Customer Lifetime Value (CLV) measures the total revenue a business can expect from a single customer throughout their relationship. Understanding CLV helps optimize marketing strategies, improve customer retention, and increase profitability. Explore the rest of the article to learn how you can calculate and leverage CLV for your business growth.

Table of Comparison

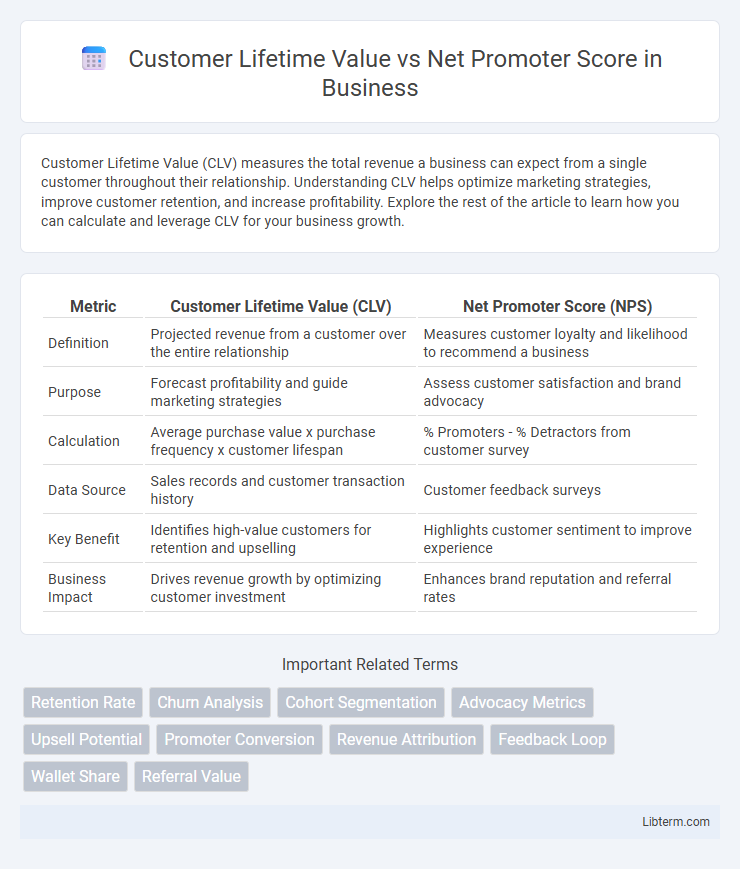

| Metric | Customer Lifetime Value (CLV) | Net Promoter Score (NPS) |

|---|---|---|

| Definition | Projected revenue from a customer over the entire relationship | Measures customer loyalty and likelihood to recommend a business |

| Purpose | Forecast profitability and guide marketing strategies | Assess customer satisfaction and brand advocacy |

| Calculation | Average purchase value x purchase frequency x customer lifespan | % Promoters - % Detractors from customer survey |

| Data Source | Sales records and customer transaction history | Customer feedback surveys |

| Key Benefit | Identifies high-value customers for retention and upselling | Highlights customer sentiment to improve experience |

| Business Impact | Drives revenue growth by optimizing customer investment | Enhances brand reputation and referral rates |

Understanding Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) measures the total revenue a business can expect from a single customer account throughout their relationship. This metric helps companies allocate resources for marketing, sales, and customer service based on long-term profitability rather than short-term gains. Understanding CLV enables businesses to identify high-value customers, optimize retention strategies, and maximize overall revenue growth.

What is Net Promoter Score (NPS)?

Net Promoter Score (NPS) measures customer loyalty by asking how likely customers are to recommend a company's product or service on a scale from 0 to 10. Respondents are categorized as Promoters (9-10), Passives (7-8), or Detractors (0-6), with the NPS calculated by subtracting the percentage of Detractors from the percentage of Promoters. This metric provides insights into customer satisfaction and predicts growth potential, complementing Customer Lifetime Value (CLV) by highlighting customer advocacy rather than direct financial value.

