Average Cash Conversion measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. Understanding this metric helps optimize your working capital and improve liquidity management. Explore the rest of the article to learn how to calculate and enhance your cash conversion cycle effectively.

Table of Comparison

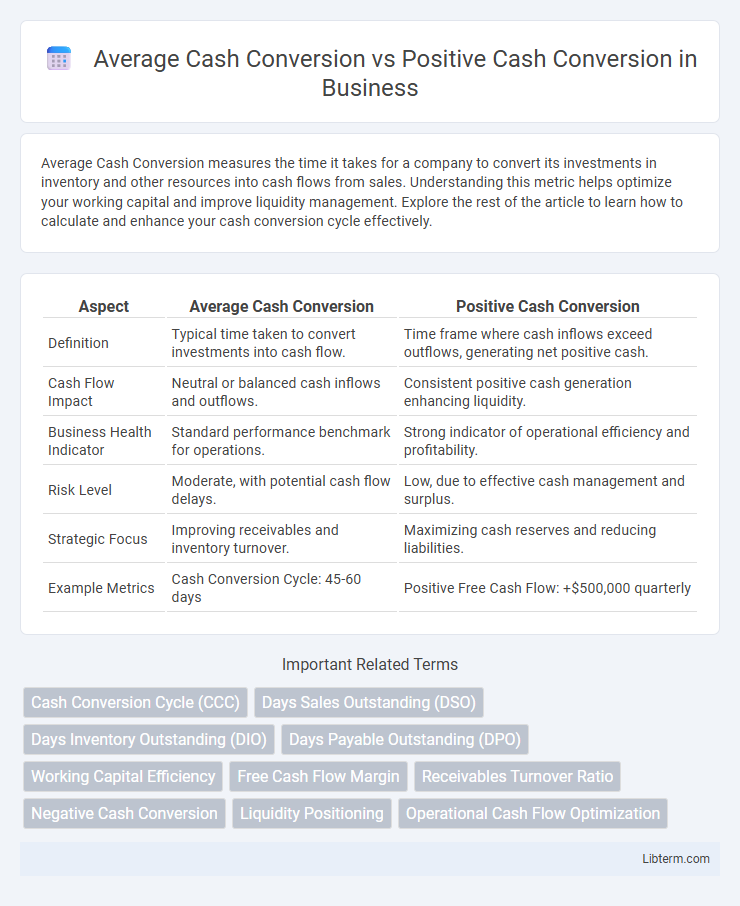

| Aspect | Average Cash Conversion | Positive Cash Conversion |

|---|---|---|

| Definition | Typical time taken to convert investments into cash flow. | Time frame where cash inflows exceed outflows, generating net positive cash. |

| Cash Flow Impact | Neutral or balanced cash inflows and outflows. | Consistent positive cash generation enhancing liquidity. |

| Business Health Indicator | Standard performance benchmark for operations. | Strong indicator of operational efficiency and profitability. |

| Risk Level | Moderate, with potential cash flow delays. | Low, due to effective cash management and surplus. |

| Strategic Focus | Improving receivables and inventory turnover. | Maximizing cash reserves and reducing liabilities. |

| Example Metrics | Cash Conversion Cycle: 45-60 days | Positive Free Cash Flow: +$500,000 quarterly |

Understanding Cash Conversion: An Overview

Average Cash Conversion measures the typical time it takes for a company to turn its investments in inventory and other resources into cash flows from sales. Positive Cash Conversion indicates a company's efficiency in generating cash faster than it spends on operational expenses, reflecting strong liquidity management. Understanding these metrics helps businesses optimize working capital and improve financial stability.

Defining Average Cash Conversion

Average Cash Conversion measures the typical time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. It is calculated by averaging the Cash Conversion Cycle (CCC) over a specific period, reflecting operational efficiency in managing working capital. Positive Cash Conversion indicates a favorable scenario where cash inflows from operations exceed cash outflows, signifying strong liquidity and efficient cash management.

What is Positive Cash Conversion?

Positive cash conversion occurs when a company efficiently turns its net income into actual cash flow, indicating strong liquidity and operational efficiency. It measures the proportion of earnings converted into cash within a specific period, often surpassing average cash conversion rates that typically reflect broader industry benchmarks. Achieving positive cash conversion signals effective management of receivables, payables, and inventory, enhancing financial stability and investor confidence.

Key Differences Between Average and Positive Cash Conversion

Average cash conversion measures the typical percentage of revenue converted into cash over a period, reflecting overall cash flow efficiency, while positive cash conversion specifically highlights periods when cash flow exceeds expectations or projections. Key differences include that average cash conversion can include both positive and negative cash flow cycles, providing a balanced view, whereas positive cash conversion exclusively indicates surplus cash generation, signaling stronger operational liquidity. Understanding these distinctions aids in assessing a company's financial health and cash management strategies more accurately.

Importance of Cash Conversion Metrics

Cash conversion metrics are critical for assessing a company's liquidity and operational efficiency, as Average Cash Conversion measures the typical time taken to convert investments in inventory and other resources into cash flows from sales. Positive Cash Conversion indicates a company's ability to generate cash more quickly than it spends, reflecting strong financial health and effective working capital management. Analyzing both metrics helps investors and managers optimize cash flow cycles, reduce financing needs, and improve overall business sustainability.

Calculating Average Cash Conversion Rate

Calculating the average cash conversion rate involves dividing the total cash collected by net sales over a specific period, reflecting how efficiently a company converts sales into cash. Positive cash conversion indicates that a business collects cash faster than it pays off its liabilities, enhancing liquidity and operational efficiency. Monitoring the average cash conversion rate aids in optimizing cash flow management and ensuring sustainable financial health.

Measuring Positive Cash Conversion Cycle

Measuring positive cash conversion cycle (CCC) involves calculating the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. A positive cash conversion cycle indicates that a company efficiently manages its receivables, payables, and inventory, resulting in faster cash inflows than outflows. Average cash conversion values provide a benchmark, but focusing on positive CCC highlights operational efficiency and liquidity strength within financial management.

Impact of Cash Conversion on Business Liquidity

Average cash conversion measures the typical time it takes for a company to turn its investments in inventory and other resources into cash flows from sales, directly affecting business liquidity by determining the availability of cash for operations. Positive cash conversion indicates that a company is efficiently managing its working capital, generating cash from sales faster than its payables cycle, which enhances liquidity and reduces reliance on external financing. Efficient cash conversion cycles support smoother operational flows, enabling businesses to meet short-term obligations, invest in growth opportunities, and maintain financial stability.

Strategies to Improve Cash Conversion Cycles

Improving cash conversion cycles involves reducing accounts receivable days, optimizing inventory turnover, and extending accounts payable periods to enhance liquidity management. Employing just-in-time inventory systems minimizes holding costs while accelerating sales conversion, and utilizing automated invoicing expedites collections. Effective supplier negotiations and dynamic discounting can further lengthen payment terms without harming relationships, accelerating positive cash conversion cycles and stabilizing business cash flow.

Choosing the Right Cash Conversion Metric for Your Business

Average cash conversion measures the typical time a business takes to convert investments in inventory and other resources into cash flow from sales, offering insight into operational efficiency. Positive cash conversion specifically indicates that a company is generating cash faster than it is spending, a critical metric for assessing liquidity and financial health. Selecting the right cash conversion metric depends on your business model and financial goals, with positive cash conversion being essential for cash-intensive industries, while average cash conversion suits businesses analyzing overall process efficiency.

Average Cash Conversion Infographic

libterm.com

libterm.com