Management buy-in occurs when key leaders within an organization fully support and commit to a new strategy or change initiative, ensuring smoother implementation and greater chances of success. Their active endorsement helps align resources, motivate teams, and overcome resistance, creating a foundation for sustainable growth. Explore the article to understand how securing management buy-in can transform your business outcomes.

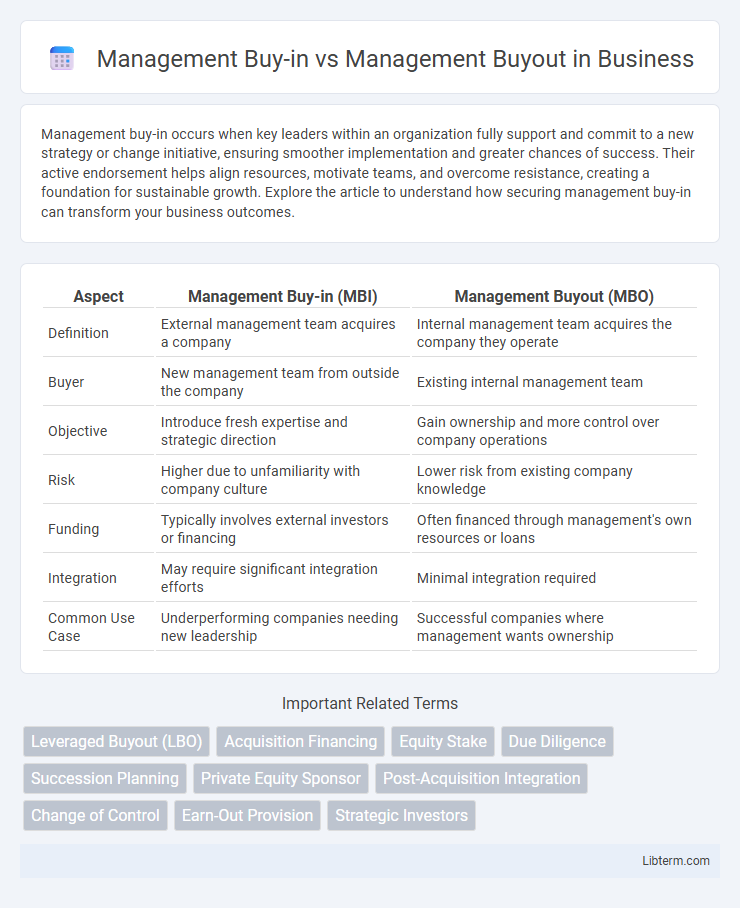

Table of Comparison

| Aspect | Management Buy-in (MBI) | Management Buyout (MBO) |

|---|---|---|

| Definition | External management team acquires a company | Internal management team acquires the company they operate |

| Buyer | New management team from outside the company | Existing internal management team |

| Objective | Introduce fresh expertise and strategic direction | Gain ownership and more control over company operations |

| Risk | Higher due to unfamiliarity with company culture | Lower risk from existing company knowledge |

| Funding | Typically involves external investors or financing | Often financed through management's own resources or loans |

| Integration | May require significant integration efforts | Minimal integration required |

| Common Use Case | Underperforming companies needing new leadership | Successful companies where management wants ownership |

Introduction to Management Buy-in and Management Buyout

Management Buy-in (MBI) occurs when an external management team acquires a controlling stake in a company, bringing new leadership and strategic direction. Management Buyout (MBO) involves the existing management team purchasing the business, leveraging their in-depth operational knowledge to drive continued growth. Both MBI and MBO are key corporate restructuring strategies used to enhance company performance and ownership control.

Defining Management Buy-in (MBI)

Management Buy-in (MBI) occurs when an external management team acquires a significant stake in a company and takes over its operations, contrasting with a Management Buyout (MBO) where existing managers purchase the business. In an MBI, new executives bring fresh expertise and strategic direction aimed at driving growth and improving performance. This approach is often used to revitalize underperforming businesses or to capitalize on new market opportunities with external managerial talent.

