A Total Return Swap is a financial derivative that allows one party to receive the total economic performance of an asset, including income and capital gains, without owning the asset outright. This instrument is commonly used for hedging, speculation, and gaining exposure to a particular asset class with minimal initial investment. Explore the detailed mechanics and strategic uses of a Total Return Swap in the rest of this article to enhance your financial knowledge.

Table of Comparison

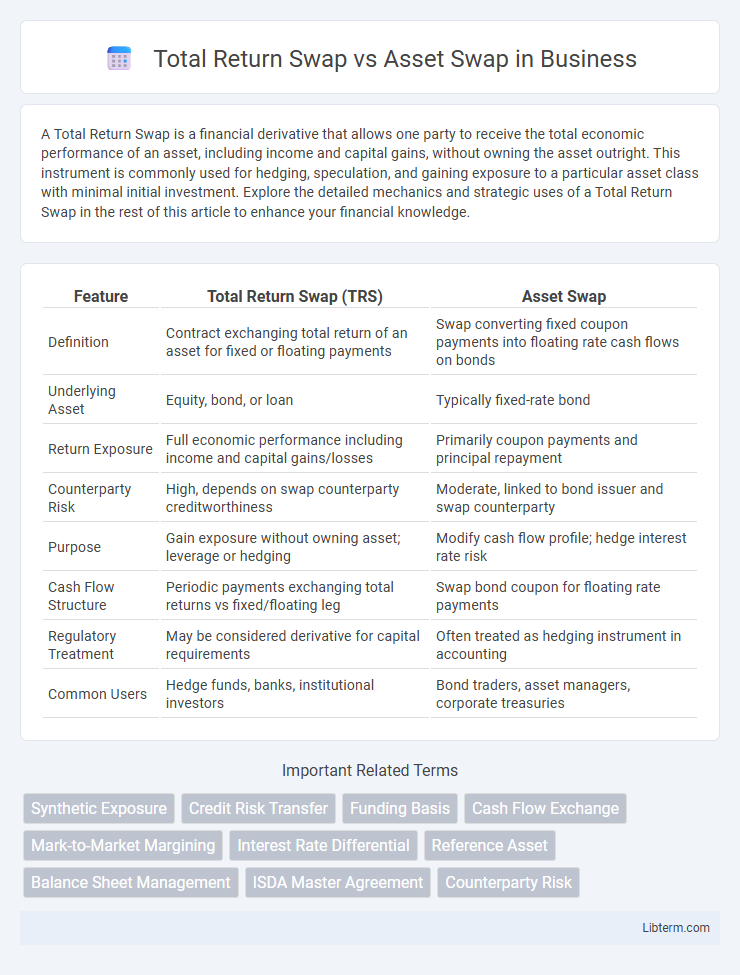

| Feature | Total Return Swap (TRS) | Asset Swap |

|---|---|---|

| Definition | Contract exchanging total return of an asset for fixed or floating payments | Swap converting fixed coupon payments into floating rate cash flows on bonds |

| Underlying Asset | Equity, bond, or loan | Typically fixed-rate bond |

| Return Exposure | Full economic performance including income and capital gains/losses | Primarily coupon payments and principal repayment |

| Counterparty Risk | High, depends on swap counterparty creditworthiness | Moderate, linked to bond issuer and swap counterparty |

| Purpose | Gain exposure without owning asset; leverage or hedging | Modify cash flow profile; hedge interest rate risk |

| Cash Flow Structure | Periodic payments exchanging total returns vs fixed/floating leg | Swap bond coupon for floating rate payments |

| Regulatory Treatment | May be considered derivative for capital requirements | Often treated as hedging instrument in accounting |

| Common Users | Hedge funds, banks, institutional investors | Bond traders, asset managers, corporate treasuries |

Introduction to Total Return Swap and Asset Swap

Total Return Swaps (TRS) allow investors to transfer the total economic performance, including income and capital gains, of an asset without owning it directly, enhancing leverage and risk management strategies. Asset Swaps typically involve exchanging the fixed-rate cash flows of a bond for floating-rate payments plus a spread, enabling investors to hedge interest rate risk or achieve a synthetic floating exposure. Both derivatives play crucial roles in portfolio optimization by tailoring risk-return profiles through customized cash flow exchanges.

Key Concepts and Definitions

A Total Return Swap (TRS) is a derivative contract where one party transfers the total economic performance, including income and capital gains, of an underlying asset to another party in exchange for fixed or floating payments. An Asset Swap involves exchanging the cash flows of a fixed income security for a floating rate, effectively transforming the nature of interest rate exposure. Key concepts in TRS include the total return leg and funding leg, while Asset Swap emphasizes coupon payments and swap spread.

