Prepaid expenses represent payments made in advance for goods or services to be received in the future, such as insurance premiums or rent. These costs are initially recorded as assets and gradually expensed over time as the benefits are realized. Discover how understanding prepaid expenses can improve your financial management by reading the rest of the article.

Table of Comparison

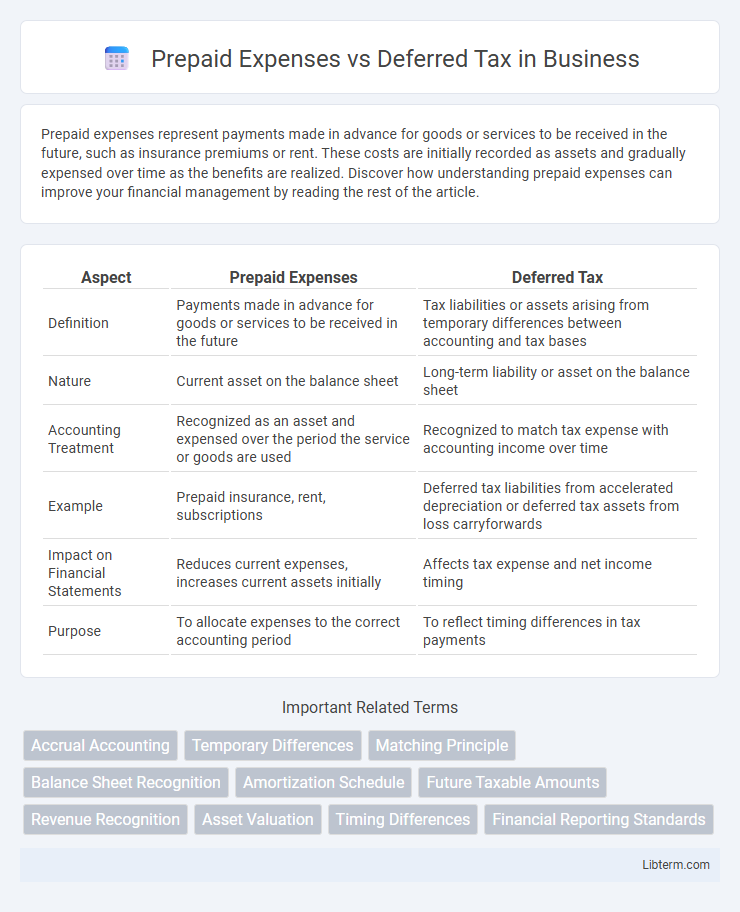

| Aspect | Prepaid Expenses | Deferred Tax |

|---|---|---|

| Definition | Payments made in advance for goods or services to be received in the future | Tax liabilities or assets arising from temporary differences between accounting and tax bases |

| Nature | Current asset on the balance sheet | Long-term liability or asset on the balance sheet |

| Accounting Treatment | Recognized as an asset and expensed over the period the service or goods are used | Recognized to match tax expense with accounting income over time |

| Example | Prepaid insurance, rent, subscriptions | Deferred tax liabilities from accelerated depreciation or deferred tax assets from loss carryforwards |

| Impact on Financial Statements | Reduces current expenses, increases current assets initially | Affects tax expense and net income timing |

| Purpose | To allocate expenses to the correct accounting period | To reflect timing differences in tax payments |

Introduction to Prepaid Expenses and Deferred Tax

Prepaid expenses represent payments made for goods or services before they are received, recorded as current assets on the balance sheet. Deferred tax arises from temporary differences between accounting income and taxable income, resulting in tax liabilities or assets recognized on financial statements. Understanding prepaid expenses and deferred tax is essential for accurate financial reporting and tax planning.

Defining Prepaid Expenses

Prepaid expenses represent payments made for goods or services that will be received or utilized in future accounting periods, categorized as current assets on the balance sheet. These expenses are initially recorded as assets and systematically expensed over time to match the period in which the benefits are realized, ensuring accurate income measurement. Unlike deferred tax, which relates to timing differences in tax reporting, prepaid expenses pertain to the prepayment of operational costs such as insurance, rent, or subscriptions.