Understanding Management Buyout (MBO)

Management Buyout (MBO) involves the existing management team acquiring a significant portion or all of the company's equity, enabling them to take control of operations and strategic direction. This type of transaction often requires financing through loans or private equity, emphasizing the management's confidence in the business's future growth and profitability. MBOs are distinct from Management Buy-ins (MBIs), where external managers purchase the company, highlighting the importance of internal leadership continuity in MBO scenarios.

Key Differences Between MBI and MBO

Management Buy-In (MBI) involves an external management team purchasing a controlling stake in a company and taking over its operations, while Management Buyout (MBO) features the existing management team acquiring the business from current owners. Key differences include the origin of the management team, with MBI attracting new leadership, and MBO maintaining continuity with existing managers. Financial structuring also varies, as MBIs often require more extensive funding and integration efforts compared to MBOs.

Strategic Objectives: MBI vs MBO

Management Buy-in (MBI) involves external management acquiring and leading a company, focusing on introducing new strategic initiatives and driving growth through fresh perspectives. Management Buyout (MBO) is conducted by internal managers aiming to maintain continuity and refine existing strategic objectives while leveraging their deep operational knowledge. Both approaches align strategic objectives with leadership capabilities, but MBI targets transformational change whereas MBO emphasizes optimization and incremental improvement.

Financing Structures for MBI and MBO

Management Buy-in (MBI) financing structures typically involve external management teams collaborating with private equity firms or venture capitalists to secure capital, often leveraging a combination of equity and mezzanine debt to facilitate the acquisition. In contrast, Management Buyout (MBO) financing relies heavily on existing internal management securing funds through bank loans, seller financing, and institutional investors, focusing on equity stakes from current managers alongside debt to balance risk and control. Both MBI and MBO transactions commonly utilize leveraged buyouts (LBOs) to maximize returns while ensuring the management team maintains a significant ownership position.

Risks and Challenges in MBI and MBO

Management Buy-ins (MBI) face risks including integration challenges as external managers must quickly adapt to existing company culture and operations, increasing the likelihood of strategic misalignment and employee resistance. Conversely, Management Buyouts (MBO) carry risks related to financial over-leverage since incumbent managers often assume substantial debt to acquire the firm, which can strain cash flow and limit operational flexibility. Both MBI and MBO confront challenges such as valuation disputes and potential conflicts of interest, but MBIs typically encounter higher uncertainty due to lack of prior company-specific knowledge.

Benefits and Opportunities of Each Approach

Management Buy-in (MBI) provides fresh management expertise and external perspectives, often leading to innovation and accelerated growth by introducing new strategic visions and operational efficiencies. Management Buyout (MBO) leverages existing internal knowledge and leadership commitment, ensuring continuity, preserving company culture, and enabling smoother transitions that reduce operational disruptions. Both approaches offer opportunities for aligned incentives and increased motivation but differ in complexity of integration and impact on organizational dynamics.

Case Studies: Successful MBIs and MBOs

Case studies reveal that successful Management Buy-ins (MBIs) often occur in companies needing fresh expertise, as demonstrated by the 2018 acquisition of a UK-based software firm by an external management team that revitalized growth through digital transformation. In contrast, notable Management Buyouts (MBOs) like the 2020 buyout of a family-owned manufacturing business highlight how internal teams leverage deep operational knowledge to enhance efficiency and profitability. Both MBIs and MBOs benefit from strong leadership alignment and strategic vision, which drive long-term business stability and value creation.

Choosing Between Management Buy-in and Management Buyout

Choosing between a Management Buy-in (MBI) and a Management Buyout (MBO) depends on factors such as the availability of internal management, access to external managerial expertise, and company culture fit. MBIs bring external management teams to inject fresh ideas and skills, often suitable for businesses needing transformation or turnaround, whereas MBOs rely on existing management with deep company knowledge, facilitating continuity and smoother transitions. Evaluating leadership capabilities, strategic goals, and financial resources helps determine whether an insider-led buyout or an outsider-led buy-in best aligns with long-term growth objectives.

Management Buy-in Infographic

libterm.com

libterm.com