How Total Return Swaps Work

Total Return Swaps (TRS) are derivative contracts where one party transfers the total economic performance of an asset, including income and capital gains, to another party in exchange for fixed or floating payments. TRS allow investors to gain exposure to an asset without owning it directly, enabling strategies like leverage, hedging, or arbitrage. Unlike Asset Swaps, which modify cash flows of bonds by swapping fixed coupons for floating rates, TRS convey complete risk and return profiles of the underlying asset.

How Asset Swaps Operate

Asset swaps operate by combining a fixed-income security with an interest rate swap, allowing investors to convert fixed coupon payments into floating rates or vice versa, effectively managing interest rate risk. The swap typically involves exchanging the fixed coupon payments of a bond for floating payments linked to a benchmark such as LIBOR or SOFR, enhancing liquidity and hedging opportunities. This structure provides flexibility in customizing yield profiles and mitigating market volatility compared to traditional bond holdings.

Structural Differences Between Total Return Swaps and Asset Swaps

Total Return Swaps (TRS) involve exchanging the total economic performance of an asset, including income and capital gains, for a fixed or floating payment, primarily transferring both credit and market risk without transferring ownership. Asset Swaps combine an underlying bond with an interest rate swap to convert fixed-rate payments into floating-rate payments, focusing on interest rate risk adjustment while retaining bond ownership and credit exposure. Structurally, TRS create synthetic ownership with full exposure to asset performance, whereas Asset Swaps modify cash flow profiles without altering the legal title of the asset.

Risk and Return Profiles

Total Return Swaps transfer both the credit risk and market risk of an underlying asset from one party to another, allowing the receiver to gain exposure to the asset's total return without owning it. Asset Swaps primarily isolate the fixed income component, transforming a bond's coupon payments into a floating rate, thus primarily managing interest rate risk while retaining credit risk exposure. Total Return Swaps tend to offer higher return potential with increased counterparty risk, whereas Asset Swaps provide more predictable cash flows with lower overall risk due to retained credit risk.

Common Use Cases in Financial Markets

Total Return Swaps are primarily used by hedge funds and asset managers to gain synthetic exposure to an asset's total return without owning the underlying security, facilitating leverage and risk transfer. Asset Swaps commonly enable fixed income investors to convert bond coupon payments into floating rates through interest rate swaps, improving liquidity and managing interest rate risk. Both instruments provide tools for arbitrage, hedging, and speculative strategies in credit, interest rate, and equity markets.

Advantages and Disadvantages of Each Swap Type

Total Return Swaps offer the advantage of transferring both the credit risk and market risk of an underlying asset without actual ownership, enabling efficient hedging and leverage benefits, but they expose the total return receiver to counterparty risk and may involve complex valuation challenges. Asset Swaps convert fixed income securities into synthetic floating rate instruments, providing flexibility to manage interest rate risk and enhance yield, though they might not transfer full economic exposure and can involve intricate contract terms affecting liquidity. Choosing between Total Return Swaps and Asset Swaps depends on the desired risk exposure, liquidity preferences, and counterparty credit considerations in the hedging or speculative strategy.

Regulatory and Accounting Considerations

Total Return Swaps (TRS) and Asset Swaps differ significantly in regulatory and accounting treatment, with TRS often triggering derivative accounting rules under IFRS 9 or ASC 815 due to their synthetic exposure to underlying assets. Regulatory capital requirements under Basel III impose distinct credit risk charges on TRS counterparties, reflecting the full economic exposure to reference assets, while Asset Swaps may be treated more like traditional bond exposures with less complex capital implications. Accounting for TRS typically involves mark-to-market valuation and recognition of both asset and liability components, whereas Asset Swaps often result in synthetic fixed-income exposures with income recognized on an accrual basis.

Choosing Between Total Return Swap and Asset Swap

Choosing between a Total Return Swap (TRS) and an Asset Swap depends on risk exposure and cash flow preferences; TRS transfers both market and credit risk of the underlying asset while providing synthetic economic exposure without ownership transfer. Asset Swaps allow investors to convert fixed-rate bonds into floating-rate instruments, isolating interest rate risk but retaining credit risk and ownership of the underlying bond. Investors seeking full risk transfer and capital efficiency often favor TRS, whereas those wanting bond ownership with adjusted interest rate exposure may opt for Asset Swaps.

Total Return Swap Infographic

libterm.com

libterm.com