Key Differences Between CLV and NPS

Customer Lifetime Value (CLV) measures the total revenue a business expects from a single customer over the entire relationship, focusing on financial impact and long-term profitability. Net Promoter Score (NPS) gauges customer loyalty and satisfaction by assessing the likelihood of customers recommending a brand, emphasizing customer experience and brand perception. CLV is quantitative and revenue-driven, while NPS is qualitative and sentiment-driven, making each metric essential for different strategic decisions.

The Role of CLV in Business Growth

Customer Lifetime Value (CLV) quantifies the total revenue a business can expect from a single customer over the entirety of their relationship, directly influencing strategic decisions on marketing spend and customer retention. By identifying high-CLV customers, businesses can prioritize personalized experiences and tailored offers that maximize profitability and long-term growth. Unlike Net Promoter Score (NPS), which measures customer satisfaction and loyalty potential, CLV provides actionable financial insights essential for sustainable business expansion and resource allocation.

How NPS Reflects Customer Loyalty

Net Promoter Score (NPS) directly measures customer loyalty by quantifying the likelihood of customers recommending a brand to others, capturing their satisfaction and emotional connection. High NPS scores correlate with increased Customer Lifetime Value (CLV) as loyal promoters drive repeat purchases and organic growth through referrals. Unlike CLV, which focuses on monetary value over time, NPS provides actionable insights into customer sentiment and loyalty trends that influence long-term revenue.

Measuring CLV: Metrics and Methods

Measuring Customer Lifetime Value (CLV) involves calculating the predicted net profit attributed to the entire future relationship with a customer, using key metrics such as average purchase value, purchase frequency, and customer retention rate. Methods like cohort analysis, predictive analytics, and machine learning models help refine CLV estimates by incorporating transaction history, customer behavior, and churn probability. Unlike Net Promoter Score (NPS), which gauges customer satisfaction and loyalty through survey responses, CLV provides a financial perspective essential for optimizing marketing spend and long-term business growth.

Calculating and Interpreting NPS Scores

Calculating Net Promoter Score (NPS) involves surveying customers on a scale of 0 to 10 regarding their likelihood to recommend a product or service, categorizing responses into Promoters (9-10), Passives (7-8), and Detractors (0-6). The NPS formula subtracts the percentage of Detractors from the percentage of Promoters, yielding a score between -100 and 100 that reflects customer loyalty and satisfaction. Interpreting NPS scores helps businesses understand customer sentiment, predict retention, and prioritize improvements for maximizing Customer Lifetime Value (CLV) by enhancing long-term relationships.

Impact of CLV and NPS on Retention Strategies

Customer Lifetime Value (CLV) quantifies the total revenue a business can expect from a single customer, guiding retention strategies towards high-value customer segments for resource allocation. Net Promoter Score (NPS) measures customer loyalty and satisfaction by assessing the likelihood of customers recommending the brand, influencing retention efforts to enhance customer experience and advocacy. Combining CLV and NPS data enables businesses to tailor retention strategies that maximize revenue growth and foster long-term customer relationships.

Integrating CLV and NPS for Strategic Decision-Making

Integrating Customer Lifetime Value (CLV) with Net Promoter Score (NPS) enables businesses to align customer loyalty metrics with revenue potential, optimizing marketing strategies and resource allocation. By analyzing NPS as a proxy for customer satisfaction and advocacy alongside CLV's financial impact, companies can prioritize high-value promoters to maximize growth and retention. This strategic fusion informs product development, personalized engagement, and customer experience improvements based on predictive customer behavior and profitability.

Best Practices for Maximizing CLV and Improving NPS

Maximizing Customer Lifetime Value (CLV) requires personalized marketing strategies that increase customer retention by delivering consistent value and enhancing customer experience across all touchpoints. Improving Net Promoter Score (NPS) hinges on actively soliciting customer feedback, addressing pain points promptly, and fostering emotional connections that transform customers into brand advocates. Implementing data-driven insights to align product offerings with customer expectations simultaneously boosts CLV and NPS, driving long-term business growth.

Customer Lifetime Value Infographic

libterm.com

libterm.com