Understanding Deferred Tax

Deferred tax arises from temporary differences between accounting income and taxable income, leading to future tax liabilities or assets. It reflects taxes due or recoverable in future periods due to timing differences in revenue recognition or expense deductions. Understanding deferred tax is crucial for accurate financial reporting and ensuring compliance with tax regulations.

Key Differences Between Prepaid Expenses and Deferred Tax

Prepaid expenses represent payments made in advance for goods or services to be received in the future, classified as current assets on the balance sheet. Deferred tax arises from temporary differences between accounting income and taxable income, resulting in liabilities or assets recorded for future tax effects. The key difference is that prepaid expenses relate to timing of cash payments and consumption of resources, while deferred tax pertains to tax timing discrepancies and future tax obligations or benefits.

Accounting Treatment of Prepaid Expenses

Prepaid expenses are recorded as current assets on the balance sheet because the payment occurs before the related benefit or service is received, with a gradual expense recognition over the asset's useful period following the matching principle in accounting. Each accounting period reflects an adjusting entry to reduce the prepaid expense balance and recognize the incurred expense, aligning with accrual accounting standards. Unlike deferred tax, which involves timing differences between accounting income and taxable income, prepaid expenses directly affect reported net income through systematic expense allocation.

Accounting Treatment of Deferred Tax

Deferred tax accounting involves recognizing temporary differences between the tax base and the carrying amount of assets and liabilities to accurately match tax expenses with accounting profits. Deferred tax liabilities or assets are recorded on the balance sheet based on expected future tax consequences of these differences, following IAS 12 or ASC 740 standards. This treatment ensures proper reflection of tax effects related to timing differences, unlike prepaid expenses which represent payments made in advance recorded as current assets.

Impact on Financial Statements

Prepaid expenses impact financial statements by increasing assets on the balance sheet and reducing expenses on the income statement until the benefit is realized, improving short-term liquidity ratios. Deferred tax liabilities and assets arise from temporary differences between accounting income and taxable income, affecting the balance sheet as non-current liabilities or assets and impacting tax expenses in the income statement. Accurate recognition of prepaid expenses and deferred taxes ensures proper matching of revenues and expenses, thereby enhancing the reliability of financial reporting and compliance with accounting standards.

Examples of Prepaid Expenses and Deferred Tax

Prepaid expenses include payments made in advance for goods or services such as insurance premiums, rent, and subscriptions, which are recorded as assets until they are used or consumed. Deferred tax arises from temporary differences between accounting income and taxable income, commonly seen in depreciation timing differences or revenue recognition discrepancies. For example, a company prepaid $12,000 in insurance for a year, recognizing it as a prepaid expense, while deferred tax liability may occur when accelerated tax depreciation exceeds book depreciation.

Common Mistakes in Reporting

Common mistakes in reporting prepaid expenses often involve failing to accurately match expenses with the related accounting periods, leading to distorted financial statements. Deferred tax errors typically arise from incorrect calculations or misclassification of temporary differences between book and tax bases, causing discrepancies in tax liabilities or assets. Misunderstanding the timing and recognition principles for both prepaid expenses and deferred tax can result in misstated earnings and non-compliance with accounting standards such as IFRS or GAAP.

Importance of Accurate Recognition and Disclosure

Accurate recognition and disclosure of prepaid expenses ensure precise matching of expenses with revenues, improving financial statement reliability and compliance with accounting standards like GAAP and IFRS. Deferred tax balances require careful assessment of temporary differences and tax rates, directly impacting tax expense reporting and future tax liabilities. Properly distinguishing and reporting these items provides stakeholders with clear insights into a company's financial health and tax position.

Prepaid Expenses Infographic

libterm.com

libterm.com