Negative cash conversion occurs when a company collects cash from customers before it needs to pay its suppliers, improving liquidity and reducing the need for external financing. This scenario indicates efficient working capital management, often seen in businesses with strong market power or delayed supplier payments. Explore further how negative cash conversion can impact your business operations and financial health throughout the article.

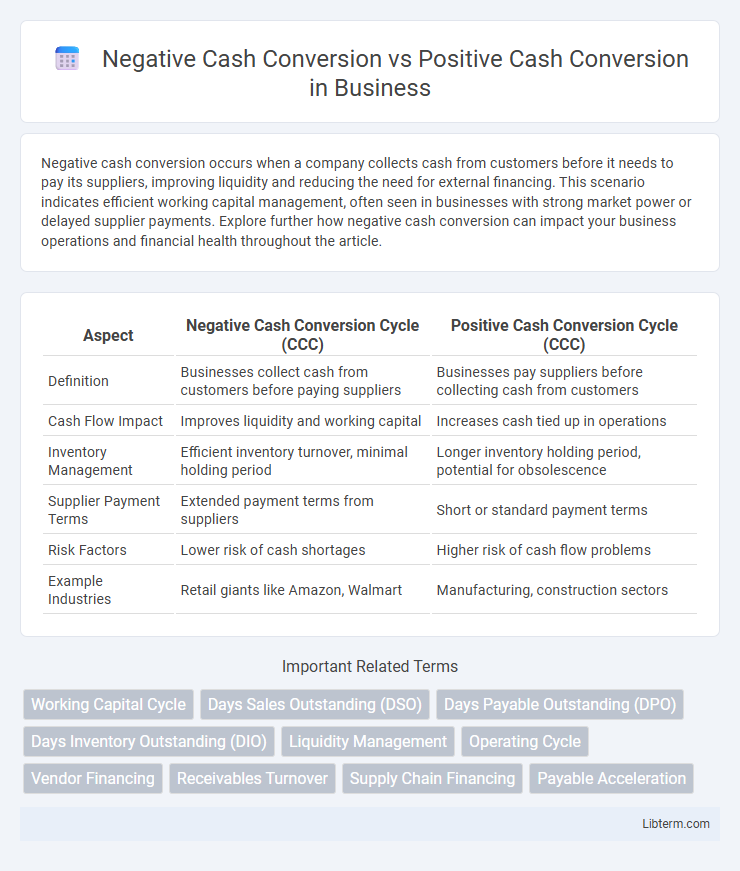

Table of Comparison

| Aspect | Negative Cash Conversion Cycle (CCC) | Positive Cash Conversion Cycle (CCC) |

|---|---|---|

| Definition | Businesses collect cash from customers before paying suppliers | Businesses pay suppliers before collecting cash from customers |

| Cash Flow Impact | Improves liquidity and working capital | Increases cash tied up in operations |

| Inventory Management | Efficient inventory turnover, minimal holding period | Longer inventory holding period, potential for obsolescence |

| Supplier Payment Terms | Extended payment terms from suppliers | Short or standard payment terms |

| Risk Factors | Lower risk of cash shortages | Higher risk of cash flow problems |

| Example Industries | Retail giants like Amazon, Walmart | Manufacturing, construction sectors |

Understanding Cash Conversion Cycle: Definition and Importance

The cash conversion cycle (CCC) measures the time a company takes to convert its investments in inventory and other resources into cash flows from sales, crucial for assessing liquidity and operational efficiency. A negative cash conversion cycle indicates a company collects cash from customers before paying suppliers, enhancing cash flow and minimizing working capital needs. Positive cash conversion cycles mean cash is tied up longer in inventory and receivables, potentially stressing the company's short-term liquidity and operational flexibility.

What Is Negative Cash Conversion?

Negative cash conversion occurs when a company collects cash from customers before it pays its suppliers and operating expenses, enabling it to effectively finance its operations without external funding. This scenario reflects in a negative cash conversion cycle (CCC), which indicates efficient working capital management and strong liquidity. Companies with negative cash conversion often enjoy better cash flow, reduced reliance on credit, and a competitive advantage in managing cash resources.

