacts of RSUs versus option pools helps companies design effective equity compensation strategies.

Choosing Between RSUs and Option Pools for Employees

Restricted Stock Units (RSUs) provide employees with actual shares of company stock after vesting, offering immediate value and reduced risk compared to stock options. Option pools grant employees the right to purchase shares at a set price, aligning incentives with company growth but carrying the risk of stock price volatility. Companies often choose RSUs for established employees seeking guaranteed equity value, while option pools are preferred for startups aiming to attract high-risk, high-reward talent.

Best Practices for Structuring Equity in Startups

Structuring equity in startups involves balancing Restricted Stock Units (RSUs) and option pools to align employee incentives with company growth while preserving founder control. Best practices recommend creating a sufficiently sized option pool, typically 10-20% of total shares, to attract talent without excessive dilution, while using RSUs selectively for senior hires to provide guaranteed equity value. Clear vesting schedules, performance milestones, and legal compliance are essential to maximize motivation, retention, and tax efficiency in startup equity compensation plans.

Restricted Stock Units (RSUs) Infographic

libterm.com

libterm.com