A Certificate of Deposit (CD) is a low-risk savings product that offers a fixed interest rate for a specified term, helping you grow your money securely. CDs usually provide higher returns than regular savings accounts, making them ideal for those seeking stable investments with guaranteed returns. Explore the rest of the article to learn how CDs can fit into your financial strategy and the best ways to maximize your earnings.

Table of Comparison

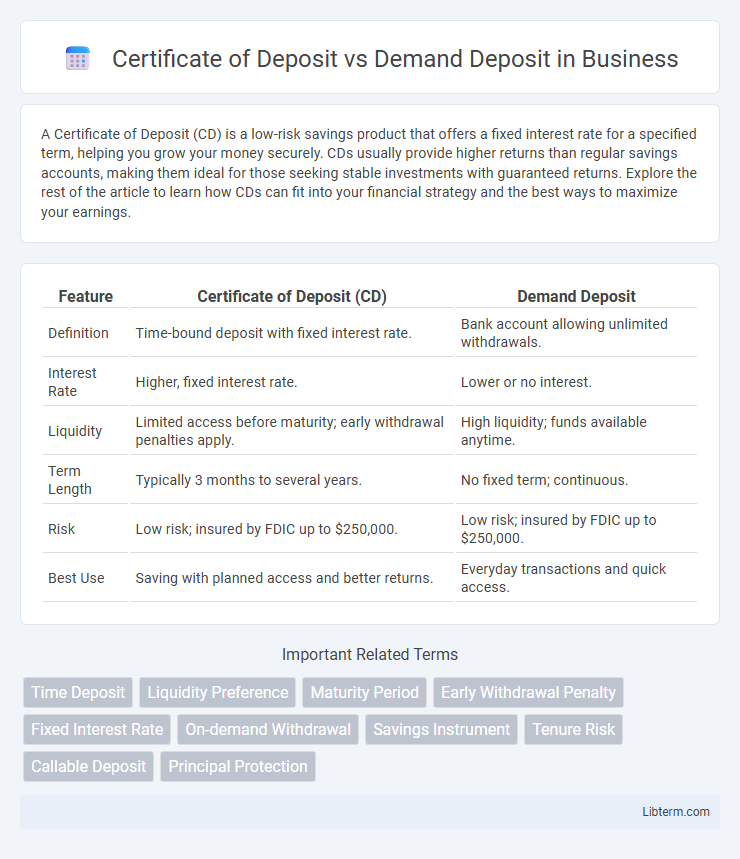

| Feature | Certificate of Deposit (CD) | Demand Deposit |

|---|---|---|

| Definition | Time-bound deposit with fixed interest rate. | Bank account allowing unlimited withdrawals. |

| Interest Rate | Higher, fixed interest rate. | Lower or no interest. |

| Liquidity | Limited access before maturity; early withdrawal penalties apply. | High liquidity; funds available anytime. |

| Term Length | Typically 3 months to several years. | No fixed term; continuous. |

| Risk | Low risk; insured by FDIC up to $250,000. | Low risk; insured by FDIC up to $250,000. |

| Best Use | Saving with planned access and better returns. | Everyday transactions and quick access. |

Introduction to Certificate of Deposit and Demand Deposit

A Certificate of Deposit (CD) is a timed deposit account offering a fixed interest rate for a specified term, typically ranging from a few months to several years, designed for investors seeking predictable returns with limited liquidity. Demand Deposits, commonly known as checking accounts, provide immediate access to funds without restrictions, supporting everyday transactions through checks, debit cards, and electronic transfers. Both financial instruments serve distinct purposes: CDs prioritize savings growth with penalties for early withdrawal, while demand deposits emphasize liquidity and transactional convenience.

Definition: What is a Certificate of Deposit?

A Certificate of Deposit (CD) is a time-bound financial product offered by banks that allows customers to deposit a fixed amount of money for a specified term, earning a higher interest rate than regular savings accounts. Unlike demand deposits, which provide immediate access to funds, a CD requires the depositor to leave the money untouched until the maturity date to avoid penalties. CDs are commonly used for secure, low-risk investments with guaranteed returns over the agreed period.

Definition: What is a Demand Deposit?

A demand deposit is a type of bank account from which funds can be withdrawn at any time without prior notice, typically used for daily transactions and payments. Unlike certificates of deposit (CDs), demand deposits offer high liquidity but usually provide lower interest rates. Common examples include checking accounts and savings accounts, which facilitate quick access to money for everyday financial needs.

Key Differences Between Certificate of Deposit and Demand Deposit

Certificates of Deposit (CDs) offer fixed interest rates with a specified maturity date, making them ideal for long-term savings, while demand deposits provide immediate access to funds without earning significant interest. CDs impose penalties for early withdrawal, contrasting with demand deposits that allow unlimited transactions without restrictions. The distinct liquidity and interest features define the fundamental differences between these two financial instruments.

Interest Rates: CD vs Demand Deposit

Certificate of Deposit (CD) accounts typically offer higher interest rates compared to Demand Deposit accounts due to fixed terms and limited liquidity. Demand Deposit accounts, such as checking or savings accounts, provide lower interest rates but allow immediate access to funds without penalties. The interest rate differential reflects the trade-off between earning potential in CDs and the flexibility of Demand Deposits.

Liquidity: Withdrawal Options Compared

Certificate of Deposit (CD) offers fixed-term deposits with limited liquidity, imposing penalties for early withdrawal before maturity, which restricts immediate access to funds. Demand Deposits, such as checking accounts, provide high liquidity allowing unlimited withdrawals and transfers without penalties or notice. This fundamental difference means demand deposits suit frequent transaction needs, while CDs are better for funds that can remain untouched to earn higher interest.

Safety and Risk Factors

A Certificate of Deposit (CD) offers higher safety through fixed terms and federally insured principal, minimizing risks of market fluctuations and sudden withdrawals. Demand Deposits, such as checking accounts, provide high liquidity but expose funds to potential risks from unlimited transactions and lower interest returns. Both accounts are typically insured by the FDIC up to $250,000, but CDs reduce liquidity risk by locking funds for a fixed period.

Ideal Use Cases for Certificate of Deposit

Certificate of Deposit (CD) accounts are ideal for individuals seeking a low-risk investment with a fixed interest rate over a predetermined term, often ranging from a few months to several years. These accounts suit savers who do not require immediate access to their funds and aim to earn higher returns compared to demand deposits, which offer greater liquidity but typically lower interest rates. CDs are particularly useful for those planning for future financial goals such as buying a home, funding education, or building an emergency fund while locking in guaranteed interest earnings.

Ideal Use Cases for Demand Deposit

Demand deposits are ideal for everyday transactions due to their high liquidity and immediate access to funds without penalties, making them perfect for managing daily expenses, bill payments, and emergency cash needs. Unlike Certificate of Deposit accounts, which lock funds for a fixed term and offer higher interest rates, demand deposits prioritize flexibility and accessibility over long-term earnings. Businesses and individuals benefit from demand deposits when requiring frequent, hassle-free withdrawals and transfers for operational or personal financial activities.

How to Choose: CD vs Demand Deposit

Choosing between a Certificate of Deposit (CD) and a demand deposit account depends on your liquidity needs and interest rate preferences. Opt for a CD if you seek higher interest rates and can lock in funds for a fixed term without early withdrawal penalties. Select a demand deposit account for flexible access to funds and transactions, despite generally lower interest earnings.

Certificate of Deposit Infographic

libterm.com

libterm.com