What Is Positive Cash Conversion?

Positive cash conversion occurs when a company's operating cash inflows exceed the cash outflows related to its working capital cycle, indicating efficient management of receivables, inventory, and payables. This metric reflects a healthy liquidity position, enabling the business to fund operations without reliance on external financing. Companies with positive cash conversion typically experience stronger cash flow stability and improved financial flexibility.

Key Differences Between Negative and Positive Cash Conversion

Negative cash conversion occurs when a company receives cash from customers before it needs to pay its suppliers, resulting in a cash conversion cycle (CCC) that is less than zero. Positive cash conversion means the company pays suppliers before collecting cash from customers, leading to a CCC greater than zero. Key differences lie in liquidity impact and working capital management, where negative CCC improves cash flow efficiency and reduces financing needs, while positive CCC may strain liquidity and require external funding.

Factors Influencing Cash Conversion Cycle

The cash conversion cycle (CCC) is influenced by factors such as inventory turnover, accounts receivable collection period, and accounts payable deferral. Companies with negative cash conversion cycles typically have faster collections and longer payment terms, which improve liquidity by turning cash flows positive. Conversely, positive cash conversion cycles may signal slower inventory movement or receivables collection, prolonging the time to convert investments back into cash.

Industries with Negative Cash Conversion Cycles

Industries such as retail, technology, and fast food commonly exhibit negative cash conversion cycles by collecting payments before paying suppliers, enhancing liquidity and reducing working capital needs. Retail giants like Amazon and Walmart leverage negative cash conversion cycles to finance operations through supplier credit and rapid inventory turnover. This financial strategy enables companies to maintain operational flexibility and invest cash generated from customers, boosting overall profitability and growth potential.

Risks and Downsides of Negative Cash Conversion

Negative cash conversion cycle (CCC) indicates that a company collects cash from sales before it needs to pay its suppliers, improving liquidity but also signaling potential over-reliance on supplier credit that may lead to strained vendor relationships and supply chain disruptions. Companies with negative CCC risk reduced negotiating leverage with suppliers and may face difficulties in scaling operations if supplier payment terms tighten unexpectedly. This aggressive working capital strategy can undermine financial stability during economic downturns and increase vulnerability to cash flow shocks.

Benefits of Achieving Negative Cash Conversion

Achieving negative cash conversion cycle means a company collects payments from customers before paying its suppliers, boosting liquidity and reducing reliance on external financing. This efficient cash flow management enhances operational flexibility and enables reinvestment in growth opportunities without incurring additional debt. Companies with negative cash conversion cycles often enjoy competitive advantages in negotiating terms with suppliers and maintaining stronger financial stability.

Strategies to Improve Cash Conversion Cycle

Improving the cash conversion cycle involves optimizing inventory management, accelerating accounts receivable collections, and extending accounts payable terms without damaging supplier relationships. Implementing just-in-time inventory systems and using automated invoicing software can reduce holding periods and improve cash inflows. Businesses with negative cash conversion cycles, such as those in retail or subscription services, benefit from these strategies by maintaining liquidity and enhancing operational efficiency.

Case Studies: Negative vs Positive Cash Conversion in Real Businesses

Companies with negative cash conversion cycles, such as Amazon and Dell, effectively use customer payments to finance inventory and operations, improving liquidity and minimizing working capital needs. In contrast, businesses with positive cash conversion cycles, like traditional retailers including Walmart, pay suppliers before collecting cash from customers, potentially straining cash flow but allowing for bulk purchasing discounts and inventory buildup. Case studies show that negative cash conversion cycles often correlate with higher cash flow efficiency and competitive advantage in fast-paced industries, whereas positive cycles can support stability in sectors where extended inventory holding is necessary.

Negative Cash Conversion Infographic

libterm.com

libterm.com